- Contact the bank before having a financial power of attorney drafted by a lawyer. ...

- Send or deliver your previously drafted financial power of attorney document to the bank. ...

- Provide identification and a copy of the financial power of attorney to the bank teller when you ready to complete a transaction.

How do I get power of attorney for a bank account?

A power of attorney allows an agent to access the principal’s bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

How can I discuss my power of attorney options with you?

Nov 08, 2019 · A joint owner has all of the same rights you do over a bank account. A power of attorney is supposed to act in your best interests and may have limited power of what can happen with your bank account.

Can a person with a power of attorney invoke the power?

Contact the bank before having a financial power of attorney drafted by a lawyer. Many banks have their own power of attorney forms that their account holders must complete and sign before the bank will acknowledge the power of attorney privileges of an agent.

How do I Activate my Power of attorney?

Copy a form or several forms into a Word or WordPerfect document so you can combine the sentences you want, fill in the blanks and consider every delegated duty you are signing over to the agent. Go over any questions with your attorney and let her finalize the document for you. She may have insights you have not considered.

What does POA mean on a bank account?

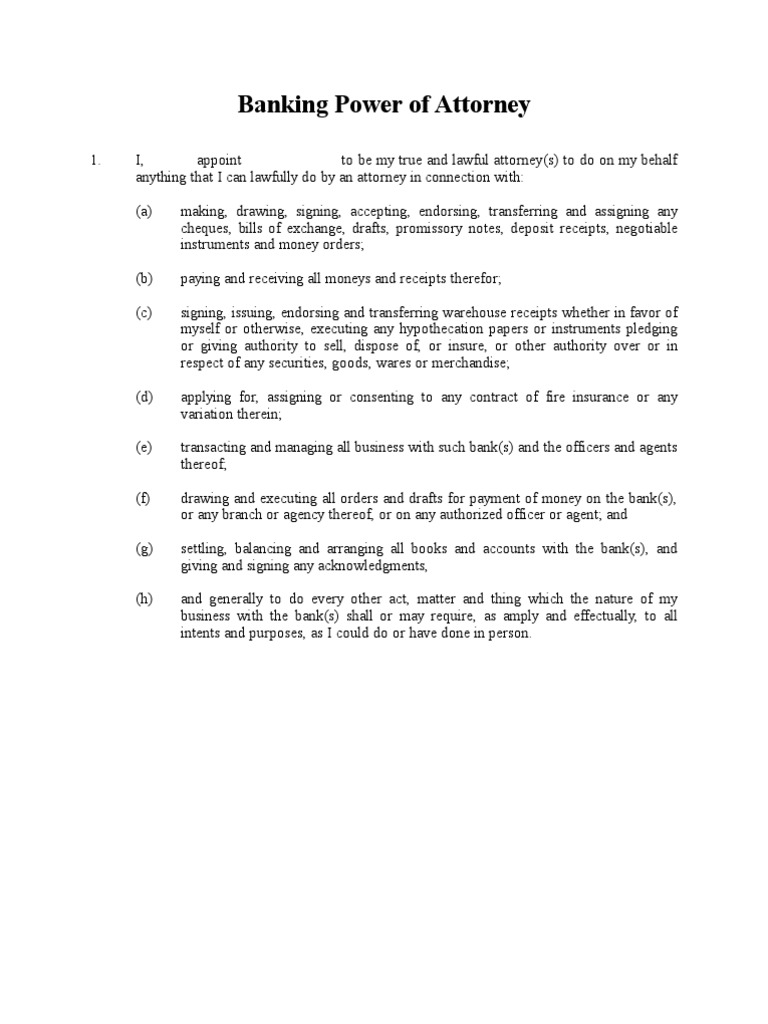

A power of attorney for banking transactions is a POA that allows a trusted agent to deal with your bank account(s) on your behalf. If you want to set up a power of attorney in a way that allows someone to make bank transactions in your stead, your POA has to specifically state that.

What does it mean to invoke a POA?

Once the signing has taken place, the power of attorney authorizes the agent to act for you immediately and the document is invoked. If the court appoints a guardian for your estate, the agent you have appointed must answer to the guardian under the law of most states.

How do I activate a power of attorney in Ontario?

You can make a power of attorney document yourself for free or have a lawyer do it. To make a power of attorney yourself, you can either: download and complete this free kit. order a print copy of the free kit online from Publications Ontario or by phone at 1-800-668-9938 or 416-326-5300.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

When should I invoke power of attorney?

When to make a lasting power of attorney Anyone can make an LPA in case they ever lose mental capacity. You should also make an LPA if you have been diagnosed with, or think you might develop, an illness which might prevent you from making decisions for yourself at some time in the future.

How do I activate a power of attorney in Canada?

ACTIVATING A POWER OF ATTORNEYFirst, you need to ascertain that you have a valid legal power of attorney or financial representation agreement. ... Second, determine if there is a living Will or health care representation agreement. ... Third, you need to ascertain the assets in the estate and safeguard the assets.More items...

How long does it take to activate power of attorney?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Who can notarize a power of attorney in Ontario?

The witnesses must also sign the power of attorney. The witnesses can't be the attorney or their spouse or partner; your spouse, partner, or child, or someone that you treats as your child; a person whose property is under guardianship or who has a guardian of the person; or a person under the age of 18.May 16, 2019

What is a power of attorney?

There are several types of power of attorney documents that a person may have drafted in order to authorize another person to act as her agent for health care or financial purposes. If you will be handling another person's financial transactions such as making withdrawals from a bank account, drawing checks on an account for the purpose ...

How to become a bank agent for another account?

As an agent for another's account, you may be required to complete an affidavit stating that you are authorized to complete transactions against the principal’s account. Fill out the necessary documentation ...

Who is Krystal Wascher?

Krystal Wascher has been writing online content since 2008. She received her Bachelor of Arts in political science and philosophy from Thiel College and a Juris Doctor from Duquesne University School of Law. She was admitted to the Pennsylvania Bar in 2009.

Do banks require power of attorney?

Many banks have their own power of attorney forms that their account holders must complete and sign before the bank will acknowledge the power of attorney privileges of an agent. Some banks will require the account holder and the agent to appear in person together to complete the power of attorney form, while others may permit ...

How to set up an enduring power of attorney?

Read More: How to Set Up Enduring Power of Attorney. Sign the forms before appropriate witnesses and a notary. The agent cannot be a witness; nor can your relatives in most states. Affirm that the contents of the power of attorney are your intent. Some attorneys suggest videotaping estate documents of this significance.

What is a durable power of attorney?

A durable general power of attorney gives an agent more powers than you have: the power to do anything you can while active, and the power to do anything he wants in case of your incapacity. Invoking a durable general power of attorney can be useful if you want your child or spouse to take care of your affairs.

Who is Linda Richard?

Linda Richard has been a legal writer and antiques appraiser for more than 25 years, and has been writing online for more than 12 years. Richard holds a bachelor's degree in English and business administration. She has operated a small business for more than 20 years.

Can you revoke a power of attorney?

You can also revoke the power of attorney, but some agents continue to act, claiming no knowledge of the revocation. You may live with the consequences of this kind of power of attorney to the grave. In most states, the durable general power of attorney terminates at death.

What is a power of attorney?

A power of attorney is a legal document that allows an agent to make decisions in your stead. There are various different types of POA documents. Check out the table below for the specific POA types:

How to write a POA?

If you decide to draft your POA on your own, you should know what clauses it must include. Your banking power of attorney should cover the following sections: 1 Names —Full names of both you and the agent 2 The effective date —The date of the POA agreement going into effect 3 Details about the agent —All relevant details about the agent, including the contact info and their address 4 The type of POA —Description of the POA agreement type 5 Instructions for the agent —Any instructions you want the agent to follow in your absence

What is a durable POA?

The durable POA stays in effect even after you become incapacitated. It’s used to handle legal, financial, and property matters. Limited power of attorney. With the limited POA, you can grant the agent clearly specified powers.

What is a power of attorney?

A power of attorney is a legal document giving a person (known as the agent) broad powers to manage matters on behalf of another person (known as the principal). Under certain circumstances, Bank of America allows agents to be added to the principal's accounts ...

What happens if one of your co-owners passes away?

If one co-owner passes away, the other co-owner owns all funds in the account. With a power of attorney, the ways in which the individual can conduct transactions can be specific and limited. See what's needed to add a co-owner to your account. See what's needed to add a co-owner to your account.

What is a trusted contact?

A trusted contact is an individual age 18 or older who is identified by you as someone we're able to contact about your account for any of the following reasons: To address suspicious financial activity on your account. To confirm specifics of your current contact information. To confirm your health status.

Can a trustee be delegated?

A delegation of a trustee's power may be subject to state laws and limitations in the trust agreement. Consult with your legal advisor to determine any legal requirements (in the law or in the trust agreement) and the appropriate language for including a delegation of a trustee's power in a power of attorney.

How to reject a POA?

Depending on the reason for rejection, there are several steps you or your Attorney may take including: 1 If you are still capable:#N#doing the transaction yourself,#N#creating a new POA,#N#obtaining a legal opinion/confirmation to clarify any problems in the POA document,#N#obtaining a doctor’s letter confirming that you were mentally capable on the date the POA document was signed and that you understood the concept of appointing a POA, 2 if you are not mentally capable:#N#applying to the court. Your Attorney or some other interested person can apply to the court for appointment as your guardian/trustee.

What is a POA?

it is a limited POA that authorizes your Attorney to do only certain transactions (for example, deposit funds to and pay out from your bank account) and the Attorney tries to do something else (e.g. taking out a loan in your name), it has been issued for a limited period of time and that time has passed,

Can you have more than one POA?

you have more than one POA and the instructions are in conflict, you die, - POAs are only valid while you are living. your Attorney instructs the bank to change the ownership of the account (for example, to make your account joint with your Attorney) unless the POA specifically permits your Attorney to do so, ...

Do banks monitor attorney transactions?

Banks take the welfare of their clients very seriously, but they do not monitor all transactions that might be done by a client’s Attorney, particularly in an online or telephone banking environment. That is why it is so important to select your Attorney carefully. If an Attorney’s transaction comes to the attention of the bank ...

What does a financial power of attorney do?

A financial power of attorney might give you power over certain assets, such as bank accounts and stocks. It can also give you power to file the principal’s tax returns.

When does a power of attorney become effective?

Generally, a power of attorney should be effective as soon as it is signed.

When is a durable power of attorney effective?

Generally, a durable power of attorney should be effective immediately. In this situation, there is nothing to activate. As soon as the durable power of attorney is signed, it is effective. However, a springing power of attorney should state how you can activate it.

What is a POA?

Read the POA to understand your powers. A POA grants the attorney-in-fact the power to make decisions that the principal used to make. However, the POA can limit your authority. For example, health care powers of attorney are often used along with living wills.

When does a POA end?

Identify the type of POA. Generally, a power of attorney terminates when the person becomes incapacitated. For this reason, a “durable” power of attorney was created, which continues in effect after the person becomes incapacitated. Read the POA to make sure it is durable.

Popular Posts:

- 1. what questions to ask before hiring an attorney

- 2. how to get an attorney mailbox at the lee county clerk of court

- 3. does the client konw what the attorney knows

- 4. what does being sued by the attorney general mean

- 5. when an attorney uses the law to bully you

- 6. how much does an attorney charge for accurint report

- 7. where do i register my general power of attorney in california

- 8. how the us attorney sells property

- 9. former un attorney gordon who now lives in main is intouch with zeta grays

- 10. divorce attorney near me who works with chronic illness and alcoholic spouse