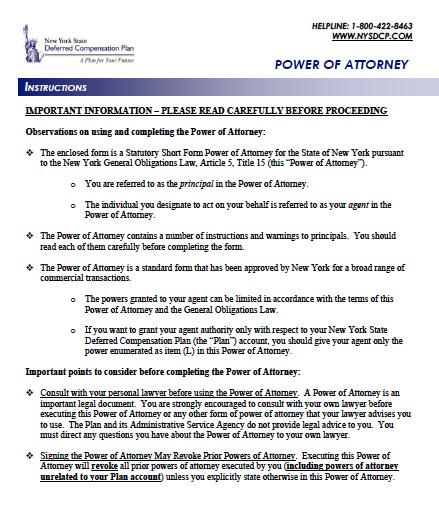

- Check your state's requirements. Requirements for power of attorney are similar in most states, but some have special forms.

- Download or write a power of attorney form. In most states, power of attorney forms don't have to be government-written legal documents.

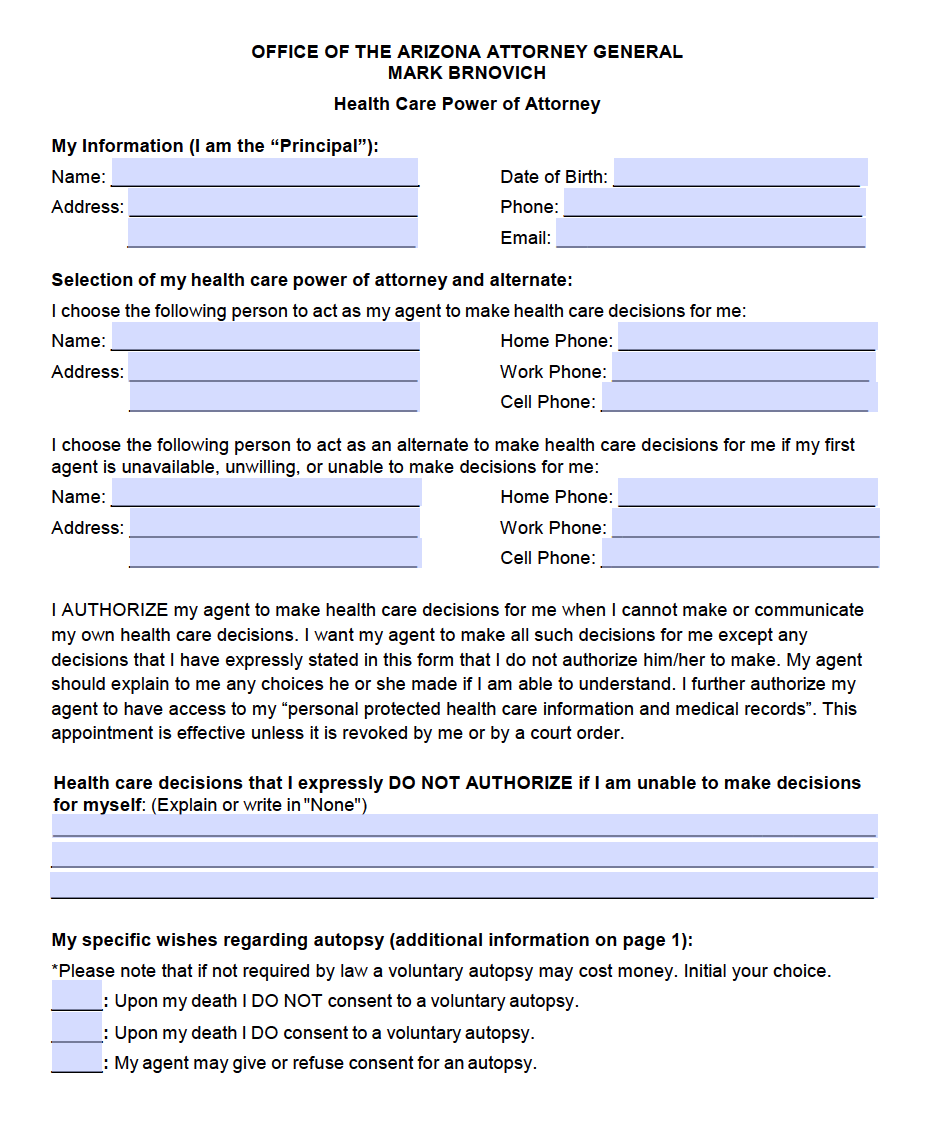

- Check your document for clarity. It must specifically name the principal, the agent (the person given power), and the type of powers granted.

- Gather witnesses. In some states it is necessary to have the signing of the document witnesses by one or two people.

- Help the grantor decide which type of POA to create. ...

- Decide on a durable or non-durable POA. ...

- Discuss what authority the grantor wants to give the agent. ...

- Get the correct power of attorney form.

How do you give someone power of attorney?

Feb 24, 2022 · Broadly speaking, you get power of attorney for a parent by having him or her name you as the agent in a POA document that he or she has signed while sound of mind. However, the process is rarely as simple as it seems, especially when it comes to ensuring that your power of attorney will be recognized by third parties.

How to acquire power of attorney?

Nov 25, 2021 · Depending on your state, the principal will need to sign the power of attorney form in the presence of witnesses, a notary public, or both. You may also be required to provide copies of the POA to those involved (like agents and healthcare professionals).

What is power of attorney and how does it work?

7 rows · Draft a Power of Attorney Document in a Flash Using DoNotPay. Don’t waste more of your time and ...

What are the three types of power of attorney?

Jul 16, 2021 · The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your state and the scope of available powers. Talk to your parent so they understand why you want to take this step and the benefits and drawbacks of the action.

How do I get power of attorney over my elderly parent?

The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your s...

What are the four types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes in...

Can I get a power of attorney if my parent has dementia?

No, if your parent already has cognitive impairment, they can’t legally sign the documents required to set up a power of attorney. This is one reas...

What are the disadvantages of a power of attorney?

The biggest drawback to a power of attorney is that an agent may act in a way that the principal would disapprove of. This may be unintentional if...

Is power of attorney responsible for nursing home bills?

As your parent’s power of attorney, you’re responsible for ensuring their nursing home bills are paid for through their assets and income. However,...

What is financial power of attorney?

Having financial power of attorney means having the authority to access and manage another person's monetary and/or property assets. As an agent with financial POA, you have the right to make certain kinds of financial decisions on behalf of the principal (as long as they are in his or her best interests). For example, your parent might give you the authority to pay bills, file taxes, make and manage investments, transfer money between different bank accounts, handle insurance claims, collect outstanding debts, sell or rent out property, or deal with retirement pensions and government benefit programs.

What is POA in law?

A POA document is generally a written agreement between two people: (1) the principal (sometimes called the grantor) and (2) the agent (sometimes called the attorney-in-fact). The agent is the person appointed to act on behalf of the principal. So your parent (the principal) can grant you (the agent) certain powers of attorney.

When does a springing POA take effect?

Unlike most other types of POA documents, a springing POA agreement doesn't take effect until a specified date or a particular event takes place. For example, your parent may not want you to have any authority until he or she becomes incapacitated or turns a certain age.

Can you have more than one power of attorney?

However, there can be more than one person with power of attorney because your parent may decide that various responsibilities should be divided up among two or more people. (Frequently, for instance, one agent will handle financial matters, whereas another will handle healthcare issues.)

What is POA agreement?

Depending on the particular agreement, a power of attorney covers a broad or narrow set of responsibilities, usually related to financial and/or medical and caregiving matters.

Is it too late to get a power of attorney?

After all, by the time your parent becomes legally incapacitated, it's too late to get power of attorney. At that point, you have to pursue the more costly and time-consuming option of adult guardianship. That's why the issue of "capacity" is so important.

What is a POA?

Also known as special power of attorney, this type of POA grants an agent the authority to handle a very specific situation on the principal's behalf. For example, your parent may grant you limited POA to represent him or her in the sale of a particular property or to manage his or her transition to a nursing home or assisted living facility. Your authority as the agent ends as soon as you've successfully completed the defined activity or reached the agreement's specified expiration date. And your powers do not extend to anything other than what is specified in the document.

The Ins and Outs of a Power of Attorney for Someone in Jail

A power of attorney (POA) is a document in which the principal hands over legal power to the agent to act on their behalf, for example, in case the principal is mentally or physically incapacitated.

How To Create a POA for an Incarcerated Person

When creating a POA, it is important to seek legal advice. In case there’s a mistake in the document, the POA will be rejected immediately. Due to their special position, incarcerated principals will have to work closely with their lawyer or future power of attorney holder to transfer their decision-making authority successfully.

What Power of Attorney Is the Best for an Incarcerated Person?

It is important to understand the different types of powers of attorney, especially when choosing one for an incarcerated person. All of these documents have their advantages and disadvantages, and the choice will depend on the principal’s unique needs and circumstances.

Draft a Power of Attorney Document in a Flash Using DoNotPay

Don’t waste more of your time and money on expensive lawyers and online templates! DoNotPay can help you draft your power of attorney document within minutes. All you need to do is follow these instructions:

DoNotPay Makes All Issues Go Away in Several Clicks

Using DoNotPay comes with plenty of advantages, the main one being that you can resolve just about anything in a matter of clicks. It doesn’t get any easier than that!

Get Rid of Paperwork With Your AI-Driven Assistant

Even though paperwork belongs in the past, we have to keep dealing with it almost daily. To avoid this annoyance, you can just use DoNotPay!

Why do you need a power of attorney?

Common Reasons to Seek Power of Attorney for Elderly Parents 1 Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations. 2 Chronic Illness: Parents with a chronic illness can arrange a POA that allows you to manage their affairs while they focus on their health. A POA can be used for terminal or non-terminal illnesses. For example, a POA can be active when a person is undergoing chemotherapy and revoked when the cancer is in remission. 3 Memory Impairment: Children can manage the affairs of parents who are diagnosed with Alzheimer’s disease or a similar type of dementia, as long as the paperwork is signed while they still have their faculties. 4 Upcoming Surgery: With a medical POA, you can make medical decisions for the principal while they’re under anesthesia or recovering from surgery. A POA can also be used to ensure financial affairs are managed while they’re in recovery. 5 Regular Travel: Older adults who travel regularly or spend winters in warmer climates can use a POA to ensure financial obligations in their home state are managed in their absence.

What are the different types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes incapacitated, so they’re not often used by older adults when planning for the end of life. A durable POA lasts even after a person becomes incapacitated, so is more commonly used by seniors.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

Who is responsible for making decisions in a POA?

One adult will be named in the POA as the agent responsible for making decisions. Figuring out who is the best choice for this responsibility can be challenging for individuals and families, and your family may need help making this decision. Your attorney, faith leader or a family counselor can all help facilitate this process. It’s a good idea to select an agent who is able to carry out the responsibilities but also willing to consider other people’s viewpoints as needed.

What is a POA?

As mentioned above, a power of attorney (POA), or letter of attorney, is a document authorizing a primary agent or attorney-in-fact (usually a legally competent relative or close friend over 18 years old) — to handle financial, legal and health care decisions on another adult’s behalf. (A separate document may be needed for financial, legal, and health decisions, however).

Is a power of attorney necessary for a trust?

Under a few circumstances, a power of attorney isn’t necessary. For example, if all of a person’s assets and income are also in his spouse’s name — as in the case of a joint bank account, a deed, or a joint brokerage account — a power of attorney might not be necessary. Many people might also have a living trust that appoints a trusted person (such as an adult child, other relative, or family friend) to act as trustee, and in which they have placed all their assets and income. (Unlike a power of attorney, a revocable living trust avoids probate if the person dies.) But even if spouses have joint accounts and property titles, or a living trust, a durable power of attorney is still a good idea. That’s because there may be assets or income that were left out of the joint accounts or trust, or that came to one of the spouses later. A power of attorney can provide for the agent — who can be the same person as the living trust’s trustee — to handle these matters whenever they arise.

What is a POA?

A POA can grant broad authority that lasts a lifetime or be limited to a specific legal transaction, such as the sale of property. The rules and requirements for POAs vary from state to state, but it’s typically an inexpensive and relatively simple process to complete.

What is durable POA?

The durable POA also allows your agent to continue acting on your behalf even if you become mentally incapacitated or too ill to make decisions on your own. You must, however, be mentally competent when you first complete and sign the POA.

Who is Sandra King?

Sandra King uses her life experience as a small business owner, single parent, community volunteer and obsessive traveler to write about a variety of topics . She holds degrees in communication and psychology and has earned certificates in medical writing, business management and landscape gardening.

Can a POA be a friend?

You should, of course, choose an agent (also called an attorney, but they don't have to be an attorney) whom you can trust. A POA agent can be a family member, close friend or even your attorney. You decide what powers to give your agent, and you can revoke the power of attorney at any time, unless you become mentally incapacitated.

Is POA form invalid?

However, there are often slight to significant differences in the language of POA forms from state to state. If that language is altered or missing, the form could be invalid. It’s important to choose the right form for your location.

Do you need to notarize POA?

The signatures should be notarized, but you aren’t usually required to file a POA with the court . There may be exceptions, however, so read the instructions on the form carefully. It may be beneficial to have legal guidance, and attorneys generally charge a minimal fee for overseeing a POA process. References.

Can a physical disability make it difficult to open a bank account?

With a physical disability, you may find it difficult to make your way to the bank to open a new account or otherwise manage routine financial matters. You may need help with a few things temporarily or require a significant amount of assistance on a regular basis. Either way, it can be a tremendous relief to give someone who is trustworthy the legal authority to manage your day-to-day financial responsibilities.

What is financial power of attorney?

What Is a Financial Power of Attorney? A financial power of attorney is a particular type of POA that authorizes someone to act on your behalf in financial matters. Many states have an official financial power of attorney form.

When does a POA become effective?

When Does a Power of Attorney Become Effective? Depending upon how it is worded, a POA can either become effective immediately, or upon the occurrence of a future event. If the POA is effective immediately, your agent may act on your behalf even if you are available and not incapacitated. This is done when someone can’t be present ...

What is a POA?

What Is Power of Attorney? A power of attorney (or POA) is a legal document that authorizes someone to act on your behalf. The person who gives the authority is called the "principal," and the person who has the authority to act for the principal is called the "agent," or the "attorney-in-fact.".

How does a POA work?

Financial Power of Attorney: How It Works. A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable. If you need to give another person the ability to conduct your financial matters ...

When does a POA end?

The authority conferred by a POA always ends upon the death of the principal. The authority also ends if the principal becomes incapacitated, unless the power of attorney states that the authority continues. If the authority continues after incapacity, it is called a durable power of attorney (or DPOA). In cases of incapacity, a DPOA will avoid ...

Can a third party accept a POA?

The big question about any POA is will a third party accept it? Generally, a third party is not required to accept a power of attorney. However, some state laws provide for penalties for a third party who refuses to accept a power of attorney using the state’s official form. One thing you can do to help assure its acceptance is contact anyone you think your agent may need to deal with and be sure they find your POA acceptable.

What is incapacity in medical terms?

Incapacity is where the principal is certified by one or more physicians to be either mentally or physically unable to make decisions. This could be due to such things as mental illness, Alzheimer’s disease, being in a coma, or being otherwise unable to communicate.

2 attorney answers

A power of attorney can be obtained if he is competent and agrees to appoint you as his agent. If that's the case, please use a "durable" power of attorney, so that if he later becomes incompetent, the power of attorney remains valid. Otherwise, it would be rendered void if he was determined later to be incompetent...

Darrell Lloyd Cartwright

A power of attorney can be obtained if he is competent and agrees to appoint you as his agent. If that's the case, please use a "durable" power of attorney, so that if he later becomes incompetent, the power of attorney remains valid. Otherwise, it would be rendered void if he was determined later to be incompetent...

What is a power of attorney?

A Power of Attorney is a document that nominates a substitute decision maker for someone who is alive but unable or unwilling to make their own decisions. There is no such thing as a Power of Attorney for a dead person.

How long after a person dies can you get a power of attorney?

Depending on whether there is real property (house) involved, you may be able to have access to her account by Small Estate affidavit. You must wait 40 days after the death before you can exercise the affidavit.

Can a power of attorney be void?

A power of attorney is void upon death. You need to see an attorney about opening up a probate estate so you can close out the bank account. You will need to be able to give the attorney a death certificate of your mother, the names and addresses of all her children, and the name of the bank, the bank account value, whether a checking or saving account and the account value.

Is a power of attorney effective after death of principal?

The bank is wrong. No power of attorney is effective after the death of the principal. You need letters of administration. See a lawyer to file a petition for probate to get letters of administration.

Do POAs end at death?

All POAs end at death. You will need permission from a probate court to settle your mother's estate. If the estate is small, you may be able to be named a special administrator which would allow you to do certain things like close bank accounts. However, if your mother's estate is larger, you may need to be named executor by the court.

Can you get POA for a deceased person?

You cannot get POA for a deceased person. Depending on the amount of money in the account, there may be small estate procedures you can use to access the funds. Which procedure would be best, depends on all of the facts of your situation. There is one procedure that does not involve going to court.

Can you close a POA account after a deceased woman dies?

You can't. The POA terminated at her death. You should be able to close the account and have the funds distributed to her heirs without any court proceedings. Talk to the bank about what they require. It is usually just an affidavit.

What is a health and welfare lasting power of attorney?

Health and welfare lasting power of attorney. Use this LPA to give an attorney the power to make decisions about things like: your daily routine, for example washing, dressing, eating. medical care. moving into a care home. life-sustaining treatment. It can only be used when you’re unable to make your own decisions.

How long does it take to register an LPA?

Fill in the forms to appoint them as an attorney. Register your LPA with the Office of the Public Guardian (this can take up to 10 weeks). It costs £82 to register an LPA unless you get a reduction or exemption.

How old do you have to be to get a LPA?

You must be 18 or over and have mental capacity (the ability to make your own decisions) when you make your LPA. You do not need to live in the UK or be a British citizen. This guide is also available in Welsh (Cymraeg). There are 2 types of LPA: You can choose to make one type or both.

What are the different types of LPAs?

There are 2 types of LPA: 1 health and welfare 2 property and financial affairs

Popular Posts:

- 1. who was attorney for joseph wolfe fullerton?

- 2. how to find an attorney for civil property in fort worth

- 3. what work can an attorney do with athletes

- 4. what can you do if your attorney is not doing his job arkansas

- 5. how to address enveilope clientcare of an attorney

- 6. how much does a power of attorney cost in north carolina

- 7. ethics talking to someone who is represented by an attorney

- 8. family law attorney in anaheim ca who speak arabic

- 9. how to check probate in florida without an attorney

- 10. how to become power of attorney for your mental ill parent