The only way you get a POA is if your daughter were to give it to you. That would give you the power to act on her behalf, but it would not take away her power to do so. What you need instead would be a guardianship/conservatorship for her. These are probate proceedings, and... You can file a civil comment.

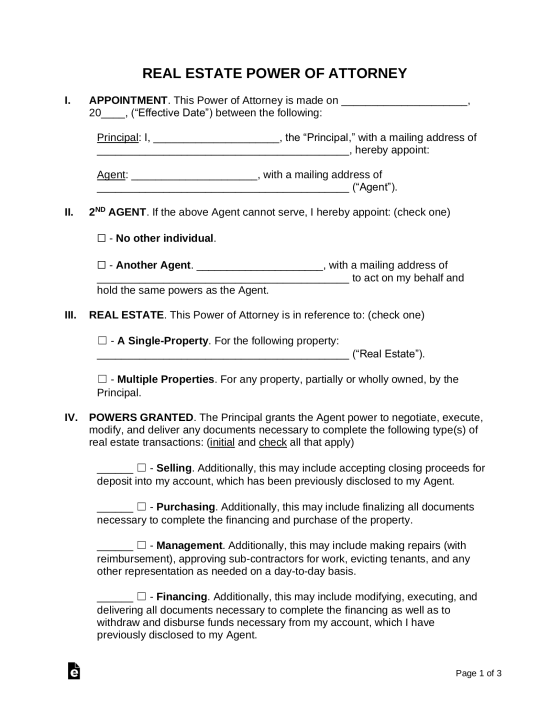

- 1) Choose the right person(s). ...

- 2) Talk to an attorney. ...

- 3) Choose what kind of power of attorney is best suited to your needs. ...

- 4) Decide on the details. ...

- 5) Fill out the power of attorney form. ...

- 6) Sign your power of attorney form in front of a notary or witness.

How do I give someone power of attorney?

Dec 09, 2012 · The only way you get a POA is if your daughter were to give it to you. That would give you the power to act on her behalf, but it would not take away her power to do so. What you need instead would be a guardianship/conservatorship for her. These are probate proceedings, and since it is very likely that they will be contested, I would suggest that you retain an attorney …

How do I choose a power of attorney for my parent?

Jul 16, 2021 · Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on ...

Can I name more than one child as power of attorney?

Jun 27, 2017 ·

Can a power of attorney do anything they want?

How do I get power of attorney over my elderly parent?

The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your s...

What are the four types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes in...

Can I get a power of attorney if my parent has dementia?

No, if your parent already has cognitive impairment, they can’t legally sign the documents required to set up a power of attorney. This is one reas...

What are the disadvantages of a power of attorney?

The biggest drawback to a power of attorney is that an agent may act in a way that the principal would disapprove of. This may be unintentional if...

Is power of attorney responsible for nursing home bills?

As your parent’s power of attorney, you’re responsible for ensuring their nursing home bills are paid for through their assets and income. However,...

Scope of a Child-Related Power of Attorney

With regard to children, a power of attorney is typically used if a custodial parent will be physically absent or unavailable for some period of time, and, as a result, will have limited ability to make "real time" decisions for the children. Some situations when a POA is used for minor children include:

Enforceability of a Child-Related Power of Attorney

A power of attorney for children is inherently limited because state law does not divest parents of their parental rights without a showing of reasonable cause (usually some allegation of wrongdoing), a hearing before a judge or magistrate, and the issuance of a court order. A child-related POA does not and cannot:

Drafting a Child-Related Power of Attorney

Because of the limited enforceability of child-related powers of attorney under the laws of most states, there is not much guidance in state statutory codes for writing one. The state laws that apply to financial and healthcare powers of attorney do, however, provide a roadmap for the basic information required. This usually includes:

3 attorney answers

I understand your frustration in trying to deal with the hospital and otherwise advocate on behalf of your daughter. I do agree with the previous two attorneys. It does appear that the best avenue to assist your daughter is to establish a Conservatorship...

Rosemary Jane Meagher-Leonard

I agree with the previous answer. This sounds like a "conservatorship" matter. You need to seek the advice of an experienced attorney who understands conservatorships in California. More than likely the attorney can file a petition for conservatorship and have you appointed as conservator of your daughter.

Stewart R. Albertson

You can look at a Health Care Power of Attorney but it has limitation and what you describe sounds more in the realm of possible conservatorship.

Joseph Franklin Pippen Jr

In summary-get your daughter to give you a POA if she is competent-if not- seek a a guardianship.

James P. Frederick

I agree with Attorney Ferrington. I would simply add that in response to your direct question, this is not a case where a POA will help you. The only way you get a POA is if your daughter were to give it to you. That would give you the power to act on her behalf, but it would not take away her power to do so.

Anders Ferrington

You can file a civil comment. You NEED to call a lawyer asap since commitment is not an easy thing . If she is committed and needs a conservatorship the lawyer can help

Why do you need a power of attorney for an elderly parent?

Common Reasons to Seek Power of Attorney for Elderly Parents. Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations.

What is a power of attorney?

At its most basic, a power of attorney is a document that allows someone to act on another person’s behalf. The person allowing someone to manage their affairs is known as the principal, while the person acting on their behalf is the agent.

What are the different types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes incapacitated, so they’re not often used by older adults when planning for the end of life. A durable POA lasts even after a person becomes incapacitated, so is more commonly used by seniors.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

What is the best document to prepare for an aging loved one?

There are two separate documents you’ll likely need as part of comprehensive planning for your aging loved one. The first is a financial POA , which provides for decisions regarding finances and for the ability to pay bills, manage accounts, and take care of investments. The second is an Advance Healthcare Directive, which is also known as a “living will” or a “power of attorney for healthcare.” This document outlines who will be an agent for healthcare decisions, as well as providing some general guidelines for healthcare decision-making.

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

How to get a POA?

When you’re ready to set up the POA, follow these steps: 1 Talk to Your Parents: Discuss what they need in a POA and what their wishes are when it comes to their finances and health care. You must also confirm their consent and make sure they agree with everything discussed. 2 Talk to a Lawyer: Everyone who gets a POA has different needs and the laws are different in each state. It’s important to get legal advice so that your parent’s wishes are taken into consideration and the document is legal. 3 Create the Necessary Documentation: Write down all the clauses you need that detail how the agent can act on the principal’s behalf. This ensures your parent’s wishes are known and will be respected. Although you can find POA templates on the internet, they are generic forms that may not stand up to legal scrutiny and probably won’t have all the clauses you require. 4 Execute the Agreement: Sign and notarize the document. Requirements for notarization and witnesses differ, so make sure you check what’s required in your state.

What is a power of attorney?

A power of attorney is a document. The person to whom it is issued is the agent or attorney-in-fact of the person who issued it. If it is a general power of attorney then the named person has the power to act in legal, financial, medical, etc. concerning the issuer.

What is a power of attorney contract?

When you hire an attorney that contract you sign is essentially a power of attorney that allows your attorney to act on your behalf in the matter specified; ie a divorce attorney in regards to your divorce. You can have an attorney prepare one for you. I would assume at least some legal clinics can prepare one for you.

Who can grant a POA?

A power of attorney (POA) must be granted by the person in question, not someone else. The grantor must be legally capable of doing so (i.e. a mentally competent adult). The requirements / process for granting (or revoking) a POA vary from one jurisdiction to another.

Do I need a power of attorney if I have a minor?

Yes. You’ll have to have an attorney draft a power of attorney for you, indicating that your parents have this power. I am assuming that you are a legal adult; if not, then they don’t serve as your power of attorney because you’re a minor.

Is a power of attorney the same as a will?

In the United States, a power of attorney and a will are completely different things. The power of attorney expired when the husband died. The will has to be probated before the property’s ownership is finally determined. The wife’s separate ownership of marital property is usually an immediate 50% of everything.

Can an attorney in fact make a will?

However, an attorney-in-fact cannot make a Will for the principal, or change (make a codicil to) an existing Will.

Can a power of attorney be cancelled?

Power of attorney is granted by the person, not by a court or other process. However, the court can cancel the power of attorney, and grant a conservatorship in its stead to a more fitting party, if there is evidence of malfeasance or negligence.

Why did the son of a power of attorney give his mother the power to make gifts?

In acting for his mother, the son desired to make gifts of her property to himself and his brothers and sisters in order to reduce the estate taxes on his mother’s death . Unfortunately, however, although the power of attorney gave the son general powers to act for his mother, the power of attorney did not specifically confer the power to make gifts.

How long does a power of attorney last?

The powers given to the attorney-in-fact can be as broad or specific as you wish and can last until death or some earlier point in time. There are no restrictions on who you can name as ...

Why did the daughter put the father's house in her own name?

As the father’s health worsened, the daughter decided to put the father’s home in her own name. When the father later died, his will named his three children as equal beneficiaries. However, since the house was no longer part of the father’s estate, two of the children received very little.

Is a power of attorney a precautionary measure?

In the estate planning context, the power of attorney is often executed as a precautionary measure, long before the onset of a disability. Accordingly, when the document is prepared, the powers given to the attorney-in-fact should be broad enough to cover just about anything that can be expected. One area that seems to create a number ...

Can a spouse be a guardian of a disabled spouse?

Since it will be necessary to have both spouses join in the sale of any jointly-owned real estate and since only the husband can deal with his individually owned assets, it may be necessary to have the court appoint a guardian to represent the disabled spouse.

Can a spouse name their children?

Typically, however, spouses will name each other and then a child or children as successors in the event the spouse dies or is unable to act. When it comes to granting powers to your children, it may be best to name at least two of them and require that they make decisions jointly.

When do you file for power of attorney for a child?

If you are a parent or primary caregiver of a child with developmental disabilities, it is imperative that you file for power of attorney before the child reaches his eighteenth birthday. This assures that the family retains control of the dependent's affairs.

How long does it take to get a power of attorney?

This can happen the same day or take several weeks depending on the court's case load.

How to hire a lawyer for a disability?

Don't hesitate to call their office and ask their experience in dealing with special needs children. If you feel a specific lawyer is qualified and you hire them, ask what paperwork you need to bring for your appointment.

Can a disabled child file for a power of attorney?

The general rule of thumb is to provide the birth certificates for the caregiver or parents and the disabled child. This helps confirm that you are legitimate and eligible to file for power of attorney.

Popular Posts:

- 1. why is the fbi director always an attorney

- 2. who was louise korbel attorney

- 3. how to fll screen ace attorney

- 4. when does durable power of attorney start

- 5. new york "a durable power of attorney terminates when"

- 6. how do you sign over power of attorney in texas

- 7. who is your power of attorney

- 8. who is the best divorce attorney in camden sc

- 9. can i contact the attorney who prepared my brothers will to find out if i am a beneficiary

- 10. what is an attorney blocked account