How to Get Power of Attorney in Michigan

- Durable Power of Attorney. When discussing powers of attorney, the principal is the person giving the power, and the agent (sometimes called the attorney-in-fact) is the person receiving the power.

- Power of Attorney for Health Care. ...

- Using a Power of Attorney Document. ...

- Create the POA Using Software or an Attorney. ...

- Sign the POA in the Presence of a Notary Public or Two Witnesses. ...

- Store the Original POA in a Safe Place. ...

- Give a Copy to Your Attorney-in-Fact or Agent. ...

- File a Copy With the Register of Deeds.

How do you become a power of attorney?

Hartsfield

- An LPA gives you back control An LPA allows you to appoint an attorney to make important decisions on your behalf if you are no longer able to. ...

- Decisions can be made quickly on your behalf without unnecessary delays or additional costs The unexpected can strike at any moment. ...

- You’ll have peace of mind

How do you establish power of attorney?

Power of Attorney: The Basics

- General Power of Attorney. This type of POA gives the agent broad rights to manage the affairs of the principal. ...

- Durable Power of Attorney. A durable power of attorney lasts after the principal’s incapacitation. ...

- Springing Power of Attorney. A springing power of attorney is a type of durable POA. ...

- Medical Power of Attorney. ...

- Limited Power of Attorney. ...

How do you obtain a power of attorney in Michigan?

- The first document is a “living will.” A living will spells out how you want to be cared for in the event you become incapacitated. ...

- Another option is the creation of Physician Orders for Life-Sustaining Treatment (POLST). ...

- With a medical power of attorney, you designate someone to make medical decisions for you. ...

What are the requirements to be a power of attorney?

Powers of attorney fall under state laws, so the requirements for creating a power of attorney differ from state to state. You can find links to most states’ laws, or simply Google the power of attorney law for your state. Keep in mind the power of ...

How much does a power of attorney cost in Michigan?

between $200 and $350 per documentAttorneys in Michigan charge a wide range of fees for powers of attorney depending on the going rate in their location and their level of experience. Many will charge between $200 and $350 per document, but other attorneys may charge an hourly rate for their work.

Can I do my own power of attorney?

In the Power of Attorney forms, you'll be asked to give details of the attorneys you wish to appoint and the capacity in which you want them to act (jointly or 'jointly and severally'). Being able to act severally means each attorney can use the Power of Attorney independently.

How quick can you get a power of attorney?

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Does a Michigan POA have to be notarized?

The durable power of attorney must either be notarized (in practice this is preferred) or witnessed by two persons who are not the agent (the person who may act for the principal). The witnesses must also sign the power of attorney.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What if there is no power of attorney when someone dies?

However, if there is no will, then the attorney can apply to become an administrator of the estate, if they are the next of kin such as a spouse, child or relative of the deceased (but not usually an unmarried partner).

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.

Does power of attorney override a will?

Can a Power of Attorney change a will? It's always best to make sure you have a will in place – especially when appointing a Power of Attorney. Your attorney can change an existing will, but only if you're not 'of sound mind' and are incapable to do it yourself. As ever, these changes should be made in your interest.

What is the process of power of attorney?

Draft the Power of attorney whether special or general, by a documentation lawyer or through a website. Submit the power of attorney with the Sub-Registrar. Attach the supporting documents with the power of attorney. Attest the power of attorney before the Registrar. Attest of the power of attorney by 2 witnesses.

How long is a power of attorney good for in Michigan?

Passage of Time May End a Michigan Power of Attorney Some banks will reject a power of attorney after as little as two or three years have passed since it was signed. In the case of real estate, we have had title companies reject a power of attorney that was more than 6 months old.

Who makes medical decisions if there is no power of attorney in Michigan?

In the event of medical incapacitation, usually a family member will be called upon to make any important decisions in the absence of a power of attorney. In this situation, difficulties can arise if there is more than one family member and they differ on the course of medical action.

Do you have to register a power of attorney?

In order for a Lasting Power of Attorney to be valid and be used by the Attorney it must be registered. With a Property and Affairs Lasting Power of Attorney, once it has been successfully registered it can be used straight away.

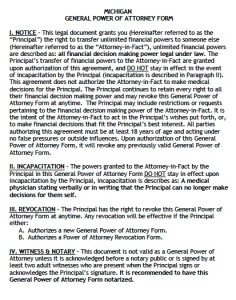

Durable Power of Attorney Michigan Form – Adobe PDF

The Michigan durable power of attorney form allows an individual, known as the “principal,” to choose a representative to make any type of financial decisions and actions on their behalf.

General Power of Attorney Michigan Form – Adobe PDF

The Michigan general power of attorney form is used to designate an attorney-in-fact to perform financial transactions on the principal’s behalf. The contract allows the attorney-in-fact unrestricted monetary powers as long as they act for the benefit of the principal.

Limited Power of Attorney Michigan Form – Adobe PDF

The Michigan limited power of attorney form is used to appoint an agent to represent the principal (the individual creating the power of attorney) in a limited or specific capacity. This agreement usually terminates once the relevant task or transaction has been completed or on a date specified in the document.

Medical Power of Attorney Michigan Form – PDF – Word

The Michigan medical power of attorney form is used to designate a “patient advocate” to make all health care decisions for the principal if they become incapacitated due to illness, old age, or injury.

Minor Child Guardianship POA Michigan Form – PDF

The Michigan minor power of attorney form allows for the parent of a minor to designate an agent to obtain guardianship over a minor. This type of authorization is most often used when the parent has to be away from the minor due to work, military deployment, or education.

Real Estate Power of Attorney Michigan Form – PDF – Word

The Michigan real estate power of attorney enables a property owner to grant another party permission to act on their behalf and make decisions relating to real estate.

Revocation of Power of Attorney Form – Michigan – Adobe PDF

The Michigan revocation of power of attorney form is used to cancel an existing power of attorney form that was created in the State.

What is a power of attorney for a minor?

Minor (Child) Power of Attorney – To choose someone else to handle day-to-day care and activities on behalf of the child.

How many witnesses are needed for a Power of Attorney?

Signing Requirements ( § 700-5501 (2) ): Two (2) witnesses or a notary public. General (Financial) Power of Attorney – For any financial-related activity but does not remain valid if the principal becomes incapacitated. Signing Requirements: No laws, although like the durable version, two (2) witnesses or a notary public are recommended.

What powers of attorney are there in Michigan?

In Michigan, powers of attorney can grant a wide range of decision making abilities to others, such as financial and property decisions. Some powers of attorney, especially those regarding health care decisions, have additional requirements. Meet the requirements. For any power of attorney (POA) to be valid in Michigan, ...

How old do you have to be to sign a POA in Michigan?

In Michigan, a durable POA must be witnessed by at least two people who are not related to the principal. These witnesses must be capable and at least 18 years old. Sign the POA. All power of attorney documents must be signed both by the principal and the agent. This is in addition to the signatures of witnesses.

What is POA document?

The POA document must clearly and explicitly state the various decision making powers granted to the agent such as management of financial assets or durable POA for health care . This is especially important for durable POA, since POA generally terminate upon the death or incapacity of the principal. Get the POA document witnessed by non-family ...

What is durable power of attorney?

What is a Durable Power of Attorney? A power of attorney is a document that allows you to give someone the authority to manage your financial affairs. This person is called your agent. Your agent can take care of your financial affairs as long as you are competent. A " durable " power of attorney is a power of attorney that remains in effect ...

Can I make a durable power of attorney effective only if I become incapacitated?

Can I Make a Durable Power of Attorney That Becomes Effective Only if I Become Incapacitated? Yes, a durable power may express your intent to make it effective upon your disability or incapacity. You should also explain in the document how you would like your disability or incapacity determined.

Why is it important to have a power of attorney?

The most important reason to have these documents in place, though, is to preserve your control over your medical and financial affairs.

What is a Durable Power of Attorney?

What you need is a Durable Power of Attorney for Health Care, also known as a Patient Advocate Designation (PAD). This document allows you to designate a person, your "advocate", to make medical decisions (including mental health decisions, if you so choose) on your behalf if you no longer can. It also lets you direct what kind ...

What is a POA?

But a POA is like a blanket: if it's poorly constructed or full of holes, it won't do the job it's intended for when it matters. Different people need different things from a POA, but everyone needs it to be legally enforceable. A low cost or internet “boilerplate” power of attorney is like a blanket: if it's poorly constructed or full of holes, ...

What is the law in Michigan regarding wearing a medical alert bracelet?

Michigan law permits you to wear a medical alert type bracelet or necklace containing this information to notify emergency personnel of your DNR. If you do not have a DNR order in place, and your advocate has not authorized one, medical personnel are legally and ethically bound to try to resuscitate you.

What is included in an estate plan in Michigan?

In Michigan, a complete estate plan includes both medical and financial powers of attorney. No matter the size of your estate, these documents preserve something that may be more valuable to you than money: your ability to make important decisions regarding your life, health, and finances.

Can you expect a living will in Michigan?

Your Living Will May Not Do What You Expect. Many people think that if they have a “living will,” their medical wishes will be known and carried out. This is an incorrect, and possibly dangerous, assumption. In Michigan, living wills have no enforceable legal effect. In Michigan, living wills have no enforceable legal effect.

Do not resuscitate Michigan?

If that's the case, your doctor can write a “do not resuscitate” (DNR) order to prevent medical providers from performing CPR when it would be otherwise called for. Michigan law permits you to wear a medical alert type bracelet or necklace containing this information to notify emergency personnel of your DNR. If you do not have a DNR order in place, and your advocate has not authorized one, medical personnel are legally and ethically bound to try to resuscitate you.

What is a durable power of attorney in Michigan?

What Is A Michigan Durable Power of Attorney? A Durable Power of Attorney in Michigan is a legal document that gives someone you appoint the legal authority to manage your financial affairs while you are alive. For this reason, a Durable Power of Attorney (DPOA) is often referred to as a Financial Power of Attorney, ...

How to choose an agent for a property?

When selecting your agent, it is very important to appoint someone that you trust. An agent can: 1 Sign your checks 2 Make deposits 3 Pay your bills 4 Contract for medical or other professional services 5 Sell your property 6 Buy insurance for you

Can a non-durable power of attorney be invalid?

Non-durable Powers of Attorney become invalid upon incapacitation. Their use is generally limited to carrying out a single task on behalf of an individual. Durable Powers of Attorney, however, are effective during incapacitation and allow for the named representative to act on behalf of the principal. A Durable Power of Attorney for Health Care ...

Do you need a power of attorney to sell your home in Michigan?

Some agencies will require a Power of Attorney to apply for benefits for the incapacitated spouse. Also, you will need a Michigan Durable Power of Attorney to sell some jointly held property such as your home. The same applies to changing the name of a beneficiary on life ...

What is a power of attorney?

In the United States, a Power of Attorney enables a person to legally make medical, financial, and certain personal decisions (such as recommending a guardian) for another person. You may need to grant someone power of attorney if you are incapable of handling all or part of your affairs for a period of time.

Why is it important to have a power of attorney?

Because the decisions that the person holding power of attorney makes are legally considered the decisions of the principal, it's vital that the agent be someone you trust absolutely and without question. Consider the following when thinking about possible agents: Consider how close the candidate is to the principal.

When does a durable power of attorney go into effect?

It often will not go into effect until the person who grants the power of attorney becomes incapacitated.

How many witnesses are needed to sign a power of attorney?

Gather witnesses. In some states it is necessary to have the signing of the document witnesses by one or two people. For instance, in Florida, a power of attorney document must be signed by two witnesses while in Utah, no witnesses are required.

Can a person with a power of attorney be conservatorship?

If the person is already mentally incapacitated and did not grant power of attorney in a living will, it may be necessary to get conservatorship or adult guardianship . In most regards, the authority held by a guardian is similar to (but more limited than) those held by someone with power of attorney.

Do you need to notarize a power of attorney?

Have the power of attorney document notarized. Some states require the agent and the principal to sign the power of attorney document in front of a notary. Even if your state does not require notarization, notarization eliminates any doubt regarding the validity of the principal's signature.

Is a power of attorney void?

If the power of attorney purports to transfer a power that cannot be transferred under the law, that part of the power of attorney is void. For instance, even if the principal and the agent agree, the agent cannot write or execute a will for the principal. Any such will is not valid.

Help Resources

- Below are frequently asked questions to assist you in filling out the form, examples of what a completed form might look like as well as a new video explaining how to fill out the new form. Frequently Asked Questions Authorized Representative Declaration Video Form 151 Business Example Form 151 (Part 5, Section 8) Example Form 151 Individual Income Tax Example

Request Copies of Tax Returns

- Complete a 4095 Request for Disclosure of Tax Return and Tax Return Information to authorize the Department of Treasury, Office of Disclosure to provide copies of tax returns to yourself or your appointee. The Disclosure officer will complete the form along with the requested tax return information and return it to you or your appointee. 4095, Request and Consent for Disclosure of …

Authorize A Representative

- If you wish to authorize another person or corporation, (tax preparer, family member, etc.,) as your representative in tax or debt matters before the State of Michigan, complete and file a form 151, Authorized Representative Declaration 151, Authorized Representative Declaration (Power of Attorney)

Request Information For Mortgage Companies

- For specific use by Mortgage Companies and Financial Institutions in dealing with mortgages. You may complete and file a Limited Power of Attorney - Borrower's Authorization for Disclosure of Information (form 4300) if you wish to have your mortgage company or financial institution contact the Michigan Department of Treasury on your behalf to obtain any and all information, in…

Written Authorization

- 205.8 Letters and notices sent to taxpayer's official representative. If a taxpayer files with the department a written request that copies of letters and notices regarding a dispute with that taxpayer be sent to the taxpayer's official representative, the department shall send the official representative, at the address designated by the taxpayer in the written request, a copy of each l…

Popular Posts:

- 1. who is new district attorney

- 2. what to put on attorney resume

- 3. what does of counsel attorney mean

- 4. who was the attorney general that got fired

- 5. how is attorney client privilege preserved in an attorney opinion letter

- 6. parental rights in indiana when power of attorney applies to parent

- 7. ace attorney how many episodes

- 8. how much does it cost for an attorney to fight the va on behalf of disabled veteran

- 9. attorney in opelika , phenix city al,& colubus,ga who deal in personal injur

- 10. what are attorney fees to file a lawsuit