How and When to Use the Durable Power-of-Attorney

- Springing Power. Most powers-of-attorney become effective immediately upon execution by the principal. ...

- Drafting. ...

- Advantages for the Seriously-Ill. ...

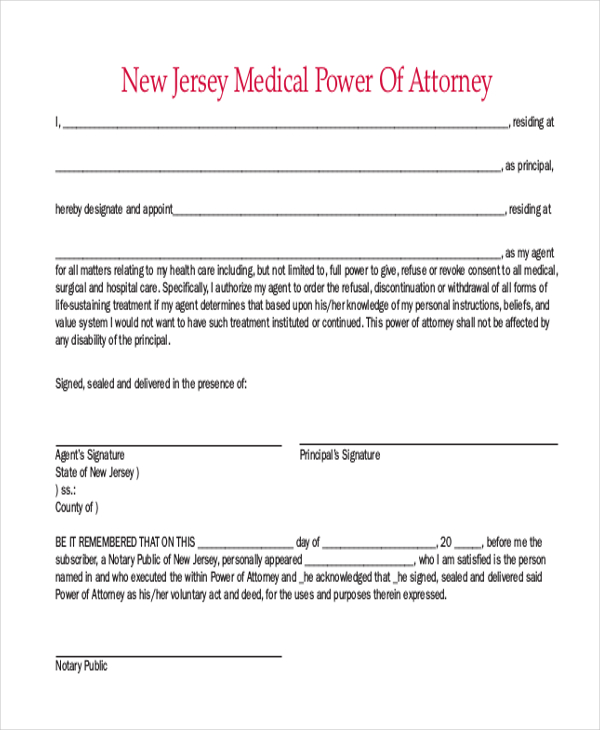

- Signing Formalities. ...

- Healthcare Considerations. ...

How to create a temporary power of attorney?

These powers include:

- Everyday medical decision-making;

- End-of-life decisions;

- Donation of organs;

- The nomination of a Conservator; and

- Autopsy authorizations.

How to enforce durable power of attorney?

Understanding and Using Powers of Attorney

- About the Power of Attorney. A Durable Power of Attorney may be the most important of all legal documents. ...

- Powers and Duties of an Attorney-in-Fact. What can I do as an Attorney-in-Fact? ...

- Using the Power of Attorney. ...

- Financial Management and the Liability of an Attorney-in-Fact. ...

- Relationship of Power of Attorney to Other Legal Devices. ...

How can you get out of being power of attorney?

- The arrangement may not be convenient for them due to location or work responsibilities.

- The agent may not want the responsibility of looking after another person’s affairs.

- An agent may decide to resign if the principal’s decision to appoint one child as their agent leads to fighting between the other siblings.

How can I set up a power of attorney?

To get started, follow these basic guidelines for designating power of attorney:

- How to set up power of attorney.

- Consider durable power of attorney.

- Limited vs. general power of attorney.

- Immediately effective vs. springing power of attorney.

- Power of attorney for health care.

What is the advantage to executing a durable power of attorney?

It Can be Empowering – A durable power of attorney allows you to decide in advance who will make decisions on your behalf without removing any of your rights or transferring ownership of assets. You also get to decide how much control the agent has over your care and your assets.

How do you invoke a power of attorney in Ontario?

You can make a power of attorney document yourself for free or have a lawyer do it. To make a power of attorney yourself, you can either: download and complete this free kit. order a print copy of the free kit online from Publications Ontario or by phone at 1-800-668-9938 or 416-326-5300.

What is the best power of attorney to have?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

How do I invoke a power of attorney UK?

How to make a lasting power of attorneyChoose your attorney (you can have more than one).Fill in the forms to appoint them as an attorney.Register your LPA with the Office of the Public Guardian (this can take up to 20 weeks).

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

How does a power of attorney get activated?

By registering it now your Lasting Power of Attorney can be activated and ready for your attorney to use it when they need it. If you decide to not register it and your attorney needs to act on your behalf, there could be a 12 week delay before it can be used.

What type of power of attorney covers everything?

Enduring power of attorney (EPA) An EPA covers decisions about your property and financial affairs, and it comes into effect if you lose mental capacity, or if you want someone to act on your behalf.

Can a power of attorney transfer money to themselves?

Can a Power of Attorney Transfer Money to Themselves? No — not without good reason and express authorization. While power of attorney documents can allow for such transfers, generally speaking, a person with power of attorney is restricted from giving money to themselves.

What is the difference between power of attorney and lasting power of attorney?

The Lasting and Enduring Power of Attorney – how they differ The main differences between the two systems are as follows: The LPA holder no longer has to apply to the court when the person conferring the power is no longer mentally capable. The LPA is now only registerable with the Office of the Public Guardian.

Do you have to register a power of attorney with the bank?

The LPA must be registered with the Office of the Public Guardian (OPG), then attorneys must register their powers with each financial provider the donor holds an account with. This legal arrangement remains in place even if your mental faculties decline, but must be set up before that happens.

When can I use power of attorney?

You can give someone power of attorney to deal with all your property and financial affairs or only certain things, for example, to operate a bank account, to buy and sell property or change investments.

How do I prove I have lasting power of attorney?

But how do you prove that you have an LPA? Once registered the LPA itself will have a perforated stamp at the bottom of the front page, saying 'validated' and a stamp or box (or both) on the front page will also show the date that the document was registered.

Does a power of attorney need to be notarized?

It depends on the state, since each state has its own rules for validating a power of attorney. Some require two witnesses and no notary, some requ...

How much does a power of attorney cost?

The cost for a power of attorney varies, depending on how you obtain the form and your state’s notary requirements. Online forms may be free, and y...

How many people can be listed on a power of attorney?

You can name multiple agents on your power of attorney, but you will need to specify how the agents should carry out their shared or separate duties.

What are the requirements to be a power of attorney agent?

Legally, an agent must be at least 18 years old and of sound mind.4 You should also choose someone you trust to act in your best interests.

When should I create a power of attorney?

You can create a power of attorney at any point after you turn 18. You need to create a power of attorney while you’re of sound mind.

Why should a power of attorney be written?

Powers of Attorney should be written clearly so that the Attorney-in-Fact and third parties know what the Attorney-in-Fact can and cannot do. If you, as Attorney-in-Fact, are unsure whether or not you are authorized to do a particular act, you should consult the attorney who prepared the document.

What is a power of attorney?

A Power of Attorney empowers an Attorney-in-Fact to do certain specified things for the Principal during the Principal's lifetime. A Living Trust also allows a person, called a "trustee," to do certain things for the maker of the trust during that person's lifetime but these powers also extend beyond death.

What happens if a third party refuses to honor a power of attorney?

Under some circumstances, if the third party's refusal to honor the Power of Attorney causes damage, the third party may be liable for those damages and even attorney's fees and court costs. Even mere delay may cause damage and this too may subject the third party to a lawsuit for damages.

What is an attorney in fact?

An Attorney-in-Fact is looked upon as a "fiduciary" under the law. A fiduciary relationship is one of trust. If the Attorney-in-Fact violates this trust, the law may punish the Attorney-in-Fact both civilly (by ordering the payments of restitution and punishment money) and criminally (probation or jail).

What is an affidavit for power of attorney?

An affidavit is a sworn written statement. A third party may require you, as the Attorney-in-Fact, to sign an affidavit stating that you are validly exercising your duties under the Power of Attorney. If you want to use the Power of Attorney, you do need to sign the affidavit if so requested by the third party.

Can a durable power of attorney be terminated?

Even a Durable Power of Attorney, however, may be terminated under certain circumstances if court proceedings are filed.

Do you have to pass a test to become an attorney in fact?

Certain financial institutions can also serve. There is no course of education that attorneys-in-fact must complete or any test that attorneys-in-fact must pass. Because a Power of Attorney is such a potentially powerful document, attorneys-in-fact should be chosen for reliability and trustworthiness.

Why do we need a durable powers of attorney?

Durable powers of attorney help you plan for medical emergencies and declines in mental functioning and can ensure that your finances are taken care of. Having these documents in place helps eliminate confusion and uncertainty when family members have to make tough medical decisions.

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

What does POA stand for in power of attorney?

When power of attorney is made durable, it remains intact if you cannot make decisions for yourself. A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. ...

What is the purpose of a durable POA?

The purpose of a durable POA is to plan for medical emergencies, cognitive decline later in life, or other situations where you're no longer capable of making decisions.

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

What is a power of attorney for healthcare?

A healthcare power of attorney, on the other hand, names someone to make medical decisions any time you are unable to do it yourself, even if you are expected to make a full recovery.

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

What is a springing power of attorney?

With a springing power of attorney, the authority to act on your behalf only kicks in after a doctor certifies that you’re incapacitated. (One drawback to keep in mind: That extra step can sometimes create delays.)

Why is an attorney in fact important?

This important document empowers an appointed agent (also known as an attorney-in-fact) to make financial and legal decisions on your behalf. It’s durable because it remains in effect even if you become incapacitated for any reason.

Can you override a power of attorney?

You still have the right to control your life, your money, your property, and your assets. And you can always override your agent, if you’re of sound mind.

What is a durable power of attorney?

A durable power of attorney form (DPOA) allows an individual (“principal”) to select someone else (“agent” or “attorney-in-fact”) to handle their financial affairs while they are alive. The term “durable” refers to the form remaining valid and in-effect if the principal should become incapacitated (e.g. dementia, Alzheimer’s disease, etc.).

How many copies of POA form are needed?

Successor Agent (optional) – Elect to have in case the agent is not available. Durable POA Form (3 copies) – It is recommended to bring 3 copies for signing. Notary Public / Witnesses – Depending on the State, it is required the form is signed by a notary public or witness (es) present.

What is UPOAA law?

The Uniform Power of Attorney Act (UPOAA) are laws created by the National Conference of Commissioners on Uniform State Laws (ULC) and have been adopted by 28 States since 2007. The incorporation of the laws is to bring uniformity to all 50 States and set common guidelines. Uniform Power of Attorney Act (UPOAA) Statutes (Revised 2006)

What powers does the principal have in real estate?

Financial Powers. The principal may grant the following standard financial powers to the agent in accordance with Section 301 (page 68): Real property – The buying, selling, and leasing of real estate; Tangible Personal Property – The selling or leasing of personal items;

What do you need to do after a form is completed?

After the form has been completed the principal will need to figure out the signing requirements in their State to finalize the document. In addition, the principal will need to gather the agent (s) as they will be required to sign the form in front of either the two (2) witnesses or notary public.

What is an attorney in fact statement?

(25) Attorney-in-Fact Declaration. The Agent who will be granted the principal powers you approved according to the conditions you set will have an acceptance statement to tend to. The printed name of the Attorney-in-Fact must be included in this statement.

What is the step 3 of a disability form?

Step 3 – Effective Immediately or Upon Disability . The principal will have to decide if the form will be effective immediately or if it will be effective upon the disability of the principal. Disability or incapacitation is usually determined by a licensed physician and usually defined under State law.

What happens to a power of attorney?

Nothing happens with your power of attorney until you are determined to be unable to participate in medical decisions. Until that time, you retain all rights to make decisions for yourself. If family members disagree with you, your choices trump their thoughts until, and unless, the power of attorney for health care has been put into effect.

Do people with Alzheimer's have power of attorney?

In the early stages of Alzheimer's disease, some people may still have intact judgment and decision-making abilities. Typically, as Alzheimer's progresses into the middle stages of disease, more power of attorney documents are put into effect. 2.

Can a power of attorney be revoked?

If you regain the ability to make or participate in medical decisions, the determination that put the power of attorney into effect can be revoked to allow you to make your own decisions. This is a protective measure meant to facilitate your right to make medical decisions to the greatest extent possible.

When do durable powers of attorney take effect?

Most durable powers of attorney are in effect as soon as they are signed, even if the idea is that they won’t be used until the individual is incapacitated. A few durable powers of attorney don’t take effect until the grantor becomes incapacitated and are known as “springing” powers of attorney.

What is the role of an attorney in fact?

Your role as “attorney-in-fact” for your mother is a “fiduciary” role, meaning that you must always act in your mother’s best interest. It is important that you always keep good records of everything you do on her behalf just in case anyone (for instance, your siblings, if any) ask any questions.

What is a power of attorney?

A power of attorney is a legal document that gives someone the authority to sign documents and conduct transactions on another person’s behalf. A person who holds a power of attorney is sometimes called an attorney-in-fact.

When to bring a power of attorney?

Always bring your power of attorney document with you when you transact business on someone else’s behalf and make sure the people you do business with know that you are acting under a power of attorney.

What does it mean when you sign a document as an attorney in fact?

When you sign a document as someone’s attorney-in-fact, your signature needs to make it clear that you—not they—are signing the document and that you are acting under the authority of a power of attorney. To understand how this works, let’s suppose your name is Jill Jones and you have power of attorney to act for your friend, Sam Smith.

What is a person who holds a power of attorney called?

A person who holds a power of attorney is sometimes called an attorney-in-fact. Many people sign a financial power of attorney, known as a durable power of attorney, to give a friend or family member the power to conduct financial transactions for them if they become incapacitated. People also commonly sign health care powers ...

What happens if you sign a document in your own name?

If you sign a document in your own name without indicating that you are acting under a power of attorney, you could be held personally responsible for the transaction. If you sign only the principal’s name, you could face criminal or civil penalties for fraud or forgery.

Why do people sign powers of attorney?

People also commonly sign health care powers of attorney to give someone else the authority to make medical decisions if they are unable to do so. Powers of attorney have other uses as well.

Who is a fiduciary under a power of attorney?

A person who acts under a power of attorney is a fiduciary. A fiduciary is someone who is responsible for managing some or all of another person’s affairs. The fiduciary has a duty to act prudently and in a way that is fair to the person whose affairs he or she is managing. An attorney-in-fact who violates those duties can face criminal charges ...

About The Power of Attorney

- A Durable Power of Attorney may be the most important of all legal documents. This legal document gives another person the right to do certain things for the maker of the Durable Power of Attorney. What those things are depends upon what the Durable Power of Attorney says. A person giving a Durable Power of Attorney can make it very broad or can li...

Powers and Duties of An Attorney-In-Fact

- What can I do as an Attorney-in-Fact? Powers of Attorney can be used for most everything but an Attorney-in-Fact can only do those acts that the Powers of Attorney specifies. Powers of Attorney should be written clearly so that the Attorney-in-Fact and third parties know what the Attorney-in-Fact can and cannot do. If you, as Attorney-in-Fact, are unsure whether or not you are authorize…

Using The Power of Attorney

- When is a Power of Attorney effective? The Power of Attorney is effective as soon as the Principal signs it, unless the Principal states that it is only to be effective upon the happening of some future event. These are called "springing" powers, because they spring into action upon a certain occurrence. The most common occurrence states that the Power of Attorney will become effect…

Financial Management and The Liability of An Attorney-In-Fact

- What is "fiduciary responsibility"? As an Attorney-in-Fact, you are fiduciary to your Principal. A "fiduciary" is a person who has the responsibility for managing the affairs of another, even if only a part of that person's affairs are being managed. A fiduciary has the responsibility to deal fairly with the Principal and to be prudent in managing the Principal’s affairs. You, as an Attorney-in-Fa…

Relationship of Power of Attorney to Other Legal Devices

- What is the difference between an Attorney-in-Fact and an executor? An Executor, sometimes referred to as a "personal representative," is the person who takes care of another's estate after that person dies. An Attorney-in-Fact can only take care of a person's affairs while they are alive. An executor is named in a person's will and can only be appointed after a court proceeding calle…

Conservators and Powers of Attorney

- What is a Conservator? Conservators (called "Guardians" in some states) are appointed by the courts for people who are no longer able to act in their own best interests. A person who has a conservator appointed by the courts may not be able to lawfully execute a Power of Attorney. If you find out that a conservator had been appointed prior to the date the Principal signed the Po…

Affidavit by Attorney-In-Fact

- State of ____________ County of ___________ Before me, the undersigned authority, personally appeared ____________ (Attorney-in-Fact) ("Affiant") who swore or affirmed: Affiant is the Attorney-in-Fact named in the Durable Power of Attorney executed by _________________ ("Principal") on ______________, 20__. To the best of Affiant’s knowledge after diligent search and inquiry: The Pri…

Popular Posts:

- 1. ace attorney spirit of justice what happened to iris

- 2. how do you find a good divorce attorney for a man

- 3. how to send a complaint against an attorney in iowa

- 4. when to hire an attorney to review your contracts

- 5. what does a real estate attorney in dawson co ga. charge for a home sale $165,000 ?

- 6. what is the average contingency fee for an attorney and a negligence case in 2019

- 7. how long is illinois attorney general term

- 8. what to do with power of attorney document

- 9. who do i report city police prosecuting attorney for harrassment to in missouri

- 10. reasons why attorney doesn't want to go to trial