Full Answer

What is a durable power of attorney in Florida?

The Florida Durable Power of Attorney represents a way in which an individual, or principal, can have someone act for them with regard to their finances and other areas of life. The durable type of POA stays in effect even if the principal ends up in a situation where he or she cannot think or act or communicate.

When does a power of attorney take effect in Florida?

In Florida, a valid POA takes effect upon execution, and a POA that operates otherwise is invalid. So, if you want a POA ready to go in case you become incapacitated, but you don’t want the agent to act on your behalf unless and until that occurs, you will need to withhold delivery of the document to the agent until you are ready for it to be used.

Can a limited power of attorney be used in Florida?

However, Florida law does allow a POA to incorporate all “banking transactions” and “investment transactions” enumerated within the POA Act by simply including the appropriate wording referencing the statute. A “limited power of attorney” is restricted in time and/or scope or only applicable to a specific transaction.

Can a durable power of attorney limit an action?

Although F.S. §709.08 (a) also states that actions can be limited by the durable power of attorney, such limiting language would appear to be unnecessary, considering that such actions could be limited by simply not authorizing and specifically enumerating them in the durable power of attorney. 5.

How long is a durable power of attorney good for in Florida?

But as a general rule, a durable power of attorney does not have a fixed expiration date. Of course, as the principal, you are free to set an expiration date if that suits your particular needs. More commonly, if you want to terminate an agent's authority under a power of attorney, you are free to do so at any time.

How long does a Lasting Power of Attorney last?

The lasting power of attorney ( LPA ) ends when the donor dies.

How long does it take for power of attorney to be granted?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Does a durable power of attorney need to be recorded in Florida?

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Can you fast track power of attorney?

OPG has an expedited registration service which is available for powers of attorney that need to be processed urgently. They give a number of examples on their website which outline the type of urgent situations that meet the criteria for this expedited service.

Can I track my power of attorney application?

The online service can also highlight any potential issues with your LPA application before printing, signing and sending it in to be registered. You can then track the application using our track my LPA system. If you've used the online tool, you'll be able to access this through your account.

How long does it take to register an enduring power of attorney?

The EPA will usually be registered between 8 and 10 weeks after you sent the application form and told the family members. It will take longer if one or more of the family members object.

What happens after power of attorney is registered?

Once your LPA has been registered by the OPG they'll return the form to you (or to the attorney if they registered it). It will be stamped on every page and it's only valid once this is done. It's important that those close to you, your doctor and anyone else involved in your care know that you have made an LPA.

How do you activate a power of attorney?

Your LPA needs to be registered by the Court of Protection before it can be activated. You have two options, you can either register the Lasting Power of Attorney as soon as it's in place and signed by you and your attorney, or leave it to be registered at a later date.

Does Florida DMV power of attorney need to be notarized?

The signature of each authorized agent must be notarized. The notary should print the name of the signing agent on the line for “Name of Person Making Statement”.

What happens to a power of attorney after a person dies?

When you die, any power of attorney that you signed during your lifetime becomes null and void. If you want to name someone to manage your financial affairs after your death, you need to make a will and name a personal representative. This can be the same person as the agent under your power of attorney, but it is critical that you have a separate will.

Does a power of attorney expire?

A regular power of attorney may also expire if the principal is “incapacitated,” i.e., legally incapable of managing their own affairs. In the case of durable power of attorney, the agent’s authority continues even during the incapacity. There is also something known as a “springing” power of attorney, which only authorizes the agent to act after a physician declares the principal is incapacitated. Current Florida law does not recognize any springing powers of attorney signed after October 1, 2011.

What is a durable power of attorney in Florida?

A Florida durable power of attorney form represents a way in which an individual, or principal, can have someone act for them with regard to their finances and other areas of life. The durable type of POA stays in effect even if the principal ends up in a situation where he or she cannot think or act or communicate.

What does "durable" mean in a power of attorney?

Definition of “Durable”. “Durable” means, with respect to a power of attorney, not terminated by the principal’s incapacity ( 709.2102 (4) ).

What powers does an attorney in fact have?

(8) Banking. A list of topics will display the powers you can grant your Attorney-in-Fact the power to perform in your name as well as the decisions he or she can make on your behalf. None of these powers are granted by default. To grant one of the power topics to the scope of your Attorney-in-Fact’s principal powers, you must initial the statement defining it. The first item gives your Attorney-in-Fact the ability to handle your transactions with banking and financial accounts as well as opening, closing, and maintaining such accounts.

Can a Florida agent apply for Medicare in your name?

By producing your initials here, you will give the Florida Agent the power to apply for government benefits and even receive payments in your name.

What happens to a durable power of attorney?

Durable Power of Attorney: the durable power of attorneys allows the authority you give to your agent to stay effective even after your incapacity. The durable power of attorney can be made general or specific. in order to create a durable power of attorney the document must state ...

What powers does a Florida attorney have?

The authority you give to your agent may be general in nature or very specific. In Florida you can create the following powers of attorneys: General Power of Attorney : the general power of attorney allows you to give your agent broad authority. Your agent will be able to do financial transactions like banking, buying or selling real estate, ...

What is the relationship between a power of attorney and a fiduciary?

The relationship between you and your agent is a fiduciary relationship. Your agent must act within the scope of the authority granted under the power of attorney. The agent must act in good faith, and must not act contrary to your best interest and your reasonable expectations if they have been communicated.

What is a limited power of attorney?

Limited or Special Power of Attorney: the limited power of attorney is used when you need to give your agent authority only for a specified purpose and for a limited duration.

How many witnesses are needed to sign a power of attorney in Florida?

According to Section 709.2105, in order for the power of attorney to be valid, you must sign the Florida power of attorney in the physical presence of two (2) witnesses and must be acknowledged by a notary.

What is a POA in Florida?

A Florida power of attorney (“POA”) allows you (the “principal”) to designate an “agent” to act on your behalf. The power of attorney in Florida is primarily used for financial transactions. However, in Florida you can also allow the agent to make health care decisions for you, the Designation of Health Care Surrogate is a document better suited ...

What does "capacity" mean in power of attorney?

In a general sense, capacity means that you understanding what you are executing and the effect of the power of attorney. As long as you understand the effects of the power of attorney, you will have the capacity to execute it. When I talk about capacity, I mean mental capacity.

What happens to a POA in Florida?

Other than a durable POA, POA authority likewise ceases if either principal or agent become incapacitated. Under Florida law, a POA between two spouses is invalidated upon filing of a petition for divorce, unless the POA survives divorce by its express terms.

What is a POA in Florida?

A specialized type of POA called a “designation of health care surrogate” (a/k/a “medical POA”) allows the agent to make healthcare decisions in the event of the principal’s incapacity. In Florida, medical POAs are authorized under a different statute (Fla. State. §765.101, et. seq.) than legal and financial POAs, ...

What is a limited POA?

Limited POAs are commonly used to facilitate financial transactions, such as the transfer of a vehicle or real estate. A more broadly written POA might empower the agent to handle a variety of financial matters – paying bills, entering into contracts, or buying and selling most property for the principal.

What does a signature mean in Florida?

A signature should clearly state that the agent is signing “as attorney in fact for” or “as agent for” the principal. Notably, the notary requirements for property executing powers of attorney changed in Florida as of January 2020, raising the likelihood of improper execution.

What is limited power of attorney?

A “limited power of attorney” is restricted in time and/or scope or only applicable to a specific transaction. You might use a limited POA to empower an agent to handle a real estate deal or to pay your bills for you for a limited time while you’re out of the country.

How old do you have to be to be an agent in Florida?

An agent must be a natural person at least 18 years of age or a financial institution with trust powers and a physical location in Florida. Appointing an agent under power of attorney is a serious matter and should not be taken lightly.

What is a POA?

What is a Power of Attorney? A power of attorney, or “POA,” is a formally executed document authorizing an “attorney in fact” (or, more commonly, an “agent”) to take certain actions – often but not always relating to legal and financial matters – on behalf of the person signing the document (the “principal”).

What is a durable power of attorney?

Durable powers of attorney have become increasingly important instruments in estate and Medicaid planning in recent years, particularly since the substantial revision to the law made in 1995. Recently the law was amended to permit “springing” durable powers of attorney, which should further enhance the use of these instruments. Now that estate planners in Florida have had sufficient time to become acquainted with the law relating to durable powers of attorney, maybe it is time to examine some of the limitations that may apply with these documents.

What is the power of attorney to make gifts?

One of the most important provisions that should be discussed with any client for inclusion in a durable power of attorney is the power to make gifts. In a larger estate this power is important as a way of reducing the principal’s estate subject to federal estate taxes upon death.

What is another applicable law?

Another less obvious example of “other applicable law” that limits an agent’s authority is the case law pertaining to the law of agency. Under the law of agency, an agent owes certain fiduciary duties to the principal. Among these duties is the duty not to act adversely to the interests of the principal.

Is a durable power of attorney voidable in Florida?

Consequently, if such a power is either inadvertently or purposely included in a Florida durable power of attorney, any conveyance pursuant to such a power would not only be voidable under Florida case law, it would in fact be void. 14.

Can a durable power of attorney remove funds from a retirement plan?

But, there is a potential problem if there is a named beneficiary of the retirement plan and the authority the agent is given includes the power to remove funds from the retirement plan or the IRA.

Does an attorney in fact have powers in Florida?

Most attorneys, if asked to explain the extent of an attorney-in-fact’s authority under Florida law, would probably respond that the attorney-in-fact has all powers to the extent “authorized and specifically enumerated” in the durable power of attorney. Such an answer is not entirely correct; the complete correct response is an attorney-in-fact has ...

Who is the attorney in fact?

Since usually the attorney-in-fact is either the principal’s spouse, a child, or someone else who is an object of the principal’s bounty, the principal will in most cases want to include the attorney-in-fact as one of the permissible recipients of any gifts made.

What is a power of attorney in Florida?

Florida Power of Attorney allows a resident to choose someone else (an “Agent”, “Attorney-in-Fact”, or “Surrogate”) to handle actions and decisions on their behalf. Each form serves a unique purpose; one may be used to assign a health care surrogate to oversee an individual’s end-of-life care while another may be used to provide a tax accountant with the authority to file a Florida resident’s state taxes. If the document is “durable,” the authority granted to the agent is indefinite and persists the principal’s incapacitation. A non-durable power of attorney will become void should the principal lose decisional capacity.

What is DR-835?

The Florida tax power of attorney form, or Form DR-835, allows a resident of Florida to choose an accountant or any other person to handle their State tax filing on their behalf. Unlike other power of attorney documents in Florida, this does not need to be witnessed or signed with a notary present.

What does "durable power of attorney" mean in Florida?

Generally speaking, to answer the question, what does durable power of attorney mean in Florida, testators/principals should be aware that a regular power of attorney in Florida terminates when or if the principal becomes unable to function, or essentially legally and medically incapacitated.

Can a durable power of attorney be stopped?

The Statute provides that regarding a power of attorney, durable cannot be stopped by the principal’s incapacity (vegetative state, brain death, coma, etc.).

What is a power of attorney in Florida?

As an introduction, a power of attorney is a document in which a person (the “principal”) designates another person to act on the principal’s behalf (the “agent”). Florida law gives the option to create a “durable” power of attorney, which remains effective even if the principal becomes incapacitated—reducing the potential need for ...

Why is it important to consult a qualified attorney when establishing a power of attorney?

It is important to consult a qualified attorney when establishing a power of attorney to ensure that it satisfies Florida’s new power of attorney law. Estate Planning for Unmarried Partners.

What is the new law that allows an agent to do everything the grantor could do?

The new law allows an agent to perform only those acts expressly granted in the document.

Do non-durable powers of attorney have to be signed by the principal?

Under the new law, durable and non-durable powers of attorney must be signed by the principal in the presence of two witnesses and acknowledged before a notary. 8.

Can a third party get a power of attorney in Florida?

A third party who is called upon to accept an out-of-state power of attorney may request an opinion of counsel concerning the power’s validity, at the principal’s expense. Military powers of attorney also remain valid in Florida if executed in accordance with relevant federal law .

Is a power of attorney a springing power of attorney?

Under the new law, the latter, so-called “spring ing” power of attorney is no longer available.

Do power of attorney agents keep records?

Under the new law, agents must keep records of all receipts, disbursements, and transactions made on behalf of the principal. Additionally, if the power of attorney authorizes the agent to access a safe-deposit box, the agent must render an inventory of the contents each time the agent accesses the box.

Statutory Form

Opening Statement

- (1) Document Date.The date that should be formally associated with this paperwork. (2) Principal Name.The Florida Party seeking to grant authority over one or more matters to an Agent must be identified. (3) Residential County And State.The country and State where you maintain your residence aids in securing your identity as the Principal issuing this document. (4) Florida Attorn…

Effective Date

- (6) Immediate Effect.This power of attorney shall be effective immediately upon signing and will continue until revoked. (7) Delayed Effect. With the exception of a deployment-contingent military power of attorney (which may be signed in advance) or one executed before October 1st, 2011, that is is conditioned on the principal’s lack of capacity, a...

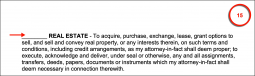

Powers of Attorney-In-Fact

- (8) Banking.A list of topics will display the powers you can grant your Attorney-in-Fact the power to perform in your name as well as the decisions he or she can make on your behalf. None of these powers are granted by default. To grant one of the power topics to the scope of your Attorney-in-Fact’s principal powers, you must initial the statement defining it. The first item give…

Special Instructions

- (20) Principal Instructions.Any conditions or limitations the Principal wishes included to control the Attorney-in-Fact’s actions must be documented within this form or attached to this form by the time it is executed.

Florida Principal’s Witnessed Signature

- (21) Signing Date.The day, month, and year that you sign this document should be recorded immediately before providing your signature. (22) Florida Principal Signing.Your act of signing must be performed before two Witnesses and a Notary Public. (23) Witness Requirement.After signing this document, relinquish possession of it to the Witnesses observing you. Each Witnes…

Specimen Signature and Acceptance of Appointment

- (25) Attorney-in-Fact Name.Notice the attached document to the appointment form just completed. This is a declaration of acceptance from the Attorney-in-Fact regarding the Principal and the authority being conveyed above. The statement presented requires the Attorney-in-Fact’s name transcribed from the power to document to its content. (26) Attorney-in-Fact Signature.Th…

Popular Posts:

- 1. when an attorney recklessly creates needless costs the other side is entitled to relief

- 2. who is ken salazar backing for attorney general

- 3. attorney how to address him as esquire

- 4. where can my power of attorney cash a check

- 5. attorney general heads what department

- 6. what is attorney advisor

- 7. how to make an address change with uscis for attorney

- 8. who pays attorney fees at closing in nc

- 9. how do i find attorney of record on a case

- 10. what is a notice of attorney liens