How to Revoke Power of Attorney

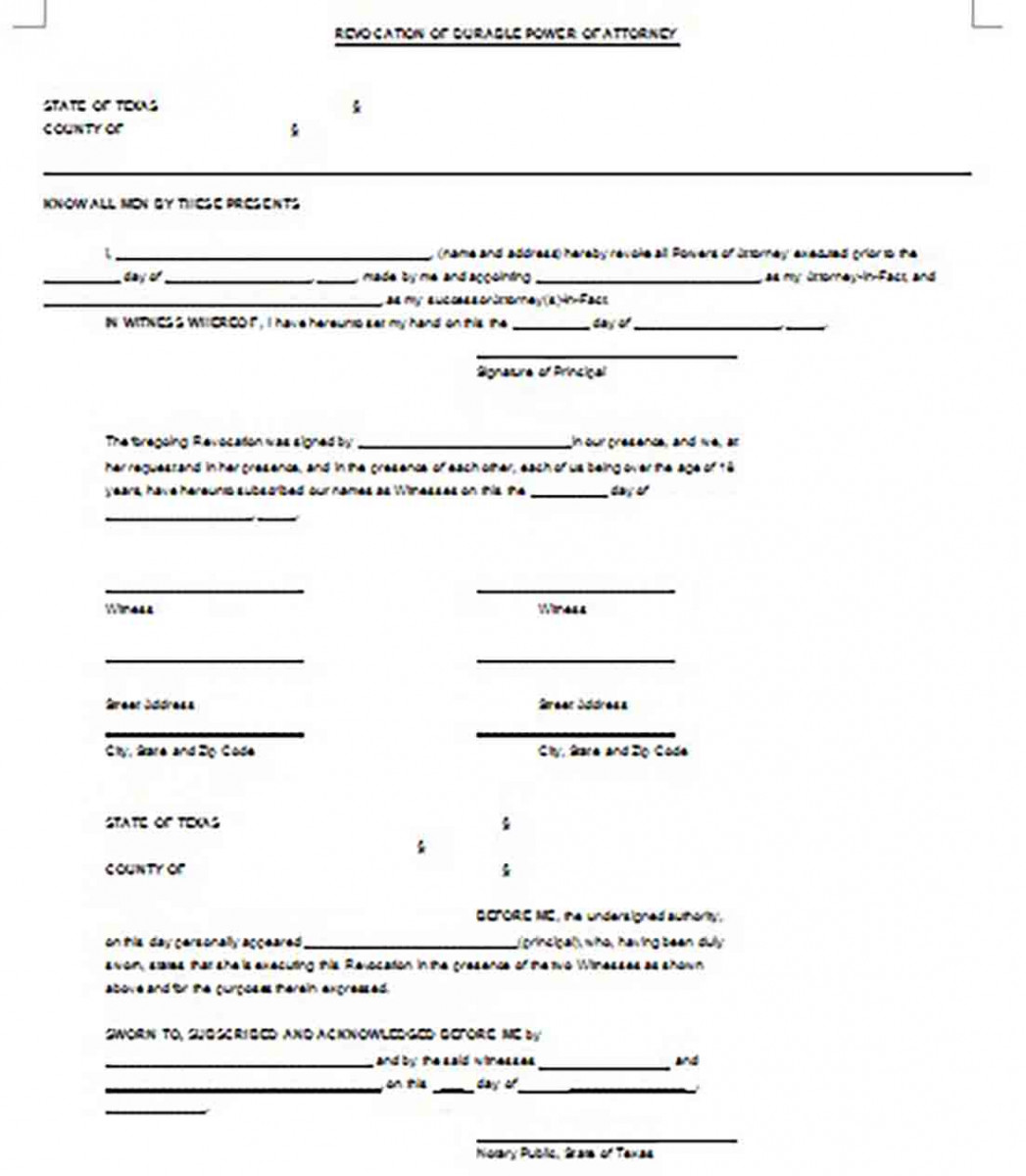

- Complete a Power of Attorney Revocation. Download the form in Adobe PDF, Microsoft Word (.docx), or Open Document Text (.odt). ...

- Execution. Complete and sign in the same way the original document was signed (e.g. witness (es), notary public, etc.).

- Send the Revocation. It is best to send a copy of the revocation to the agents via certified mail. ...

Full Answer

How do you remove power of attorney?

Authorizing an agent. Complete lines 1–3. Check the box on line 4. Check the box on line 5a titled "Sign a return" and write the following statement on the lines provided: Sign and date the form. If your agent e-files your return, he or she should attach Form 2848 to Form 8453, U.S. Individual ...

How to revoke IRS 2848?

Nov 19, 2021 · How To Revoke A Power Of Attorney 1. Prepare A Written Revocation Letter A letter of revocation is a written document that states that you are revoking... 2. Destroy All Existing Copies Of Your Power Of Attorney This option only works if you never handed your original power... 3. Create A New Power ...

How to cancel a power of attorney?

Jul 18, 2021 · There are 2 ways to revoke a Power of Attorney authorization: Authorize Power of Attorney for a new representative for the same tax matters and periods/years. A new authorization will automatically revoke the prior authorization. Send a revocation to the IRS. Follow Revocation Instructions, Form 2848, Power of Attorney and Declaration of …

Can Poa be revoked?

Internal Revenue Service Publication 947 (Rev. February 2018) Cat. No. 13392P Practice Before the IRS and Power of ... Retention/Revocation of Prior Power(s) of Attorney.....10 Revocation of Power of Attorney/Withdrawal of Representative.....10 When Is a Power of Attorney Not ...

How do I cancel a power of attorney with the IRS?

If you want to revoke a previously executed power of attorney and do not want to name a new representative, you must write “REVOKE” across the top of the first page with a current signature and date below this annotation.

Where do you file and withdraw form 2848?

Submit your Form 2848 securely at IRS.gov/Submit2848. Fax. Fax your Form 2848 to the IRS fax number in the Where To File Chart.Sep 3, 2021

How long is a POA valid IRS?

Length of POA Generally, a POA lasts for 6 years. To extend the POA for an additional 6 years, you must submit a new POA . Any POA declaration(s) filed on or before January 1, 2018 will stay on file until the listed expiration date or December 31, 2023, at which point it will expire.Dec 17, 2021

Does IRS Form 2848 expire?

Automatic Expiration: Form 2848 requires a manual cancelation but Form 8821 automatically expires. This makes it particularly useful for basic tasks like requesting your client's tax information that doesn't require full representation.Mar 23, 2021

How long does it take the IRS to process form 2848?

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.Jan 26, 2021

Can form 2848 be filed electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.Nov 15, 2021

Does the IRS accept durable power of attorney?

The IRS will accept a durable power of attorney when the document authorizes the named decision-maker to handle tax matters. But, the authorized agent will be required to execute IRS Form 2848 and file an affidavit before being recognized by the IRS.Jan 19, 2016

Does IRS recognize POA?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.Sep 2, 2021

Can IRS power of attorney be signed electronically?

The process to mail or fax authorization forms to the IRS is still available. Signatures on mailed or faxed forms must be handwritten. Electronic signatures are not allowed.Jan 25, 2021

Should I use form 2848 or 8821?

Use: Form 2848, Power of Attorney and Declaration of Representative PDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information Authorization PDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.Aug 26, 2021

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a power of attorney?

Power of Attorney. You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

What is a low income clinic?

Low Income Taxpayer Clinics (LITCs) are independent from the IRS and may be able to help you. LITCs represent eligible taxpayers before the IRS and in court. To locate a clinic near you, use the Taxpayer Advocate Service LITC Finder, check Publication 4134, Low Income Taxpayer Clinic List PDF, or call 800-829-3676.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

What is an oral disclosure?

Oral Disclosure. If you bring another person into a phone conversation or an interview with the IRS, you can grant authorization for the IRS to disclose your confidential tax information to that third party. An oral authorization is limited to the conversation in which you provide the authorization.

What is a power of attorney?

A power of attorney is a legal document that appoints a person, known as an agent, to have rights to make legal and/or financial decisions on your behalf.

What to do if you need a new power of attorney?

If you need to execute a new power of attorney, then proceed with naming an appropriate agent to act on your behalf regarding medical or financial matters. By confirming that you have destroyed all previous copies of your canceled power of attorney, you can eliminate any confusion.

How to get a TDS?

Before You Get Started 1 If you are an e-Services user (e.g, TDS, TIN Matching) and logged in, you will need to log out of e-Services and return here to log in. 2 Ensure you have authenticated the identity of your client. 3 Make sure the form is signed by all parties either electronically or with an ink signature. Refer to the Frequently Asked Questions below for more information on electronic signatures. 4 Have your Secure Access credential ready, along with the device used to receive the security code. If you don’t have a Secure Access account, you can sign up when you click the Log in to Submit button.

How long does it take to create an account on a mobile phone?

Individuals who can verify their identity with a U.S.-based mobile phone can complete the process in a single session, which takes about 15 minutes to complete.

What is a 2848 form?

The IRS calls Form 2848 the Power of Attorney and Declaration of Representative Form. It allows you to authorize a tax specialist to represent you in negotiations with the IRS. Take note that you need to cede authority to a certified tax specialist and not just anybody. The IRS only allows you to give authority to an intern accountant ...

Who receives your tax information?

The tax specialist receives your confidential tax information and inspects it. Once you file an IRS power of attorney Form 2848, the person you name on the form has all the powers you would have.

Can a power of attorney be a CPA?

Only two groups of people can be included as your power of attorney. You can add a credentialed tax professional such as an enrolled agent, attorney, or certified public accountant (CPA).

Is 8821 a power of attorney?

Regardless of whether you file tax Form 8821 or Form 2848, you are ultimately responsible for any tax liability you might incur. Like other official IRS forms, these power of attorney forms are available on the IRS official site.

Popular Posts:

- 1. how to become a student attorney in wisconsin

- 2. how to find out if a person is an attorney in new mexico

- 3. "2019" who is running for attorney general in dupage county il

- 4. can a self-proving will be notarized by the attorney who drafted it in wisconsin?

- 5. how much do attorney recruiter make

- 6. what is lawful attorney-in-fact

- 7. what if the power of attorney over the wife is the daughter but the husband is still alive

- 8. who won the ny attorney general debate

- 9. who does the kendall county state's attorney report to

- 10. immigration attorney - how to get connected with clients