How to Use a Durable Power of Attorney The agent should bring a certified copy of the Durable Power of Attorney with them when they conduct business as your agent. When they sign documents on your behalf, they should sign their name and then indicate that they’re signing as power of attorney.

How do I get a durable power of attorney?

Dec 01, 2021 · They can’t: Contract a marriage in most states, though a few do allow it. Make, amend, or revoke a will. Use a person’s assets or money as their own. Vote on behalf of a person. Transfer responsibility to another agent. Change or violate the terms of the POA. Make any legal or financial decisions ...

What is a durable power of attorney for health care?

How to Use a Durable Power of Attorney The agent should bring a certified copy of the Durable Power of Attorney with them when they conduct business as your agent. When they sign documents on your behalf, they should sign their name and then indicate that they’re signing as power of attorney.

What happens to my durable power of attorney after divorce?

Jan 27, 2022 · A durable power of attorney gives your agent the right to make decisions and take the actions specified for the long term. Even if you are mentally incapacitated or deemed unfit to make decisions for yourself, your agent can still act on your behalf. Since most older adults need a POA only in case they become incapacitated, this is the preferred type. Medical Power of …

Can a power of attorney be used to step down?

Nov 02, 2018 · Your durable power of attorney should give you the right to act in your father’s place on most legal and financial matters. Social Security and medical records are a bit of an anomaly. Powers of attorney are authorized under state law and thus do not apply to Social Security, which is a federal program.

What is the advantage to executing a durable power of attorney?

What does durable mean in power of attorney?

How do I activate a power of attorney in Ontario?

What three decisions Cannot be made by a legal power of attorney?

Can a power of attorney transfer money to themselves?

How much does a power of attorney get paid in Ontario?

Does a power of attorney in Ontario need to be notarized?

How much does a power of attorney cost in Ontario?

Does a power of attorney need to be notarized?

It depends on the state, since each state has its own rules for validating a power of attorney. Some require two witnesses and no notary, some requ...

How much does a power of attorney cost?

The cost for a power of attorney varies, depending on how you obtain the form and your state’s notary requirements. Online forms may be free, and y...

How many people can be listed on a power of attorney?

You can name multiple agents on your power of attorney, but you will need to specify how the agents should carry out their shared or separate duties.

What are the requirements to be a power of attorney agent?

Legally, an agent must be at least 18 years old and of sound mind.4 You should also choose someone you trust to act in your best interests.

When should I create a power of attorney?

You can create a power of attorney at any point after you turn 18. You need to create a power of attorney while you’re of sound mind.

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

What happens if you don't have a power of attorney?

An attorney-in-fact can handle many types of transactions, including: If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent before they can take care of your finances for you.

What is a power of attorney for healthcare?

A healthcare power of attorney, on the other hand, names someone to make medical decisions any time you are unable to do it yourself, even if you are expected to make a full recovery.

What is a POA?

A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident.

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

What is a POA?

A Power of Attorney (or POA) is a legal document that authorizes someone else to handle certain matters on your behalf. A Durable Power of Attorney remains in effect even if the creator becomes mentally incompetent. This is different from a traditional Power of Attorney which becomes defunct when the creator loses mental capacity.

Why do you need a durable power of attorney?

As demonstrated in the story above, one of the most compelling reasons to create a Durable Power of Attorney is the possibility of incapacity. If you have a revocable living trust, it’s true that your Successor Trustee can step in to take control over the assets of your trust if you become incapacitated.

Can you put life insurance in a trust?

But some assets, like life insurance and retirement accounts, cannot be titled into a trust. If you become incapacitated and want someone to access these assets, your agent will need a Power of Attorney document.

What is a power of attorney?

A general power of attorney legally authorizes your “agent” (aka attorney-in-fact) to act on your behalf in a wide range of business matters. A few examples include filing tax returns; buying and selling real estate; paying bills; and managing bank accounts.

What is a springing power of attorney?

Springing Power of Attorney: This type of Durable Power of Attorney does not “spring into effect” until the principal (creator) becomes incapacitated, allowing you to avoid giving your agent immediate authority. In California, a Springing Power of Attorney usually includes this phrase: “This power of attorney shall become effective upon ...

What is a durable power of attorney?

A durable power of attorney form (DPOA) allows an individual (“principal”) to select someone else (“agent” or “attorney-in-fact”) to handle their financial affairs while they are alive. The term “durable” refers to the form remaining valid and in-effect if the principal should become incapacitated (e.g. dementia, Alzheimer’s disease, etc.).

What is UPOAA law?

The Uniform Power of Attorney Act (UPOAA) are laws created by the National Conference of Commissioners on Uniform State Laws (ULC) and have been adopted by 28 States since 2007. The incorporation of the laws is to bring uniformity to all 50 States and set common guidelines. Uniform Power of Attorney Act (UPOAA) Statutes (Revised 2006)

What is the meaning of section 114?

In accordance with Section 114 (page 23), the agent must act: To principal’s expectations while performing in their best interest; In good faith; Only with the scope of authority within the power of attorney. To act without a conflict of interest to be able to make decisions on behalf of the principal’s best interest;

What is the meaning of "in good faith"?

In good faith; Only with the scope of authority within the power of attorney. To act without a conflict of interest to be able to make decisions on behalf of the principal’s best interest ; To keep records of all receipts, disbursements, and transactions made on behalf of the principal;

What is an agent certification?

An agent certification is an optional form that lets an agent acknowledged their designation by the principal. The agent must sign in the presence of a notary public ( Section 302 – Page 74 ):

What is real property?

Real property – The buying, selling, and leasing of real estate; Tangible Personal Property – The selling or leasing of personal items; Stocks and Bonds – Selling shares of stock or bonds; Commodities and Options – Making transfers of financial items or derivatives;

What is personal maintenance?

Personal and Family Maintenance – Deciding and budgeting the amount of money to pay for the principal and any family members being supported; Benefits from Governmental Programs or Civil or Military Service – To make claims for any government benefit or subsidy; Retirement Plans – To amend any retirement plan.;

What is a durable power of attorney?

A durable general power of attorney gives an agent more powers than you have: the power to do anything you can while active, and the power to do anything he wants in case of your incapacity. Invoking a durable general power of attorney can be useful if you want your child or spouse to take care of your affairs.

How to set up an enduring power of attorney?

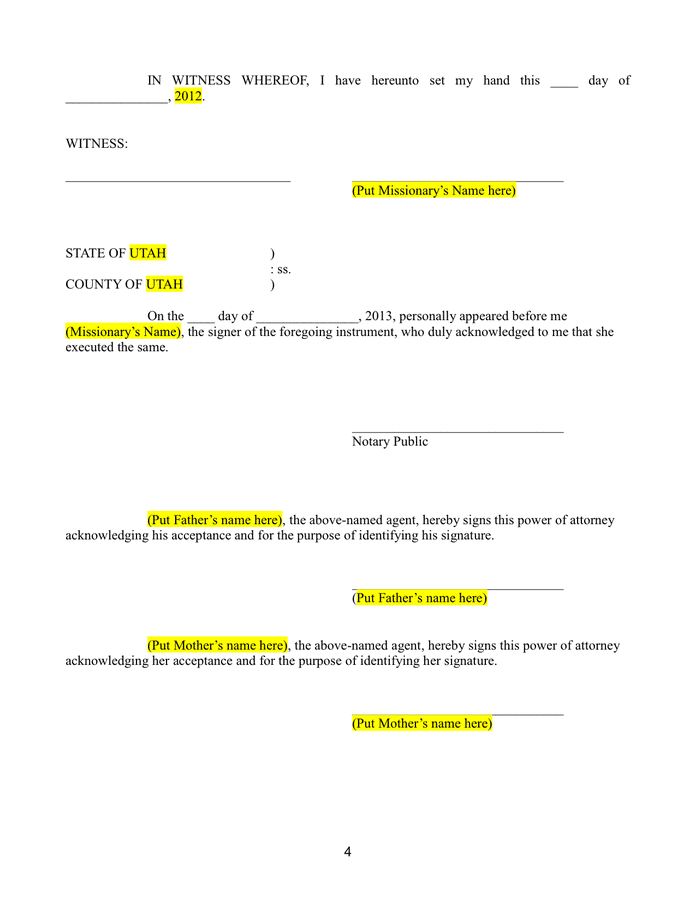

Read More: How to Set Up Enduring Power of Attorney. Sign the forms before appropriate witnesses and a notary. The agent cannot be a witness; nor can your relatives in most states. Affirm that the contents of the power of attorney are your intent. Some attorneys suggest videotaping estate documents of this significance.

Can an agent be a witness?

The agent cannot be a witness; nor can your relatives in most states. Affirm that the contents of the power of attorney are your intent. Some attorneys suggest videotaping estate documents of this significance. Give a copy of the durable general power of attorney to the agent you designate, and also to your bank, your stockbroker, your children, ...

Can you revoke a power of attorney?

You can also revoke the power of attorney, but some agents continue to act, claiming no knowledge of the revocation. You may live with the consequences of this kind of power of attorney to the grave. In most states, the durable general power of attorney terminates at death.

Who is Linda Richard?

Linda Richard has been a legal writer and antiques appraiser for more than 25 years, and has been writing online for more than 12 years. Richard holds a bachelor's degree in English and business administration. She has operated a small business for more than 20 years.

Do you need a power of attorney to act on your behalf?

Your attorney-in-fact will need the original power of attorney document, signed and notarized, to act on your behalf. So, if you want your attorney-in-fact to start using the document right away, give the original document to the attorney-in-fact. If you named more than one attorney-in-fact, give the original document to one of them.

Can you give copies of durable power?

If you wish, you can give copies of your durable power to the people your attorney-in-fact will need to deal with —in banks or government offices, for example. If the durable power is in their records, it may eliminate hassles for your attorney-in-fact later because they will be familiar with the document and expecting your attorney-in-fact to take action under it.

Can you use a power of attorney if you are incapacitated?

If your power of attorney won't be used unless and until you become incapacitated , however, it may seem premature to contact people and institutions about a document that may never go into effect. It's up to you. Be sure to keep a list of everyone to whom you give a copy.

What is financial power of attorney?

What Is a Financial Power of Attorney? A financial power of attorney is a particular type of POA that authorizes someone to act on your behalf in financial matters. Many states have an official financial power of attorney form.

Do banks have power of attorney?

Many states have an official durable power of attorney form, which is usually a durable financial power of attorney form. Some banks and brokerage firms have their own power of attorney forms. Also, for buying or selling real property, a title insurance company, lender or closing agent may require the use of their form.

Can a third party accept a power of attorney?

Generally, a third party is not required to accept a power of attorney. However, some state laws provide for penalties for a third party who refuses to accept a power of attorney using the state’s official form.

How does a POA work?

Financial Power of Attorney: How It Works. A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable. If you need to give another person the ability to conduct your financial matters ...

What is a POA?

What Is Power of Attorney? A power of attorney (or POA) is a legal document that authorizes someone to act on your behalf. The person who gives the authority is called the "principal," and the person who has the authority to act for the principal is called the "agent," or the "attorney-in-fact.".

When does a POA become effective?

When Does a Power of Attorney Become Effective? Depending upon how it is worded, a POA can either become effective immediately, or upon the occurrence of a future event. If the POA is effective immediately, your agent may act on your behalf even if you are available and not incapacitated. This is done when someone can’t be present ...

What is incapacity in medical terms?

Incapacity is where the principal is certified by one or more physicians to be either mentally or physically unable to make decisions. This could be due to such things as mental illness, Alzheimer’s disease, being in a coma, or being otherwise unable to communicate.

Popular Posts:

- 1. the attorney general is most similar to which county-level role?

- 2. where can i get a free printable power of attorney form

- 3. do i have to use an attorney for a will when a person dies in florida?

- 4. how can i find a pro bono attorney

- 5. how cancel power of attorney

- 6. why did tracie hunter's attorney resign

- 7. bus driver who hit train has been referred to the district attorney

- 8. does a maryland power of attorney work when you move states

- 9. how to file a complaint with the nc attorney general

- 10. a professional negligence action requires that a client's attorney prove which elements?