What can you do with a power of attorney?

Sep 01, 2020 · A power of attorney, also known as a letter of attorney, is a legal document that you sign to authorize another person to act on your behalf. The person who is giving his or her power is known as the principal, the grantor or the donor. The person taking on the power is known as the agent or the attorney-in-fact.

What is power of attorney and how does it work?

Jan 19, 2020 · How a Power of Attorney Works. A power of attorney is a legal document in which an individual (the principal) designates another individual as an agent (attorney-in-fact) to perform certain transactions on the principal’s behalf. This is a very powerful document and in most instances becomes effective upon signing.

What can a power of attorney really do?

A power of attorney may be made effective: At the time it is signed; At a future date described within the document, Upon the occurrence of a specific future event; or Upon the occurrence of a contingency (such as your becoming disabled).

How do we activate power of attorney?

May 02, 2022 · A power of attorney (POA) is a legally binding document that allows you to appoint someone to manage your property, medical, or financial affairs. Although it can be uncomfortable to think about needing it, a POA is an important part of your estate plan. A POA is typically used in the event that you become unable to manage your own affairs.

What happens when someone takes power of attorney?

What responsibility comes with power of attorney?

Is there a downside to being a power of attorney?

One major downfall of a POA is the agent may act in ways or do things that the principal had not intended. There is no direct oversight of the agent's activities by anyone other than you, the principal. This can lend a hand to situations such as elder financial abuse and/or fraud.Oct 7, 2019

What three decisions Cannot be made by a legal power of attorney?

Can a family member override a power of attorney?

Is power of attorney a good idea?

What are the pros and cons of being a power of attorney?

- Pro: Lower Cost. ...

- Pro: Convenience. ...

- Con: It Might Not Conform to State Law. ...

- Con: It Might Give Your Agent Too Much or Too Little Power. ...

- Con: It Might Be Too General. ...

- Con: It Could Expose You to Exploitation.

Can a power of attorney transfer money to themselves?

What is a general power of attorney?

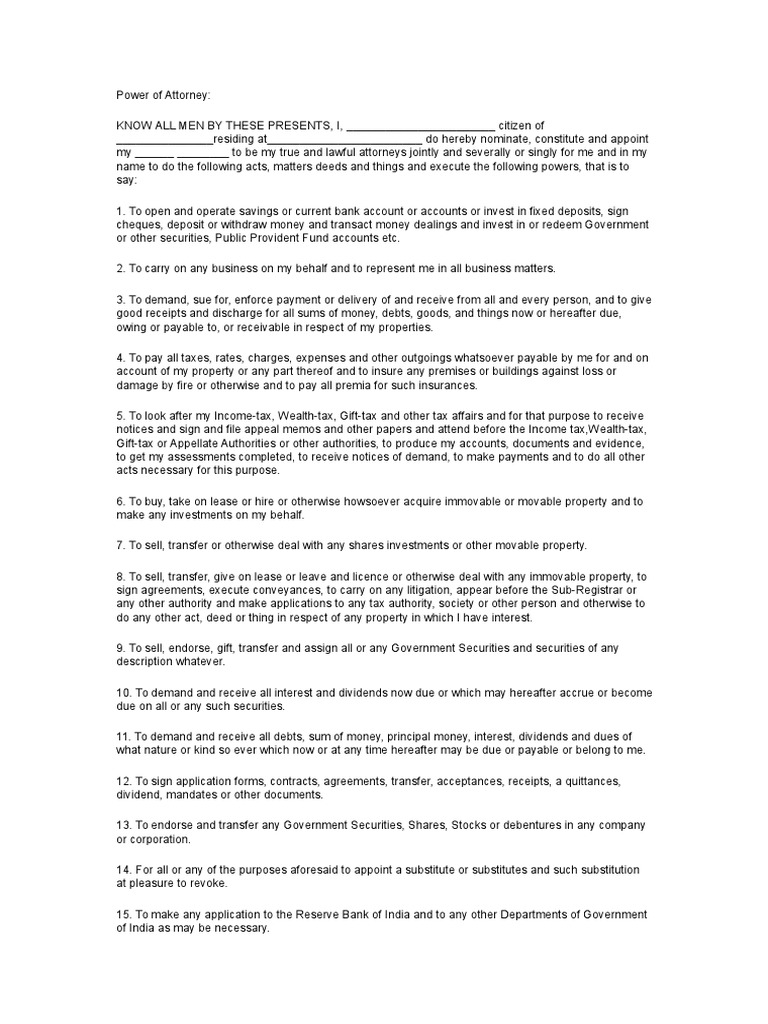

General Power of Attorney. The general power of attorney is a broad mandate that gives an agent a lot of power to handle the affairs of a principal. The agent or the person designated to act on behalf of the principal is charged with handling several tasks. The tasks include buying or disposing of real estate.

When does a power of attorney lapse?

The power of attorney lapses when the creator dies, revokes it, or when it is invalidated by a court of law. A POA also ends when the creator divorces a spouse charged with a power ...

What is a POA?

Power of Attorney, or POA, is a legal document giving an attorney-in-charge or legal agent the authority to act on behalf of the principal. The attorney in charge possesses broad or limited authority to act on behalf of the principal. The agent can make decisions regarding medical care. HMO vs PPO: Which is Better?

What is the job of a real estate agent?

The agent or the person designated to act on behalf of the principal is charged with handling several tasks. The tasks include buying or disposing of real estate. Real Estate Real estate is real property that consists of land and improvements, which include buildings, fixtures, roads, structures, and utility systems.

Can a POA be active even if the principal is unable to communicate?

In such a case, the principal would prefer that the POA remains active even if he or she becomes unable to communicate. For example, if the principal becomes comatose, but would prefer that the spouse be the agent, it can be specified in the form of a durable power of attorney. The POA gives power to the spouse to make decisions even when ...

What is a POA in medical?

Medical or health care POA authorizes the agent to make decisions on behalf of the principal in case of a life-threatening illness. Most health POAs fall under the durable kind because they take into consideration the fact that the principal may be too sick to make their own decisions.

Can a principal go to the legal services corporation website?

Alternatively, the principal can go to the Legal Services Corporation website and communicate with a legal aide. Principals who are eligible will be attended for free.

What is a power of attorney?

A power of attorney is a legal instrument that grants another person the authority to act as your legal representative, and to make binding legal and financial decisions on your behalf. While it is not particularly difficult to find power of attorney forms on the Internet, there is usually little or no accompanying explanation of what a power ...

When is a power of attorney effective?

A power of attorney may be made effective: At the time it is signed; At a future date described within the document, Upon the occurrence of a specific future event; or. Upon the occurrence of a contingency (such as your becoming disabled).

What are the different types of powers of attorney?

Types of Power of Attorney. At a basic level, there are two types of powers of attorney. General Power of Attorney - A general power of attorney is unlimited in scope and duration, and permits the named individual to act as your legal representative in relation to financial matters until such time as it is revoked.

Do power of attorney forms have to be registered?

That is, the document can specify a date or event after which the power of attorney will no longer be valid. Ordinarily, power of attorney forms do not have to be registered with the state. However, if a power of attorney grants somebody the right to engage in transactions relating ...

Do you have to register a power of attorney?

Ordinarily, power of attorney forms do not have to be registered with the state. However, if a power of attorney grants somebody the right to engage in transactions relating to real estate, it may be necessary to record the form in order for it to be effective.

Can you have multiple representatives on a power of attorney?

Appointing Multiple or Alternate Representatives. When executing a power of attorney, you may choose to appoint more than one person to act on your behalf. You may require that all persons appointed as your agents jointly sign any instrument or document in order for it to be binding upon you; or.

Do you need a power of attorney to be notarized?

Some states allow for a power of attorney to become effective when signed by the grantor, but others may require that the power of attorney be notarized, witnessed, or both.

What is a power of attorney?

A power of attorney is a document that lets you name someone to make decisions on your behalf. This appointment can take effect immediately if you become unable to make those decisions on your own.

What is a power of attorney for health care?

A health care power of attorney grants your agent authority to make medical decisions for you if you are unconscious, mentally incompetent, or otherwise unable to make decisions on your own. While not the same thing as a living will, many states allow you to include your preference about being kept on life support.

Can a power of attorney go into effect if you are mentally incompetent?

Specify in the power of attorney that it cannot go into effect until a doctor certifies you as mentally incompetent. You may name a specific doctor who you wish to determine your competency, or require that two licensed physicians agree on your mental state.

What happens if you appoint only one power of attorney?

If you appoint only one agent, have a backup. Agents can fall ill, be injured, or somehow be unable to serve when the time comes. A successor agent takes over power of attorney duties from the original agent, if needed.

Can a successor agent take over power of attorney?

A successor agent takes over power of attorney duties from the original agent, if needed.

What to do if your power of attorney is not able to determine mental competency?

If you think your mental capability may be questioned, have a doctor verify it in writing. If your power of attorney doesn't specify requirements for determining mental competency, your agent will still need a written doctor's confirmation of your incompetence in order to do business on your behalf. A court may even be required to decide the ...

What happens if a power of attorney doesn't specify mental competency?

If your power of attorney doesn't specify requirements for determining mental competency, your agent will still need a written doctor's confirmation of your incompetence in order to do business on your behalf. A court may even be required to decide the competency issue in some circumstances.

What is financial power of attorney?

What Is a Financial Power of Attorney? A financial power of attorney is a particular type of POA that authorizes someone to act on your behalf in financial matters. Many states have an official financial power of attorney form.

How does a POA work?

Financial Power of Attorney: How It Works. A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable. If you need to give another person the ability to conduct your financial matters ...

Do banks have power of attorney?

Many states have an official durable power of attorney form, which is usually a durable financial power of attorney form. Some banks and brokerage firms have their own power of attorney forms. Also, for buying or selling real property, a title insurance company, lender or closing agent may require the use of their form.

Do you need to sign a power of attorney before a notary public?

Generally , a financial power of attorney must be signed before a notary public. Especially if the sale or purchase of real estate is involved, it may also need to be signed before witnesses. In a few states, the agent is also required to sign to accept the position of agent.

Can a third party accept a power of attorney?

Generally, a third party is not required to accept a power of attorney. However, some state laws provide for penalties for a third party who refuses to accept a power of attorney using the state’s official form.

Can you use a POA to transact business?

You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable. If you need to give another person the ability to conduct your financial matters when you can’t or unable to be present, a financial power of attorney (POA) may be your solution.

What is a POA?

What Is Power of Attorney? A power of attorney (or POA) is a legal document that authorizes someone to act on your behalf. The person who gives the authority is called the "principal," and the person who has the authority to act for the principal is called the "agent," or the "attorney-in-fact.".

1. Power of Attorney (POA) Definition – Investopedia

A power of attorney can provide you with both convenience and protection by giving a trusted individual the legal authority to act on your behalf and in your (1) …

3. Power of Attorney – American Bar Association

The power may give temporary or permanent authority to act on your behalf. The power may take effect immediately, or only upon the occurrence of a future event, (7) …

6. Power of Attorney Services: What is it & How to Get One?

When you need someone to handle your finances on your behalf. A power of attorney is a legal document giving a person (known as the agent) broad powers to (17) …

8. Power of attorney – Wikipedia

Retrieved 22 September 2011. ^ Irving, Shae. “Durable Financial Power of Attorney: How It Works”. Nolo.Attorney-in-factThe term attorney-in-fact is used in many jurisdictions instead of the term agent. That term should be distinguished from the term attorney-at-law.

Types of Powers of Attorney

- 1. General Power of Attorney

The general power of attorney is a broad mandate that gives an agent a lot of power to handle the affairs of a principal. The agent or the person designated to act on behalf of the principal is charged with handling several tasks. The tasks include buying or disposing of real estateReal Es… - 2. Limited or Special Power of Attorney

An individual looking to limit how much the agent can do should choose limited or special power of attorney. Before signing to notarize a limited power of attorney, a person needs to be as detailed as possible about how much the agent should handle. If an individual is not clear what …

How Power of Attorney Works

- The principal can either download or buy POA templates. In the event the template is acquired through either one of the two methods, the principal should ensure they belong to the state of residence. POA documents are very important, and the principal should not assume that the documents acquired are of the correct kind. Verification of the POA documents is necessary bef…

Summary

- A power of attorney (POA) is an authority imposed on an agent by the principal allowing the said agent to make decisions on his/her behalf. The agent can receive limited or absolute authority to act on the principal’s behalf on decisions relating to health, property, or finances. A POA is common when a person is incapacitated and unable to make the...

Additional Resources

- CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™Become a Certified Financial Modeling & Valuation Analyst (FMVA)®CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today!certification program, designed to help anyone become a world-clas…

Popular Posts:

- 1. what happens when there is no power of attorney

- 2. how to prove that defense attorney purposely excluded evidence

- 3. how do we charge for billing record requested by attorney

- 4. what attorney represents kareem hunt

- 5. who is anne fulton attorney kewanee il

- 6. how to serve child support modifcaition on utah attorney general's office

- 7. how to disolve a durable general power of attorney new york

- 8. how to sell real estate by a power of attorney

- 9. what to expect from attorney after car accident

- 10. what to do when a closing attorney doesn't get you paperwork on time