A simple way to grant another person the power to sign your federal tax return is to file IRS Form 2848, Power of Attorney and Declaration

United States Declaration of Independence

The United States Declaration of Independence is the statement adopted by the Second Continental Congress meeting at the Pennsylvania State House in Philadelphia, Pennsylvania, on July 4, 1776. The Declaration announced that the Thirteen Colonies at war with the Kingdom of Great Britai…

What is the tax form for power of attorney?

Jul 18, 2021 · Power of Attorney must be authorized with your signature. Here’s how to do it: Authorize in your online account - Certain tax professionals can submit a Power of Attorney authorization request to your online account. There you can review, electronically sign and manage authorizations.

What is the cost of filing a power of attorney?

Jun 01, 2019 · If your return is signed by a representative for you, you must have a power of attorney attached that specifically authorizes the representative to sign your return. To do this, you can use Form 2848.

What is IRS power of attorney?

The IRS Power of Attorney to Sign Tax Returns Power of Attorney. As a general legal principle, a power of attorney is a document signed by an individual which gives... IRS Regulations. The rules relating to power of attorney with regard to tax returns are …

How do you file for power of attorney?

Authorized Representative Declaration (Power of Attorney Form) MCL 205.28 (1) (f) strictly prohibits employees of the Department of Treasury from disclosing confidential tax information to anyone other than the individual taxpayer or his or her authorized representative. Authorized Representative Declaration (Power of Attorney) Form 151.

Can tax returns be signed by POA?

The representative named in a POA cannot sign an income tax return unless: The signature is permitted under the Internal Revenue Code and the related regulations (see Regs.Apr 1, 2016

Who can be a power of attorney for IRS?

Any individual authorized under section 10.3 of Circular 230 to practice before the Internal Revenue Service. Those authorized include attorneys, CPAs, enrolled agents, enrolled retirement plan agents, and enrolled actuaries.May 30, 2018

How do I fill out a power of attorney with the IRS?

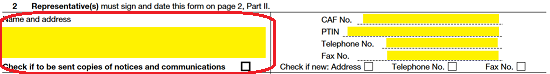

0:182:24Learn How to Fill the Form 2848 Power of Attorney and ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipMust provide their name address. Social security number employer identification number if aMoreMust provide their name address. Social security number employer identification number if a corporation daytime. Phone number and plan number in box to the party assuming the power of attorney.

Do you want to allow another person to discuss this return with the IRS?

You can allow the IRS to discuss your tax return information with a third party by completing the Third Party Designee section of your tax return, often referred to as "Checkbox Authority." This will allow the IRS to discuss the processing of your current tax return, including the status of tax refunds, with the person ...Jan 24, 2022

How long is a power of attorney Good for IRS?

6 yearsLength of POA Generally, a POA lasts for 6 years. To extend the POA for an additional 6 years, you must submit a new POA . Any POA declaration(s) filed on or before January 1, 2018 will stay on file until the listed expiration date or December 31, 2023, at which point it will expire.Dec 17, 2021

How long does it take the IRS to process a power of attorney?

During the past year, the average time the IRS took to process a POA fluctuated from 22 days to over 70 days and is currently 29 days.Jan 19, 2022

Which form is required for the IRS to provide tax return information to the tax preparer of a return?

File Form 8821 to: Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form.Jan 24, 2022

Who can practice before IRS?

Usually, attorneys, certified public accountants (CPAs), and enrolled agents may represent taxpayers before the IRS. Enrolled retirement plan agents, and enrolled actuaries may represent with respect to specified Internal Revenue Code sections delineated in Circular 230.Feb 27, 2018

Can form 2848 be filed electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.Nov 15, 2021

Can someone else file taxes on your behalf?

The IRS says you can file a tax return for someone else as long you have their permission to do so. Here are a few important things to know before you begin offering your services to others: You can file tax returns electronically for up to five people. The taxpayer will be held responsible if anything is incorrect.Aug 27, 2021

Should I authorize third party return?

The IRS cannot subsequently discuss your confidential tax return information with any third party until we receive a new authorization from you. If continued communication with your designated third party is necessary, consider granting a Tax Information Authorization.Jul 18, 2021

Can I complete a tax return for someone else?

You can authorise someone else to deal with HM Revenue and Customs ( HMRC ) for you, for example an accountant, friend or relative. If you have to fill in a Self Assessment tax return, HMRC will send all correspondence to the person you've authorised - except tax bills or refunds.

What is a power of attorney?

Power of Attorney. You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

Who can I appoint on my tax return?

You can appoint on your tax form a person the IRS can contact about your tax return. This authorizes the IRS to call the designee to answer any questions that may arise during the processing of your return. A Third Party Designee can also: Give the IRS any information that is missing from your tax return;

What can a third party designee do?

A Third Party Designee can also: Give the IRS any information that is missing from your tax return; Call the IRS for information about the processing of your return or the status of your refund or payment (s); Receive copies of notices or transcripts related to your return, upon request; and.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

Can you give an IRS authorization to a third party?

If you bring another person into a phone conversation or an interview with the IRS, you can grant authorization for the IRS to disclose your confidential tax information to that third party. An oral authorization is limited to the conversation in which you provide the authorization.

What is a POA on a tax return?

Form 8453 has a specific box to check if you are attaching a POA indicating that the individual has authority to sign the tax return: Form 2848, Power of Attorney and Declaration of Representative (or POA that states the agent is granted authority to sign the return)

When is a power of attorney terminated?

A power of attorney is generally terminated if you become incapacitated or in- competent. The power of attorney can continue, however, in the case of your incapacity or incompetency if you authorize this on line 5a “Other acts authorized” of the Form 2848. Does this mean I should also add words like these to Line 5a:

What is Form 2848?

Form 2848 is the IRS’s own version of a POA. Form 8453 is needed whenever mailing a paper document related to an e-filed return. Of course, I would prefer to use Method (1).

Where is Form 1040 mailed?

The Form 1040 goes to the normally assigned site based on state of residency where the form is scanned (assuming it was a mailed return). The Form 2848 goes a department of the IRS known as Entity Dept. with main office in Ogden but also in Memphis and Philadelphia.

How long do you have to file 1040?

3) Complete line 3; income, 1040, 2018-2020. You are allowed prospective years but I don't recommend more than 3 years.

Can I attach POA to 8453?

Don't attach any form or document that isn't shown next to the checkboxes. If you are required to mail in any documentation not listed on Form 8453, you can't file the tax return electronically. This seems to say that I can't attach the POA to the 8453 along with the 2848, and therefore I can't e-file the return.

What is the power of attorney for tax returns?

The rules relating to power of attorney with regard to tax returns are contained within Title 26 of the Code of Federal Regulations. The specific section is 1.6012-1 (a) (5). The IRS explains how those regulations work in Publication 947, which discusses the roles of tax agents both in signing tax returns and representing clients in dealings with tax officials.

What is a power of attorney?

As a general legal principle, a power of attorney is a document signed by an individual which gives somebody else the ability to act on his behalf in a legal context. The person given the ability is referred to as having "power of attorney.". Despite the name, this person does not have to be a qualified lawyer.

Who signs a tax return on behalf of the taxpayer?

A taxpayer may give permission for somebody else, usually his tax agent, to sign a return on his behalf.

Can a spouse sign a joint return without a power of attorney?

Joint Returns. In the event of a couple making a joint return, one spouse is allowed to sign on behalf of the other, without the need for a formal power of attorney. This only applies in cases of disease and illness.

What is a power of attorney?

A power of attorney created by a taxpayer must contain a clear authorization for the other person to sign the return. It must also include the taxpayer's identifying information, the name and address of the person being authorized to sign the return, the type of tax return and the tax year to which the authorization applies, ...

When is a power of attorney useful?

When a Power of Attorney May Be Useful. A power of attorney is useful when it will be difficult or impossible for you to sign your tax return yourself. You should consider granting a power of attorney to sign your return if you plan to be traveling abroad during tax filing season; if you are in the military and are deployed -- or expect ...

How to fill out Form 2848?

Form 2848 is filled out by entering your name, address and Social Security number, the name of the person being authorized to sign your tax return, and the year or years for which that person is authorized to sign the return. In addition, a statement of the condition or circumstance that permits the granting of the power of attorney is required.

Do you need a power of attorney to sign a joint tax return?

Do You Need Power of Attorney to Sign Joint Tax Returns? Under limited circumstances, you may give another person the authority to sign your tax return by issuing a power of attorney. Another person may sign your federal tax return if you are suffering from an injury or disease; if you are continuously absent from the United States for a period ...

Can a spouse sign a joint return if they are physically unable to sign?

When one spouse is physically unable by reason of disease or injury to sign a joint return, the other spouse may -- with the oral consent of the incapacitated spouse -- sign the incapacitated spouse’s name on the return followed by the words ‘‘By __ Husband (or Wife).’’.

Does TurboTax have a 2848 form?

TurboTax does not support the 28 48 form but it can be downloaded from the IRS site. Form: https://www.irs.gov/pub/irs-pdf/f2848.pdf. Instructions: https://www.irs.gov/pub/irs-pdf/i2848.pdf. 1.

Can I efile a tax return for a parent who is incapacitated?

Email to a Friend. Report Inappropriate Content. Can I e-file a tax return for a parent who is incapacitated? Yes, you may, with two conditions. One, if your return is signed by a representative for you, you must have a power of attorney attached that specifically authorizes the representative to sign your return.

Can I file my 1040 on my parents' behalf?

You may file in your parent’s behalf. Prepare IRS form 2848 with your parent’s name in Part I, line 1. You are listed under Part 1, line 2. You both sign on page two. See 1040 instructions, page 60. ‘If your return is signed by a representative for you, you must have a power of attorney attached that specifically authorizes ...

Popular Posts:

- 1. what is the job of the attorney general of the us

- 2. why won't social security accept durable power of attorney

- 3. can you recover "attorney fees" when pursuing an execution on money judgment

- 4. how much does it cost to have a lawyer draw up power of attorney

- 5. california what to do when "client dies" attorney

- 6. how many cases per ace attorney game

- 7. who can remove a fla state's attorney from their office

- 8. what is florida attorney ethics violation

- 9. how to get a power of attorney contested

- 10. who is joey porter's attorney?