Creating a Durable Power of Attorney Download Article

- Find Durable Power of Attorney forms. Your principal may not be able to search for these forms, fill them out, or...

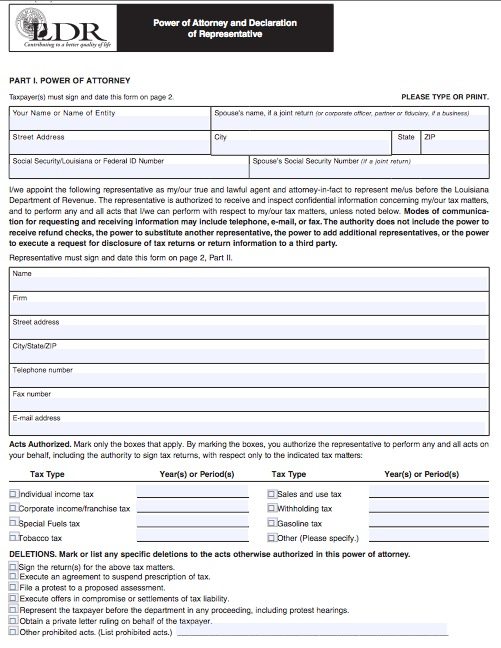

- Complete the form, or draft your own document. If you have a fill-in-the-blank form, provide the information...

- Sign the document in front of a notary. Every state requires you and your...

Is it necessary to have a durable power of attorney?

To become valid, a POA letter must be: Signed by the principal and the agent. Witnessed (in some states) Notarized by a notary licensed in your state.

What are the benefits of a durable power of attorney?

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages long. Some states have their own forms, but it's not mandatory that you use them. Some banks and brokerage companies have their own durable power of attorney forms.

Is it necessary to file a durable power of attorney?

Feb 11, 2022 · How to Get DPOA (5 steps) Step 1 – Download the Form. Most States have a statutory form that is required to be completed in order to be accepted. Otherwise, the principal may ... Step 2 – Select the Financial Powers. Step 3 – Effective Immediately or Upon Disability. Step 4 – Prepare the Form for ...

How to fill out a durable power of attorney?

Aug 25, 2012 · There is no need to file a durable power of attorney with any governmental entity at this time. In some cases, it may be necessary to record the power of attorney for instance, if it is used to sell real estate. However, you do not need to record the power of attorney in order to make it generally valid. Report Abuse.

When A Financial Power of Attorney Takes Effect

A financial power of attorney can be drafted so that it goes into effect as soon as you sign it. (Many spouses have active financial powers of atto...

Making A Financial Power of Attorney

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages...

When A Financial Power of Attorney Ends

Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your de...

What Is A Durable Power of Attorney?

A Durable Power of Attorney (form) is for anyone wanting another person to handle matters on their behalf when incapacitated. It’s by far the most...

How to Get Durable Power of Attorney

Getting a durable power of attorney will require the principal to find someone that they can trust to handle their assets if they should not be abl...

Durable Poa vs General Poa

Both forms allow for the principal to select someone else to act on their behalf. Although, the durable allows for the relationship to continue in...

Agent’S Acceptance of Appointment

At the end of the form, the Agent must read and acknowledge the power that they have and how important their position is for the principal. This ad...

What does it mean to have a power of attorney?

If you are an attorney, this means you have the power to act on someone else's behalf. You’ll often hear lawyers referred ...

Where to sign POA?

Sign the document in front of a notary. Every state requires you and your principal to sign the durable POA in the presence of a notary. If you’re not sure where to find a notary, you can use the Notary Locator provided by the American Society of Notaries.

Why are lawyers called attorneys?

You’ll often hear lawyers referred to as attorneys-at-law, or simply as attorneys, because they have the power to act on behalf of their clients in particular legal situations. Likewise, when someone, as the principal, grants you durable power of attorney, you become their agent.

What are financial decisions?

Financial decisions include the ability to access all bank, retirement, and credit accounts, sign income tax returns, collect Social Security or other government benefits, sell stocks and make investments, and manage the principal's real estate. ...

Who is Jennifer Mueller?

Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

Can a principal revoke a POA?

Understand your principal can revoke your authority at any time. If your principal's condition improves, or if she decides she no longer wants a POA, she can revoke it whenever she wants as long as she's mentally competent.

What is a durable power of attorney?

A durable power of attorney for finances -- or financial power of attorney -- is a simple, inexpensive, and reliable way to arrange for someone to manage your finances if you become incapacitated (unable to make decisions for yourself).

When does a power of attorney end?

When a Financial Power of Attorney Ends. Your durable power of attorney automatically ends at your death. That means that you can't give your agent authority to handle things after your death, such as paying your debts, making funeral or burial arrangements, or transferring your property to the people who inherit it.

What happens if you don't have a power of attorney?

If you don't, in most states, it will automatically end if you later become incapacitated. Or, you can specify that the power of attorney does not go into effect unless a doctor certifies that you have become incapacitated. This is called a "springing" durable power of attorney. It allows you to keep control over your affairs unless ...

What do you do with your money?

buy, sell, maintain, pay taxes on, and mortgage real estate and other property. collect Social Security, Medicare, or other government benefits. invest your money in stocks, bonds, and mutual funds. handle transactions with banks and other financial institutions. buy and sell insurance policies and annuities for you.

How to transfer property to a trust?

transfer property to a trust you've already created. hire someone to represent you in court, and. manage your retirement accounts. The agent is required to act in your best interests, maintain accurate records, keep your property separate from his or hers, and avoid conflicts of interest.

Can a divorce be invalidated?

A court invalidates your document. It's rare, but a court may declare your document invalid if it concludes that you were not mentally competent when you signed it, or that you were the victim of fraud or undue influence. No agent is available.

Can you revoke a power of attorney?

As long as you are mentally competent, you can revoke a durable power of attorney at any time. You get a divorce. In a handful of states, if your spouse is your agent and you divorce, your ex-spouse's authority is automatically terminated. In other states, if you want to end your ex-spouse's authority, you have to revoke your existing power ...

What is a durable power of attorney?

A durable power of attorney form (DPOA) allows an individual (“principal”) to select someone else (“agent” or “attorney-in-fact”) to handle their financial affairs while they are alive. The term “durable” refers to the form remaining valid and in-effect if the principal should become incapacitated (e.g. dementia, Alzheimer’s disease, etc.).

What is UPOAA law?

The Uniform Power of Attorney Act (UPOAA) are laws created by the National Conference of Commissioners on Uniform State Laws (ULC) and have been adopted by 28 States since 2007. The incorporation of the laws is to bring uniformity to all 50 States and set common guidelines. Uniform Power of Attorney Act (UPOAA) Statutes (Revised 2006)

Who determines if a disability form is effective?

The principal will have to decide if the form will be effective immediately or if it will be effective upon the disability of the principal. Disability or incapacitation is usually determined by a licensed physician and usually defined under State law.

What is an agent certification?

An agent certification is an optional form that lets an agent acknowledged their designation by the principal. The agent must sign in the presence of a notary public ( Section 302 – Page 74 ):

What is real property?

Real property – The buying, selling, and leasing of real estate; Tangible Personal Property – The selling or leasing of personal items; Stocks and Bonds – Selling shares of stock or bonds; Commodities and Options – Making transfers of financial items or derivatives;

What is personal maintenance?

Personal and Family Maintenance – Deciding and budgeting the amount of money to pay for the principal and any family members being supported; Benefits from Governmental Programs or Civil or Military Service – To make claims for any government benefit or subsidy; Retirement Plans – To amend any retirement plan.;

What do you need to do after a form is completed?

After the form has been completed the principal will need to figure out the signing requirements in their State to finalize the document. In addition, the principal will need to gather the agent (s) as they will be required to sign the form in front of either the two (2) witnesses or notary public.

What is a power of attorney?

A power of attorney document lets you choose a trusted friend or relative to help you with your finances and/or health care decisions. After you sign it, the person you choose will take the power of attorney document to your medical providers, bank, school, and other places to make decisions and sign contracts just as if he or she were you. ...

What is the phone number for King County?

If you live outside King County, call the CLEAR hotline Monday-Friday from 9:15 am to 12:15 pm at 1-888-201-1014. You can also apply online at nwjustice.org/get-legal-help . If you live in King County, call 211 for information and referral to a legal services provider Monday-Friday from 8:00 am to 6:00 pm.

What is durable power of attorney?

What is a Durable Power of Attorney? A power of attorney is a document that allows you to give someone the authority to manage your financial affairs. This person is called your agent. Your agent can take care of your financial affairs as long as you are competent. A " durable " power of attorney is a power of attorney that remains in effect ...

What is the duty of an agent?

Your agent must follow your instructions and act in your best interest. The agent must keep receipts and accurate records about your assets. The agent must keep a record of the actions done on your behalf. If you ask your agent to keep you informed of his or her actions, then he or she must do so.

What does it mean when you are incapacitated?

If you are incapacitated, it means you have a mental or physical condition that prevents you from taking care of your own financial affairs. You must sign your durable power of attorney in front of a notary or two witnesses. Also, your agent must sign an acknowledgement of responsibilities and duties before exercising authority.

Can you name more than one agent?

You can name more than one agent to act at the same time. Include in your durable power of attorney whether the agents will act separately or as one. You should also name successor agents who will act if your agent becomes unavailable or unwilling to act on your behalf.

Can a spouse be a power of attorney?

To provide your consent and signature to these legal transactions after your disability or incapacity, your spouse must be named as your agent under a durable power of attorney.

Marty Burbank

We don't record them usually unless we are using them with regard to real property. If fact to record a POA there must be an associated real piece of real property to attach it to. It must also be attached separately to ever piece of relevant real property...

Alan Leigh Armstrong

While a POA should be prepared so it can be recorded, it seldom is recorded UNLESS there is real property sold, bought, or refinanced under the POA. In those cases, the escrow company usually records them along with the deed and trust deed (for the loan) in the county where the real property is located.

Edna Carroll Straus

They are not recorded by the county clerk. (Unless they are involving real property.) You can find the address using your search engine.

Popular Posts:

- 1. which line to deduct attorney fees on taxes

- 2. what type of attorney would work with non-injury accidents

- 3. russian attorney who met with donald trump jr

- 4. what should i do if an attorney puts a lien on my house?

- 5. blank power of attorney forms free download

- 6. what is the difference between the attorney general and the soliciter general

- 7. how much does the average attorney make a year

- 8. how to cancel attorney representation

- 9. who was the attorney general in 2009

- 10. what exactly does a defense attorney do