You can revoke a power of attorney in one of three ways:

- In writing. You can sign a revoking power of attorney form. ...

- By destroying it. If you never gave anyone a copy of your power of attorney and never told your agent about it, you can simply shred your power of attorney ...

- By signing a new power of attorney. ...

What is a California power of attorney revocation?

Dec 22, 2021 · Locate the Execution Date on the original Power Appointment document then record it using the space between the words “…Revoke The Power Of Attorney Dated” and “Empowering…” In addition to the Principal, we will need to clearly identify the individual (Attorney-in-Fact/Agent) whose Principal Powers should be terminated here.

How do I revoke a power of attorney in Texas?

Jan 25, 2016 · How to Revoke a Power of Attorney in California Step 1 : Enter your legal name on the first line of California Revocation of Power of Attorney form followed by name of the county of your residence. Step 2 : Then enter date, instrument number of recording, book and page number, and name of the county of recording power of attorney on respective lines.

How do I cancel a power of attorney?

Dec 02, 2016 · California law allows for revocation by following any requirements shown on the original power of attorney. Hence, it is important to check the original power of attorney to make that a revocation is allowed and through which requirements. The details that a revocation of POA must contain are: The name and address of the principal who conferred the powers; The …

How do you make a power of attorney durable in California?

Mar 12, 2022 · Match with the search results: The principal may revoke the POA by creating and signing a revocation form; · A court-appointed guardian may request the termination of a particular agent’s ……. read more Đánh Giá post

What is the procedure for Cancelling power of attorney?

Can you revoke a power of attorney?

Can I revoke a power of attorney any time?

How do I change power of attorney in California?

How long does a power of attorney last?

Once an LPA has been validly executed, it will last indefinitely unless revoked by the donor, the attorney, the Court of Protection or by operation of law.May 25, 2021

What do you mean by revoked?

Can a irrevocable power of attorney be revoked?

How do I challenge a power of attorney?

What is revocation in law?

What three decisions Cannot be made by a legal power of attorney?

Can I notarize a power of attorney in California?

How long does a power of attorney last in California?

Step by step guide on how to revoke financial power of attorney

A document should be written stating that the current power of attorney is no longer valid. While you can find a revocation document online and fill it in yourself, it is preferable that you get the services of an attorney to revoke a POA.

Why would someone revoke the power of attorney for finances?

There are many possibilities as to why the principal would like to revoke the powers granted:

How to revoke a power of attorney?

To revoke power of attorney, start by checking the laws governing power of attorney in your state, since the procedure varies. In most states, the principal should prepare a revocation document saying that the power of attorney has been revoked, then take it to a notary to be signed.

Who can revoke a POA?

Learn who can revoke power of attorney. The person for whom the document provides power of attorney is known as the principal. The principal is the only one who can revoke the power of attorney (POA) while the principal is competent.

Can a bank be held liable for a power of attorney?

Therefore, if your agent acts in accordance with the power of attorney document before the revocation reaches the third party (for example, a bank) the bank can not be held liable for any money taken or used by the agent in conjunction with the power of attorney.

Why do people need a durable power of attorney?

Many seriously ill people choose a durable power of attorney because they want their agent to continue to make their decisions after they can no longer communicate their wishes, and, because of their illness, want the power of attorney to go immediately into effect.

Can a power of attorney be transferred?

Make sure that the principal and agent know that some powers cannot be conferred under state law. If the power of attorney pur ports to transfer a power under state law that cannot be transferred, the power of attorney is void as to that power.

Is a power of attorney void?

If the power of attorney purports to transfer a power under state law that cannot be transferred, the power of attorney is void as to that power. For instance, even if the principal and the agent agree, the agent cannot write or execute a will for the principal. Any such will is not valid.

Do you have to sign a document in front of a notary?

Some states require this document to be signed in front of a notary. Even if the state where you live does not legally require the signature to be notarized, signing in front of a notary eliminates any doubt as to the authenticity of the signature.

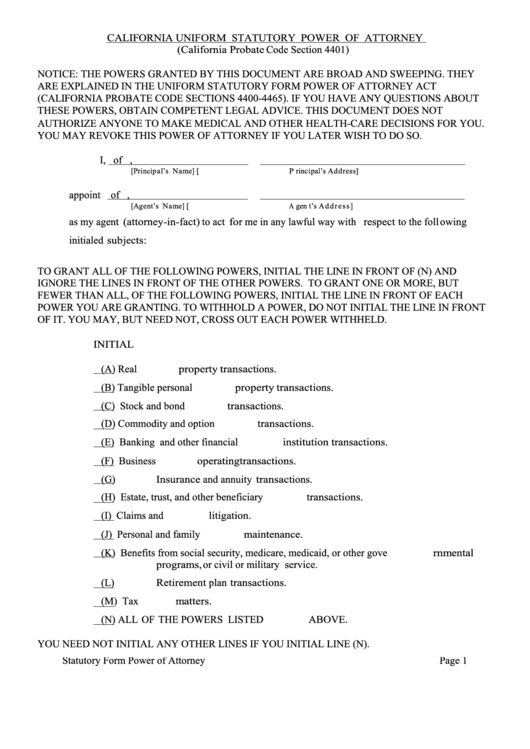

What is a power of attorney in California?

A power of attorney allows someone else to handle financial or healthcare matters on your behalf, and California has specific rules about types and requirements.

Can a POA be notarized?

If the POA gives your agent the right to handle real estate transactions, the document must be notarized so that it can be recorded with your county. The agent listed in the POA cannot be a witness to the document. The principal and two witnesses must sign a healthcare POA.

What is a POA in California?

The California healthcare POA is found in Section 4701 of the Probate Code and is called an advanced healthcare directive. You can also work with an attorney or an online service to create and execute your POA. If you are unsure about which form to use or how to complete and execute it, legal assistance is a good idea.

What is a POA?

A power of attorney (POA) gives someone you name the authority to handle legal or financial matters for you under specific circumstances. When you create a POA, you are called the principal, and the person you choose to act for you is called your attorney-in-fact or your agent.

What is a general POA?

General POA. This is the broadest kind of POA and gives your agent the right to handle a wide variety of financial matters for you. Limited POA. This is sometimes called a specific POA. This is a very narrow POA that gives your agent the authority to act for you only in specific situations you list in the document.

What is a springing POA?

Springing POA. A general or limited POA can be written so that it takes effect only at a certain time or under certain conditions (so it "springs" into action only at that time). For example, you could create it so that it takes effect only if you are incapacitated or so that it is effective for one month.

Who sign a POA?

A general or limited POA must be signed by the principal and two witnesses or a notary. If the POA gives your agent the right to handle real estate transactions, the document must be notarized so that it can be recorded with your county. The agent listed in the POA cannot be a witness to the document.

Popular Posts:

- 1. what is the difference between prosecutor and district attorney

- 2. how does american attorney get admitted in canada

- 3. how much is a north carolina domestic violence attorney in greensboro,nc

- 4. what is a surety bond for a texas attorney

- 5. what is another word for a general attorney

- 6. what happens when an attorney dies

- 7. how to get an opinion from the attorney general of arkansas

- 8. who to designate as medical power of attorney

- 9. jim o'neill district attorney and david freeman what did they do?

- 10. how do you file aggrivance with attorney general in washington state