How much does a real estate attorney charge to sell a house?

Oct 21, 2021 · Typically, closing costs include realtor commissions for both agents, transfer taxes, and recording fees. Many sellers choose to list For Sale by Owner to save on realtor commissions. However, most buyers utilize realtors and a realtor isn't likely to bring their buyer to you without a predetermined commission agreement they'll get when the sale closes. All in all, …

Who pays closing costs when selling a house?

Jan 29, 2021 · If you have an attorney represent you at closing, you’ll pay for the attorney fees. An attorney may charge by the hour — $150 to $350 an hour is standard according to Thumbtack), or they may charge a flat fee for outlined services such as preparing closing documents. “Sometimes closing attorney’s fees are split. But a FSBO seller must pay wire fees,” Pitts says.

Who is responsible for transfer taxes when selling a house?

Apr 05, 2022 · Buyers can have real estate agreements drawn up by a real estate attorney or agent. A title company or Realtor can help the buyer find someone to write a contract if necessary. If the seller doesn ...

Who pays escrow fees when buying a house?

Nov 08, 2017 · Have a real estate attorney help you set the terms of your sale and loan. Do not rely on forms from your office supply store. Hire a note servicer to collect monthly payments.

How much does a partner agent charge for a home sale?

What's more, Partner Agents charge a flat-fee commission of $3,000 or 1% if the home sells for over $350,000. Not only will you save so much time, but you'll also cut down on extra costs that your realtor will take care of.

How much does it cost to sell a house FSBO?

All in all, selling your home FSBO can cost around $4,000, minimum.

What are closing costs for a home sale?

Typically, closing costs include realtor commissions for both agents, transfer taxes, and recording fees. Many sellers choose to list For Sale by Owner to save on realtor commissions.

What does a realtor do when deciding on a listing price?

When deciding on a listing price, a realtor will usually consult create a comparative market analysis that breaks down home costs in your area. Next, you and the realtor can set a realistic price that will be both competitive and profitable.

How much does it cost to hire a photographer for a realtor?

Hire a Photographer - $110-$300. In most cases, your realtor will set up professional photos for your home to showcase it in the best possible light, literally and figuratively. If you go the For Sale by Owner route, you'll be responsible for taking photos of your home's interior and exterior. Hiring a professional photographer can cost ...

How much does escrow cost?

Escrow generally costs 1% to 2% of the final price, so sellers can expect to pay 0.5% to 1% of the sale price in escrow fees. Title fees: These fees include a title search to verify that the seller owns the property, and without any conflicting liens. Depending on the sale price and the location, title fees can range from $300 to $1,500.

What is a seller concession?

Seller concessions. Buyers may negotiate a financing concession, in which the seller pays part or all of the buyer’s closing costs. Often, a buyer negotiates for concessions, so they owe less in cash at the time of closing. “At 3% of the sales price, that’s a substantial amount,” Pitt notes.

How much does it cost to get a reconveyance deed?

Reconveyance fees: Once your mortgage is paid off, you’ll have to obtain a reconveyance deed to prove it — typical fees for this range from $50 to $65. Recording fees: After obtaining a reconveyance deed, the seller must have it recorded, usually at the county recorder’s office.

What are mandatory closing costs?

Mandatory costs include a long list of fees and taxes from involved parties such as the local and state government and mortgage lenders. Additional closing costs may include any seller concessions, attorney fees, and the buyer’s agent’s commission.

What happens if you sell your home without a realtor?

When you sell your home without a Realtor®, you save on the commission you would pay a listing agent. However, if you sell your home to a buyer represented by an agent, you’re still likely on the hook for the buyer’s agent commission (2% to 3% of the sale price), as this cost is customarily paid for by the seller.

What is the average commission rate for real estate agents?

The national average real estate agent commission is 5.8%, though the percentage may vary slightly from market to market. The listing agent and the buyer’s agent split the commission at the close of the sale.

How much does an attorney charge for closing?

Attorney fees. If you have an attorney represent you at closing, you’ll pay for the attorney fees. An attorney may charge by the hour — $150 to $350 an hour is standard according to Thumbtack), or they may charge a flat fee for outlined services such as preparing closing documents.

How much does a Zillow warranty cost?

They typically cover the home’s major systems, including plumbing, electrical and appliances. Cost: A one-time cost of between $300 and $500 for one year of warranty coverage. To avoid negotiating with a buyer and paying for additional incentives like a home warranty, sell directly to Zillow instead.

How much is escrow fee?

Cost: Usually 1% of the purchase price. On a $200,000 house, that’s $1,000 for the seller and $1,000 for the buyer. Note that this does not include the actual ...

How much does title insurance cost?

Cost: Lender’s title insurance coverage costs between $500 and $1,000.

How much does a home inspection cost?

Cost: The average home inspection costs between $250 and $700. Sellers sometimes decide to do a pre-inspection for a better sense of what the buyer’s inspector will find ...

Why is title insurance important?

It’s important for the buyer to have, because it protects them from legal or financial damages if another party were to try and claim ownership over the home in the future, after they purchase the home.

What is transfer tax?

Transfer tax. If you’ve bought or sold a home before , you know the financial details are much more complex than just the listing price. From inspections to agent fees and everything in between, both buyers and sellers hold financial responsibility for transaction expenses and closing costs — and knowing who pays for what can help ensure ...

Why do sellers do pre inspections?

Sellers sometimes decide to do a pre-inspection for a better sense of what the buyer’s inspector will find and the chance to make any important repairs before listing. A pre-inspection costs the same amount as a buyer’s inspection.

What is land contract?

A land contract is used when the owner provides financing when going to sell, so that you do not have to get a mortgage elsewhere to purchase the property. The contract stipulates the amount of the loan, the interest rate, and what happens if you fall behind on property taxes or payments. You and the seller can negotiate the terms of the agreement, ...

What is FSBO sale?

A FSBO sale can occur in a seller’s market or when sellers want to maximize their profits on a sale by not having to pay a commission to a real estate agent. So if the buyers want to make a written offer on property, who will be tasked with drawing up the purchase agreement, or the contract outlining the terms and conditions of the sale?

What is a purchase contract?

As a real estate buyer, a purchase contract is one of the first steps toward closing the sale. “In layman’s terms, a purchase contract is simply the written contract between the buyer and seller outlining the terms of the sale,” Hardy explains.

What is a seller's agent?

The seller’s agent is typically the person who draws up a real estate purchase agreement. But what happens if the home is for sale by owner (or FSBO) and the owner isn’t represented by a real estate agent at all? A FSBO sale can occur in a seller’s market or when sellers want to maximize their profits on a sale by not having to pay a commission ...

Why do people move on when they don't have a realtor?

It’s not unheard of for buyers to move on, because they are afraid to sign a contract without the help of an agent. Experts say the solution is to turn to the buyer’s own representation for writing a contract. “Typically, if the seller does not have a Realtor®, the buyer’s agent ends up doing most of the work,” explains Ryan Hardy, ...

Who can help a buyer with a real estate contract?

Buyers can have real estate agreements drawn up by a real estate attorney or agent. A title company or Realtor can help the buyer find someone to write a contract if necessary. If the seller doesn’t have an agent lined up to draft the purchase contract, the buyer’s own real estate agent can take care of the transaction paperwork as ...

Where does Jeanne Sager live?

Jeanne Sager has strung words together for the New York Times, Vice, and more. She writes and photographs people from her home in upstate New York. Get Pre-Approved Connect with a lender who can help you with pre-approval.

What is a wraparound loan?

A “wraparound” loan creates a new mortgage between you and the buyer. However, you continue paying your existing loan. Not all lenders allow this. In fact, many have an acceleration or due-on-sale clause that requires you to pay off your mortgage when you sell your home.

What does FSBO mean when selling a home?

FSBO means “for sale by owner”. When you sell a home, one of your first decisions is whether to FSBO (for sale by owner, pronounced “fizz-bo”) or hire an agent. But there are other options as well, offering less-than-full service and still saving you money. Learn about your options, from full-service Realtor to going it alone, ...

How much down do you put on an 85/15/5 mortgage?

An 85/15/5 requires just 5 percent from the buyer and 15 percent from you.

What percentage of sellers use a limited service agent?

Redfin concluded that 25 percent of sellers in the last year pulled it off without the help of a full-service agent. About 15 percent of sellers used a limited service agent, and about 10 percent listed without an agent’s help. So if you decide to go it alone, you’re not really going it alone.

What are the advantages of financing a sale?

Not only do you receive your profit from the sale; you can take what a lender would get in interest and loan fees.

Why do you need FSBO?

The biggest reason to consider some form of FSBO is the money you may save. If your house sells for $300,000, a traditional real estate commission of 6 percent would cost you nearly $20,000. You can keep that money or drop your price to sell faster.

Why do you respond to emails and phone calls?

Respond to emails and phone calls immediately, because any of them could be from a potential buyer. Remember that serious buyers want to narrow down their list quickly, view those homes and complete the process ASAP.

How much does a real estate attorney charge?

How much does a real estate attorney cost? How much you’ll pay for real estate attorney fees depends on your market and how involved they are in the transaction, but they typically charge a flat rate of $800 to $1,200 per transaction. Some attorneys charge hourly, ranging from $150 to $350 per hour.

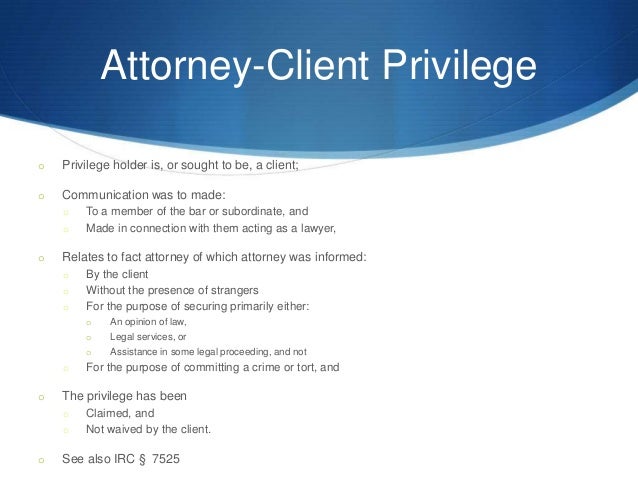

What is a real estate attorney?

Real estate attorneys help oversee home sales, from the moment the contract is signed through the negotiating period (aptly called the “attorney review”) to closing. A seller’s attorney reviews sales contracts, communicates terms in a professional manner and attends closings to prevent mishaps. Selling a home is a complex process ...

Why do you need an attorney for real estate?

An attorney helps you protect your investment and assets while ensuring you’re conducting your side of the transaction legally — which can prevent costly missteps. Real estate attorneys are required in many states, but even if you aren’t legally required to use an attorney while selling, it can be a good idea.

Who is responsible for underwriting title insurance?

Title company: A representative of the title company is responsible for underwriting the title insurance and transferring the clean title of the home to the buyer.

Who hires an inspector to inspect a house?

Inspector: The inspector is hired by the buyer. Their job is to make sure the buyer knows about everything that may need to be repaired on the home. Sellers also sometimes hire an inspector to do a pre-inspection so they can make any necessary repairs before putting the house on the market.

Do you need an attorney for a closing?

In 21 states and the District of Columbia, attorneys are legally required as part of the closing process. Attorney-required states include: As a best practice, if the other party in your transaction has a lawyer representing them and supporting their best interests, you should too.

Who pays for title insurance?

A home buyer and seller can negotiate who hires a title company and pays associated fees. In most cases, the home seller pays for the owner’s title insurance policy while the buyer pays for the lender’s policy. If you’re the one responsible for ordering title, be sure to have everything sorted out before closing day.

What do you need to do on the day of a for sale by owner closing?

On the day of your for-sale-by-owner closing, gather up all your paperwork and make sure you have a photo ID and your checkbook on you. When you meet with the buyer (and their real estate agent, if they have one), you’ll sign all the paperwork required to transfer ownership of your home.

What happens if an appraisal comes in below the sale price?

If an appraisal comes in below the sale price, a buyer and seller may be forced to renegotiate to cover the difference. Similar to an appraisal, a home inspection is ordered by the home buyer to evaluate the structure and systems of a home, from the roof to the foundation.

What does an escrow agent do?

Your escrow agent will order the title, property tax information, loan balances and other necessary paperwork. The escrow agent will also serve as a third party who holds money in trust until a property sale closes. Say you received an earnest money deposit from the home buyer or have contracts that need safe keeping.

What does closing by owner mean?

It typically means all the energy you spent marketing your home has led to the right offer. It’s a major milestone – but it also means you have a new set of tasks ahead of you. If you’re selling your home on your own, use this for-sale-by-owner closing to-do list to make sure you’re on the way to a successful sale!

Do you need an attorney to close a home sale?

Some states (and in some cases, certain regions within states) require that an attorney prepare certain legal documents or oversee the closing of a home sale. You might need to do a little digging to find the requirements in your area.

Do you get a check for escrow fees?

escrow or attorney fees, title fees and any pending property taxes or bills. If you’re making a profit after all expenses are paid off, you should receive a check for the balance. If not, you should have a cashier’s check ready to square your end of the bargain.

What are some examples of fees you can deduct?

For example, you can deduct fees paid for: collecting money owed to you by a customer. defending you or an employee in a lawsuit over a work-related claim, such as a discrimination lawsuit filed by a former employee. negotiating or drafting contracts for the sale of your goods or services to customers.

What is estate tax planning?

estate tax planning or settling a will or probate matter between your family members. help in closing the purchase of your home or resolving title issues or disputes (these fees are added to your home’s tax basis) obtaining custody of a child or child support. name changes. legal defense in a civil lawsuit or criminal case—for example, ...

Can you deduct attorney fees if you sue the government?

Certain Property Claims Against the Federal Government. Individuals may also deduct attorney fees if they sue the federal government for damage to their personal property. This applies both to civilians and federal employees.

Is personal legal fees deductible?

General Rule: Personal Legal Fees are Not Deductible. Personal or investment-related legal fees are not deductible starting in 2018 through 2025, subject to a few exceptions. In the past, these fees could be deductible as a miscellaneous itemized deduction. However, the TCJA eliminated these deductions for 2018 through 2025.

Can you deduct attorney fees for a civil case?

lawsuits related to your work as an employee--for example, you can't deduct attorney fees you personally pay to defend a lawsuit filed ...

Is a rental business a business?

Most rental activities qualify as a business. However, some may not. For example, the IRS has indicated landlords who have triple net leases with their tenants are not in business. Such leases require tenants to take care of property maintenance and insurance as well as paying rent.

Is legal fees deductible on taxes?

Legal fees incurred in creating or acquiring property, including real property, are not immediately deductible. Instead, they are added to the tax basis of the property. They may deducted over time through depreciation.

What is appraisal contingency?

An appraisal contingency allows cancellation if the property appraises for less than the selling price. A financing contingency provides for cancellation when the buyer cannot secure financing. An inspection contingency allows cancellation when the seller refuses to correct defects found during the property inspection.

Why is it important to be aware of the condition of your property?

Being aware of the condition of your property, as contained in the inspection report, can help you during negotiations with a buyer. A buyer cannot as easily blind-side you with supposed problems when you know the condition of your commercial real estate .

What is the biggest challenge when selling commercial real estate?

As mentioned earlier in the guide, correctly pricing a property is one of the biggest challenges when selling commercial real estate. It almost always makes sense to hire a professional commercial property appraiser to help you set an asking price.

What can a broker do for you?

They can save you countless hours of managing the marketing of your property. A skilled broker will already have a list of potential buyers for your warehouse, office building, vacant industrial property, or other types of commercial real estate.

How much does a commercial real estate broker charge?

Commercial real estate brokers typically charge a 4-8% commission. For a multi-million dollar property, the commission is a hefty price that some owners are unwilling to pay. Typically, a broker will work with multiple clients at the same time.

What are the advantages of selling a commercial property?

Advantages of Selling “By Owner”. Privately selling a commercial property has the potential for the owner to pocket the most amount of money. Without hiring a realtor, 4-8% of the purchase price can be saved. A sale ‘by owner’ can be the best choice if the seller knows a potential buyer.

What are the advantages of working with a commercial real estate broker?

A commercial real estate broker can help you put together a comprehensive marketing plan that will expose your property to the right potential buyers. They can save you countless hours of managing the marketing of your property.

Who Pays Real Estate Commission?

Who Pays Escrow Fees?

- Escrow fees are typically split 50-50 between buyer and seller. Escrow fees cover the services of an independent third party to conduct the closing and manage funds during the transaction. Cost:Usually 1% of the purchase price. On a $200,000 house, that’s $1,000 for the seller and $1,000 for the buyer. Note that this does not include the actual money being held in your escrow …

Who Pays For The Home Inspection?

- The buyer pays for a home inspection if they choose to conduct one. Inspections are meant to protect the buyer from any hidden defects in the home that could impact the home’s value, cost a lot of money to repair or make the home unsafe to live in. Cost:The average home inspection costs between $250 and $700. Sellers sometimes decide to do a pre-inspectionfor a better sens…

Who Pays For The Appraisal?

- Buyers cover the cost of the home appraisal, which is usually required by their lender if they will be taking out a mortgage to buy the home. Even if it isn’t required, buyers sometimes complete appraisals for peace of mind that they’re making a smart investment and not overpaying. Cost:The average cost of a home appraisal nationally is $350.

Who Pays For A Land Survey — Buyer Or Seller?

- The home buyer pays for a land survey, if they request one. Considered due diligence (much like a home inspection), a land survey lets the buyer know the details of the exact property they’re purchasing, including property boundaries, fencing, easements and encroachments. Cost:The average price is around $550, but it can vary depending on property size, shape and location.

Who Pays For Title Insurance?

- Both the buyer and seller pay for title insurance, but each type is slightly different. The seller pays for the title insurance coverage for the buyer, and the buyer pays for the title insurance policy for their lender. In general, title insurance ensures the home is “free and clear” and that no third party has an unknown claim to the property.

Who Pays For A Home Warranty — Buyer Or Seller?

- The seller pays for a home warranty. It’s often offered as an incentive to attract buyers, but it’s not required. Offering a home warranty gives the buyer assurance that they won’t have to pay any huge repair bills soon after moving in — most policies are good for a year. They typically cover the home’s major systems, including plumbing, electrical and appliances. Cost:A one-time cost of be…

Who Pays Real Estate Transfer Taxes?

- The seller is responsible for paying any real estate transfer taxes, which are charged when the title for the home is transferred from the old owner to the new owner. Transfer taxes can be levied by a city, county, state or a combination. Cost:Transfer tax costs vary dramatically in different parts of the country and can even vary from one city to its nearby suburbs. And rates can fluctuate over t…

Popular Posts:

- 1. how much does workers comp allow the attorney in your case to take

- 2. what is difference between conservatorship and power of attorney

- 3. what happens to accused persons who cannot afford to pay an attorney to represent them quizlet

- 4. how old is george sink jr attorney

- 5. how to find and check the background of a good criminal attorney

- 6. who is the montgomery county district attorney

- 7. how to file a complaint on a district attorney

- 8. how to become an employment law attorney

- 9. what is the definition of attorney

- 10. what is a power of attorney in new york state