- Your full legal name and address.

- Your agent's full legal name and address.

- The date the power becomes effective.

- The date the power ends, if applicable.

- The specific powers granted.

How can you get out of being power of attorney?

Jan 07, 2012 · Download - http://powerofattorneyform.com/durable.htmHomepage - http://powerofattorneyform.comA legal instrument that allows a person, typically referred to ...

How to find out if somebody has power of attorney?

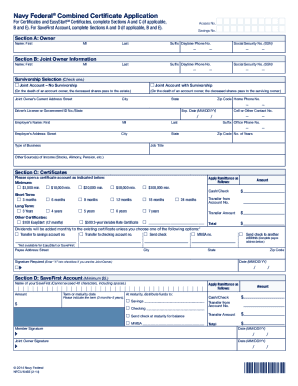

Nov 08, 2021 · Form 2848 allows taxpayers to name someone to represent them before the IRS. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. You can download a Form 2848 from IRS.gov or access the file in the image below.

How can I set up a power of attorney?

Aug 12, 2021 · Because a general power of attorney can give your agent a lot of authority, it is wise to ensure you create it with care. To protect your interests when you fill out the POA, you must fill in the details accurately and ensure you are …

How to create a power of attorney?

Apr 07, 2020 · How do you fill out a power of attorney for vehicle transactions? Step 1 – Gather Vehicle Information. Step 2 – Select the Agent. Step 3 – Choose Powers. Step 4 – Signing in Front of a Notary Public. Step 1 – Principal and Agent. Step 2 – Vehicle Information.

How do I fill out a power of attorney form?

0:392:05Learn How to Fill the Power of Attorney Form General - YouTubeYouTubeStart of suggested clipEnd of suggested clipYou must first designate the individual who will act as your agent. Under the power of attorney. TheMoreYou must first designate the individual who will act as your agent. Under the power of attorney. The individual you choose should be someone you trust.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

Can I do power of attorney myself?

Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor. In order to make a power of attorney, you must be capable of making decisions for yourself.

What is the procedure of power of attorney?

Procedure for Power of Attorney in India Submit the power of attorney with the Sub-Registrar. Attach the supporting documents with the power of attorney. Attest the power of attorney before the Registrar. Attest of the power of attorney by 2 witnesses.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

How long does a power of attorney take?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

What are the disadvantages of power of attorney?

What Are the Disadvantages of a Power of Attorney?A Power of Attorney Could Leave You Vulnerable to Abuse. ... If You Make Mistakes In Its Creation, Your Power Of Attorney Won't Grant the Expected Authority. ... A Power Of Attorney Doesn't Address What Happens to Assets After Your Death.More items...•Sep 4, 2018

Does power of attorney need to be registered?

It is not necessary to register the power of attorney deed unless it involves transfer of property rights/title etc. Both the parties to the power of attorney deed must fully understand what their rights and obligations are under the deed and should act accordingly.Jun 28, 2016

Should the power of attorney be registered?

Registration: In many cases, a general or specific power of attorney need not be registered. The question of registration arises only if a power is given for the sale of immovable properties. ... However, the Supreme court has recently ruled that a power of attorney given to sell immovable properties should be registered.

Is notarized power of attorney valid?

Notarization is one of the proper form of authenticating power of attorney in the eye of law and as such General power of attorney dated 28.08. 2008 is valid and properly ratified.

How many years can you list on a power of attorney?

Instead, list the current tax year for which you are filing a return or you can list a series of years to cover past and future filings. However, you can only list up to three future years from the year you file the power of attorney form.

What to do if you don't have a CAF number?

If you don’t have one, enter “none” and the IRS will assign a number to you. You should get a letter from the IRS with your CAF number, which you will need to use when you send a Form 2848 along with each year’s tax return for your parent. You can leave PTIN blank (this is a number assigned to paid tax preparers).

What is line 3 on a 1040?

Line 3 – Acts authorized: These are the acts you, the representative, are being authorized to perform. If you’re simply filing a return for a parent, you can list “Income” under “Description of Matter.”. Write 1040 for the tax form number if you’re filing a basic tax return for your parent.

What is a 2848 form?

Form 2848 allows taxpayers to name someone to represent them before the IRS. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. You can download a Form 2848 from IRS.gov or access the file in the image below.

What does "accept payment" mean?

accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative (s) or any firm or other. entity with whom the representative (s) is (are) associated) issued by the government in respect of a federal tax liability.

How to fill out POA?

2. Fill Out the POA 1 Your details, such as official name and address, should go into the section reserved for the principal. 2 Your representative’s name and official address should go into the section reserved for the agent or attorney-in-fact. 3 If you intend to designate more than one person as attorney-in-fact, do so in the secondary agent section. The people you include in that section will act on your behalf if the first agent is not in a position to do so. 4 Read the general POA instructions on designating powers to your agent. You must be as clear and specific as possible. So, be sure also to include the duration a power of attorney will be in effect and the particular authority you are giving to your agent.

How to get a power of attorney notarized?

Take the power of attorney document and your state identification to a notary public. Sign and date the paper and ask him to notarize your signature. Make copies of the document for yourself and your agents.

What is autoplay power of attorney?

Brought to you by Sapling. Check the form's instructions for granting authority. You might have to initial all powers you're giving or only powers you're not giving, depending on the format. A general power of attorney gives your agent broad authority, but you usually can eliminate some powers ...

How to eliminate powers of attorney?

A general power of attorney gives your agent broad authority, but you usually can eliminate some powers if you want to do so by putting a line through the powers. Follow the power of attorney's directions for the powers section. Write in any other powers you're giving that are not shown on the form using specific wording.

What happens if you make mistakes in your agent?

If you make mistakes, you might give your agent powers you don't want her to have, omit powers you do want to give her or end up with a useless document. You are the principal, the person giving authority, and your agent is the person you're allowing to act in your place.

How to get a power of attorney?

The simplest way to get power of attorney is to do so with the agreement of the person who may need to turn over his decision-making rights. If your loved one is terminally ill, a time may come when he won't be able to make financial or medical decisions. He may decide to willingly sign over power of attorney to you.

What is the name of the person who gives up his power of attorney?

1. Determine the terms of the power of attorney. The person that is given the decision-making ability is the agent, also known as the attorney-in-fact. The person who gives up his ability to make decisions is known as the principal.

Why do notaries notarize power of attorney?

This is because the notary has to verify the identity of the people involved before he witnesses the signatures. Since this is the case, notarizing the power of attorney document reduces the chance that it will be brought into question by anyone who may have a problem with its validity.

What should the form say about the rights of an agent?

The form should say exactly what rights the agent will take over. In a clear and specific manner, document the rights being granted to the agent; when those rights will take effect; and when, if ever, those rights will stop. Make sure the form says whether the rights are springing durable or durable.

When does a durable power of attorney go into effect?

A durable power of attorney goes into effect immediately. It continues to be valid when the person who asks for it is no longer able to make decisions. A general power of attorney does not remain in effect after someone is unable to make decisions for themselves.

When do you need a durable power of attorney?

You may also need a durable power of attorney if it is suggested that one is needed by the principal. A durable power of attorney goes into effect immediately.

Can you use a template for a power of attorney?

To avoid any confusion and to make sure that everyone involved knows exactly what rights are being given, it's a good idea to use a state-issued form as a template. You can use a template of a state form to write your own power of attorney document.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative (s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreement to Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

What is the APO number for Guam?

855-214-7522. All APO and FPO addresses, American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, the U.S. Virgin Islands, Puerto Rico, a foreign country, or otherwise outside the United States. Internal Revenue Service. International CAF Team.

What is a fiduciary notice?

Use Form 56, Notice Concerning Fiduciary Relationship, to notify the IRS of the existence of a fiduciary relationship. A fiduciary (trustee, executor, administrator, receiver, or guardian) stands in the position of a taxpayer and acts as the taxpayer, not as a representative.

What is the purpose of Form 2848?

Purpose of Form. Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.

What is Form 2848?

The individual you authorize must be eligible to practice before the IRS. Form 2848, Part II, Declaration of Representative, lists eligible designations in items (a)– (r). Your authorization of an eligible representative will also allow that individual to inspect and/or receive your confidential tax information.

How to change last known address?

To change your last known address, use Form 8822, Change of Address, for your home address and Form 8822-B, Change of Address or Responsible Party—Business, to change your business address. Both forms are available at IRS.gov. . Authorizing someone to represent you does not relieve you of your tax obligations. .

Can a law student represent a taxpayer?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business, or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "Qualifying Student" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

Popular Posts:

- 1. who was.charlie crists attorney general

- 2. florida power of attorney how do you gign document

- 3. are independent actions barred when the attorney general is involved?

- 4. what is an attorney in fact means in florida

- 5. what is the responsibility of power of attorney

- 6. attorney evansville in who will fight against cps

- 7. how old is natasha mayne attorney

- 8. how to find a pro bono attorney to help setting up nonprofit organizationin in pennsylvania

- 9. how do you fill out financial power of attorney

- 10. what is up with shiloh's attorney on general hospital