Can a non-VA attorney help a veteran?

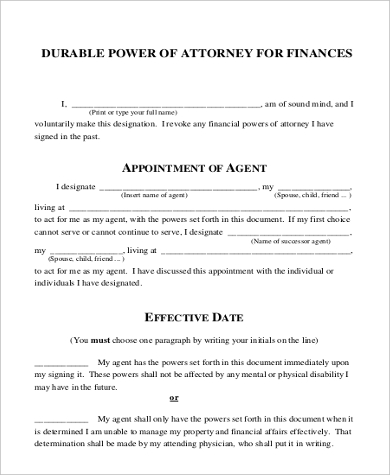

Wisconsin Power of Attorney for Finances and Property Page 4 F-00036 (Rev. 08/2016) RELIANCE ON THIS POWER OF ATTORNEY FOR FINANCES AND PROPERTY. Any person, including my agent, may rely upon the validity of this power of attorney or a copy of it unless that person knows that the power of attorney has been terminated or is invalid.

Do I need a gifting power of attorney in Wisconsin?

Mar 08, 2021 · Power of Attorney for Health Care. Assigned Number. Title. Version Date. Publication Type. Other Location. Language. F-00085. Power of Attorney for Health Care - Letter.

How do I get free legal help in Wisconsin?

Jan 25, 2022 · Family estate planning in Wisconsin (UW Extension) Look for the "View Publication" link to read online for free. WI Statutes: ch. 155 "Power of Attorney for Health Care" Parental. Power of Attorney Delegating Parental Power (Marathon Register in Probate) WI Statutes: s. 48.979 "Delegation of power by parent" (Parental Power of Attorney)

Can a volunteer attorney help with military law or family law?

Mar 09, 2021 · Email your completed Power of Attorney form [email protected]. If you have any questions, call us at (877)-328-6505. We'd love to help! v6.1 21.

Does VA recognize POA?

The VA doesn't recognize power of attorney (POA). If a veteran is still competent and simply wishes for a person, such as a family member, to handle their claim for benefits, then they can complete VA Form 21-22a to appoint them as their one-time representative.

What can you do with a power of attorney?

A general power of attorney allows the agent to act on behalf of the principal in any matters, as allowed by state laws. The agent under such an agreement may be authorized to handle bank accounts, sign checks, sell property, manage assets, and file taxes for the principal.

Does VA help with wills?

VA makes financial planning and online will preparation services available at no cost to beneficiaries of: SGLI (Servicemembers' Group Life Insurance)

Does Wisconsin have legal aid?

LEGAL ACTION OF WISCONSIN, INC. ( Legal Action provides free civil legal services to low-income people and senior citizens in the areas of housing, public benefits, family law, jobs and economic development and education.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

What does the VA pay for when a veteran dies?

VA will pay up to $796 toward burial and funeral expenses for deaths on or after October 1, 2019 (if hospitalized by VA at time of death), or $300 toward burial and funeral expenses (if not hospitalized by VA at time of death), and a $796 plot-interment allowance (if not buried in a national cemetery).Oct 1, 2019

Will writing for veterans?

Arlington, VA – Wills for Veterans is a new initiative of the Federal Bar Association that began at the national level in February 2017. This is a pro bono project where participating FBA chapters are providing will drafting and signing services to any veterans in the local area.

Can veterans sue the VA?

Can You Sue the VA for Medical Malpractice? The FTCA allows veterans and their families to file a medical malpractice claim against VA doctors and employees if their negligent care caused an injury. "Negligence" means the lack of ordinary care.

What is a Judicare attorney?

3 “Judicare” means a delivery system for legal aid through instructing private legal practitioners to represent individual legal aid clients.

What are legal acts?

Legal Act refers to act that is not condemned as illegal. For example, a surgeon's incision is a legal act, whereas stabbing is an illegal one. It also refers to any act that binds a person in some way or one which creates a legally recognized obligation.

What are some legal actions?

Legal Action definitionLitigation.Lawsuit.criminal proceedings.Criminal proceeding.Adjudicative proceeding.Legal Proceedings.ADR Proceeding.Informal proceedings.More items...

What kinds of issues do we help with?

Volunteers may be able to provide eligible individuals with free legal assistance on some civilian legal issues. Referrals for family law issues are done on a very limited basis with the first priority given to cases that affect or result from military service. Other areas of law that we may be able to help with include:

Request Help

Your first stop should be Wisconsin Free Legal Answers. It's a free online legal clinic where you can post your request for legal advice about any civil (not criminal) law topic. In addition to answering your questions, volunteers can also refer you to helpful legal resources.

Other Important Information

Volunteers work with low income service members on civilian legal issues only. Our volunteers do not handle issues related to military law, military discharges or open cases that are being handled by a military legal assistance office.

Why is this important?

OnPay works with government entities on your behalf, reporting new hires to state labor departments, calculating tax rates, paying taxes and insurance contributions, and filing financial reports. To do this effectively, you will need to grant us Power of Attorney for each state where your company has a tax obligation.

Returning your completed form

Email your completed Power of Attorney form [email protected]. If you have any questions, call us at (877)-328-6505. We'd love to help!

What happens if you don't have a durable power of attorney?

If you cannot manage your own affairs someone else must. A Durable Power of Attorney allows your agent to act even if you become incapacitated or incompetent. If you do not have a Durable Power of Attorney and you become incompetent, it may be necessary for your family to ask the court to appoint a guardian for you.

Should I be an agent?

Yes. You should get the help you need to carry out your duties as agent. For instance, if you are managing many assets, you should get investment advice or even make arrangements with a trust company to manage the investments through a custodial account. The reasonable costs of these services are expenses that should be paid from the principal's assets.

What does "incapacity" mean in medical terms?

on the occurrence of a specific event, for example, when two physicians have decided that the principal has regained the ability to act for himself or herself; when the principal becomes incapacitated, if the power does not state that it is durable (continues into incapacity);

Can you borrow money from a power of attorney?

No , unless the Power of Attorney specifically allows you to use any of the property for your own benefit. For example, unless the document specifically says so, you may not borrow money from the principal even if you are paying it back at the same or a higher interest rate you would pay a bank. Also, you should not sell any of the principal's property to yourself, your friends, or your relatives even at a fair price unless the Power of Attorney makes it clear that you can.

Can I give money to a principal?

No, unless the Power of Attorney specifically says that you can make donations or gifts. You are to use the money for the principal's benefit, and such donations and gifts are not considered to be for the principal's benefit. If, however, the document authorizes gifting or donating, you may make gifts or donations of the principal's property, but only as specified in the document. For example, the document may list certain family members or charities. It may permit gifting or donations only in amounts consistent with past giving, or only if the gifts or donations don't cause tax consequences or jeopardize eligibility for public benefits. Again, read the document carefully. Even with such a provision, however, you must still be mindful of your fiduciary responsibility. The principal's needs come first. Obtain a lawyer's advice if you have questions about a gifting power or its provisions.

Can you use the principal's money to reimburse yourself?

Unless the Power of Attorney prohibits it, you may use the principal's money to reimburse yourself for reasonable and necessary out-of-pocket expenses that you have incurred in acting as agent for the principal's benefit.

What is a Guardian of Estate?

What is a Guardian of Estate?#N#A Guardian of the Estate is appointed by the Court and is responsible for financial management of the ward’s assets and bill paying. The Court will require an annual accounting of the ward’s assets.

What is conservatorship in financial services?

The conservatorship is a court supervised system under which the client voluntarily agrees to allow the agency to manage the client’s estate.

on This Page

See more on wisbar.org

What Kinds of Issues Do We Help with?

- Volunteers may be able to provide eligible individuals with free legal assistance on some civilian legal issues. Referrals for family law issues are done on a very limited basis with the first priority given to cases that affect or result from military service. Other areas of law that we may be able to help with include: 1. tenant-landlord 2. residential real estate 3. debts and bankruptcy 4. guardia…

Request Help

- Your first stop should be Wisconsin Free Legal Answers.It's a free online legal clinic where you can post your request for legal advice about any civil (not criminal) law topic. In addition to answering your questions, volunteers can also refer you to helpful legal resources. If you find that you need more help than can be provided through the brief advice in Wisconsin Free Legal Answ…

Other Important Information

- Volunteers work with low income service members on civilian legal issues only. Our volunteers do not handle issues related to military law, military discharges or open cases that are being handled by a military legal assistance office. We are also unable to help with family law issues at this time. We will make our best efforts, but we cannot guarantee that a volunteer attorney will be availabl…

Popular Posts:

- 1. what is da district attorney

- 2. what to bring when meeting a bankruptcy attorney

- 3. who is the u s attorney for the western district of texas?

- 4. nys how to dismiss your attorney

- 5. a paralegal who fills out forms without attorney supervision

- 6. how to cc an attorney on a letter

- 7. what does substitution of attorney civil without court order

- 8. what is the name of the code of ethics that governs attorney in your state

- 9. who is the attorney general cabinet secretary for

- 10. who was attorney general for branch davidiana