This is done by revoking your POA with the IRS. Revocation can be done in one of two ways. The first way is to mail or fax a copy of the POA to the IRS with the word “REVOKE” written across the top of the first page with a current signature and the date below this annotation.

Full Answer

What do I need to do to revoke a "power of attorney"?

· There are 2 ways to revoke a Power of Attorney authorization: Authorize Power of Attorney for a new representative for the same tax matters and periods/years. A new authorization will automatically revoke the prior authorization. Send a revocation to the IRS. Follow Revocation Instructions, Form 2848, Power of Attorney and Declaration of …

How can you get out of being power of attorney?

· Then, you must mail or fax a copy of the power of attorney with the revocation annotation to the IRS, using the Where To File Chart, earlier, or if the power of attorney is for a specific matter ...

How do you reverse a power of attorney?

· It can be accomplished in one of three ways, the clearest of which is writing a letter to revoke the power of attorney you granted in the first place. 1. Prepare A Written Revocation Letter. A letter of revocation is a written document that states that you are revoking the power of attorney created on a certain date.

How can I reverse a power of attorney?

If you do not have a copy of the power of attorney you want to revoke, you must send the IRS a statement of revocation that indicates the authority of the power of attorney is revoked, lists the matters and years/periods, and lists the name and address of each recognized representative whose authority is revoked.

Do you need to notarize a power of attorney?

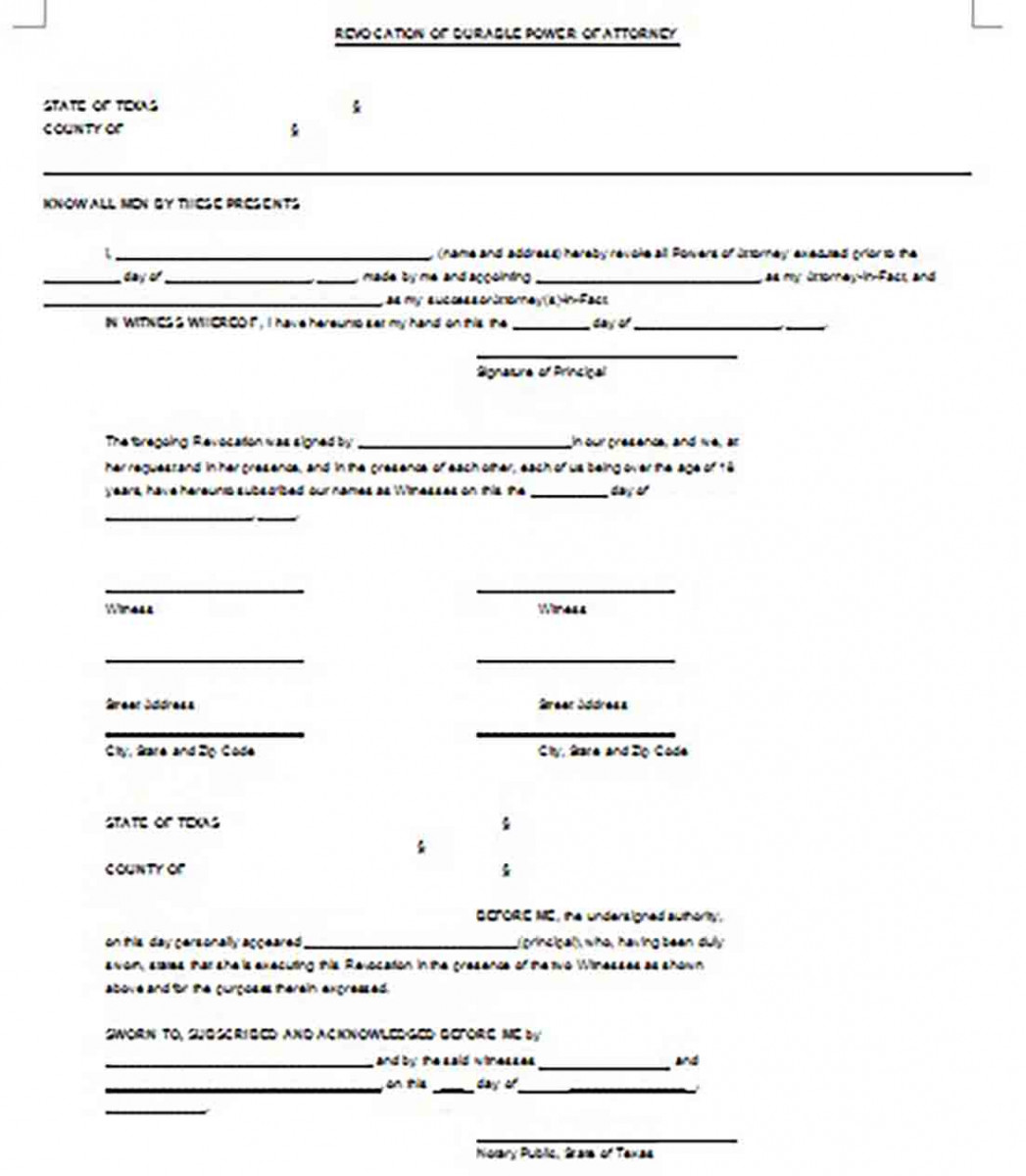

Have the document notarized. Some states might not require you to have the document notarized. However, having the principal’s signature notarized eliminates any doubt regarding the validity of that signature. The notary must verify the identity of the principal before witnessing the signature. Notarizing the power of attorney document reduces the chance that it will be contested by an outside party who may question its validity.

What to do if a document is unclear?

Consider hiring an attorney to review the document. An attorney may notice legal issues that people who aren't trained in legal matters would not think to include or leave out. For example, an attorney may notice that the document uses language that could been seen as ambiguous and could lead to confusion.

Do you have to have a document notarized?

Have the document notarized. Some states might not require you to have the document notarized. However, having the principal’s signature notarized eliminates any doubt regarding the validity of that signature. The notary must verify the identity of the principal before witnessing the signature.

Do you need to sign a power of attorney in Utah?

For instance, in Florida, a power of attorney document must be signed by two witnesses, whereas Utah does not require witnesses. Check here to find out if your state requires a durable power of attorney document to be signed by witnesses.

Can a power of attorney be transferred under state law?

Make sure that the principal and agent know that some powers cannot be conferred under state law. If the power of attorney purports to transfer a power under state law that cannot be transferred, the power of attorney is void as to that power.

How old do you have to be to have a springing power of attorney?

A situation for a springing power of attorney could be when the principal specifies in the power of attorney document that the agent would not have power until the principal was 75 years old, but once the principal reached that age, the agent would have the specified powers, regardless of the principal’s capacity.

Why do people need a durable power of attorney?

Many seriously ill people choose a durable power of attorney because they want their agent to continue to make their decisions after they can no longer communicate their wishes, and, because of their illness, want the power of attorney to go immediately into effect.

Who is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the return.

What is a handwritten signature?

A scanned or digitized image of a handwritten signature that is attached to an electronic record ; A handwritten signature input onto an electronic signature pad; or. A handwritten signature, mark, or command input on a display screen with a stylus device.

How to change last known address?

To change your last known address, use Form 8822, Change of Address, for your home address and Form 8822-B, Change of Address or Responsible Party—Business, to change your business address. Both forms are available at IRS.gov. . Authorizing someone to represent you does not relieve you of your tax obligations. .

What is a fiduciary notice?

Use Form 56, Notice Concerning Fiduciary Relationship, to notify the IRS of the existence of a fiduciary relationship. A fiduciary (trustee, executor, administrator, receiver, or guardian) stands in the position of a taxpayer and acts as the taxpayer, not as a representative.

What is Form 2848?

The individual you authorize must be eligible to practice before the IRS. Form 2848, Part II, Declaration of Representative, lists eligible designations in items (a)– (r). Your authorization of an eligible representative will also allow that individual to inspect and/or receive your confidential tax information.

What is the purpose of Form 2848?

Purpose of Form. Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.

Can I represent a business before the IRS?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business , or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "k" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

Can a power of attorney be revoked?

A Power of Attorney can be revoked by the Principal at any time, regardless of any dates identified in the original document.

When is a power of attorney automatically terminated?

A power of attorney is automatically terminated if the principal dies or, for non-durable forms, becomes incapacitated.

Who should be made aware of a Power of Attorney revocation?

Any third-parties that had copies of the previous Power of Attorney (i.e., financial institutions, healthcare or other agencies) should be made aware of immediately and a copy of the revocation should be supplied. Once all parties have been made aware, they are no longer legally able to complete business with the Agent.

Where should a revocation of a power of attorney be filed?

The revocation along with the new Power of Attorney, if applicable, should be filed in the same place the original Power of Attorney was filed (i.e., county clerk), to prevent it from not being recognized as a legal document in a court of law or other legal proceedings.

Can a power of attorney be revocable verbally?

Verbal revocations are not acceptable unless it was previously documented in the original Power of Attorney. Once the revocation of the Power of Attorney takes place, it will nullify the existing document and will serve as confirmation.

Do I need a lawyer to revoke a power of attorney?

When revoking a Power of Attorney, a lawyer is not required. The legal consult can ensure all original Power of Attorney details (i.e. name, date, duties, statement of sound mind) are addressed in the revocation. Verbal revocations are not acceptable unless it was previously documented in the original Power of Attorney.

What is the step 3 witness area?

Step 3 – In the witness area, the principal’s name will be mentioned again as well as the date of the revocation. Below, the witnesses will be required to sign their names and enter their mailing addresses.

How to verify a taxpayer's address?

Verify the taxpayer’s name, address, and SSN or ITIN through secondary documentation, such as a federal or state tax return, IRS notice or letter, social security card, or credit card or utility statement. For example, if a taxpayer changed their address in 2020, a 2019 tax return can be used to verify the taxpayer’s name and taxpayer identification number, and a recent utility statement to verify the taxpayer’s address.

What is a government photo ID?

Examples of a government-issued photo ID include a driver’s license, employer ID, school ID, state ID, military ID, national ID, voter ID, visa, or passport;

Where to submit 8821?

Forms 8821 with an electronic signature image or digitized image of a handwritten signature may only be submitted to the IRS online at IRS.gov/Submit8821.

What is a remote transaction for 8821?

If the taxpayer electronically signs Form 8821 in a remote transaction, a third party submitting Form 8821 to the IRS on behalf of the taxpayer must attest that he or she has authenticated the taxpayer’s identity. A remote transaction for an electronic signature occurs when the taxpayer is electronically signing the form and the third party submitter isn’t physically present with the taxpayer.

What is a handwritten signature?

A scanned or digitized image of a handwritten signature that is attached to an electronic record ; A handwritten signature input onto an electronic signature pad; or. A handwritten signature, mark, or command input on a display screen with a stylus device.

What is a TIN number?

A TIN is used to confirm the identity of a taxpayer and identify the taxpayer's return and return information. It is important that you furnish your correct name, social security number (SSN), individual taxpayer identification number (ITIN), and/or employer identification number (EIN).

How long does it take to receive Form 8821?

If you are submitting Form 8821 to authorize disclosure of your confidential tax information for a purpose other than addressing or resolving a tax matter with the IRS (for example, for income verification required by a lender), the IRS must receive the Form 8821 within 120 days of the taxpayer’s signature date on the form. This 120-day requirement doesn’t apply to a Form 8821 submitted to authorize disclosure for the purpose of assistance with a tax matter with the IRS.

Popular Posts:

- 1. how to file a childs power of attorney nm

- 2. what is a pilot attorney

- 3. how to find an attorney for adult industry

- 4. attorney general who would not prosecute criminals if they bribed him.

- 5. what intial should you put on letter when you prepared for attorney

- 6. what do you think a successful close might mean to the defense attorney

- 7. how is the state attorney choosen

- 8. what is an attorney opinion letter for a refinance

- 9. how to write a thank you letter expressing my sincere gratitude to my workerscomp attorney

- 10. how do i change power of attorney if i dont have address