Full Answer

Can an executor of an estate have a power of attorney?

May 20, 2021 · Basically, when it comes to Can an executor appoint a power of attorney, the answer is mostly Yes. The executor most of the time appoints another executor on behalf of him/her. Unless the will has mentioned something else, the executor can appoint a power of attorney. Some powers are in the hands of the executor and at times, they are not.

Can an executor appoint an agent to represent the executor?

Mar 23, 2017 · March 23, 2017 by Michael Giusto. One of the responsibilities of an estate executor or administrator is dealing with beneficiaries of an estate. What appears to be a straightforward task can be complicated when the executor is contacted by someone who claims to hold a power of attorney (POA) for a beneficiary of the estate (also known as an “attorney-in …

What is the role of an executor of an estate?

Aug 05, 2019 · By default, an executor or administrator has very limited powers. For example, the personal representative may: Collect assets of the estate. Preserve assets of the estate. Pay valid creditor claims. Make distributions per the will and Georgia law. If the executor or administrator wants to take any other actions, they will likely need to secure ...

What happens to a power of attorney when the principal dies?

Feb 26, 2021 · Unlike your executor, the job performed by your power of attorney is carried out while you are still alive. They are charged with handling your financial and medical needs on your behalf during your lifetime. A power of attorney’s authority to act on your behalf ceases on your death. When you die, the power of attorney’s responsibility (and authority) ends and, usually, …

What is an executor?

An executor (also known as an administrator) is the person in charge of the estate of a deceased person. (i.e., their assets, property, shares, bank accounts, and so on). Can an executor appoint a power of attorney?

What is renunciation of executors?

Renunciation of an executor’s duties is a reasonably easy procedure. If an executor wishes to completely relinquish their right to act. Then, they may renounce (step down) from their duties. An executor must ensure that they have not “Intermeddled” in the estate before agreeing to renounce. This assumes they haven’t done something that an executor would do when handling an estate. Such as paying debts, selling personal belongings, and so on.

Can an executor appoint a power of attorney?

Basically, when it comes to Can an executor appoint a power of attorney, the answer is mostly Yes. The executor most of the time appoints another executor on behalf of him/her. Unless the will has mentioned something else, the executor can appoint a power of attorney. Some powers are in the hands of the executor and at times, they are not.

What is the default rule in Georgia?

The default rule in Georgia is that the personal representative serves with limited powers.

What to do after a loved one passes away?

After a loved one passes away, it is not uncommon to want to begin handling their affairs right away . Often, one of the first things the family will want to access the deceased’s bank accounts. Unfortunately, they quickly learn that the bank will not speak with them or give them any information, l... READ MORE.

What is a power of attorney?

Your Power of Attorney is the person you name in a power of attorney document to act on your behalf ( usually in the event that you become disabled or incapacitated). Technically, the document itself the power of attorney and the person you name in that document is more correctly referred to as your “Attorney-in-Fact” (or, less often, your “Agent”). In other words, you sign a power of attorney in order to appoint an attorney-in-fact to handle your affairs (for instance, day to day financial and health care decision making) and your attorney-in-fact is said to act under (that is, by authority of) the power of attorney document that you used to appoint him or her. However, referring to one’s attorney-in-fact as their power of attorney is so exceedingly commonplace that I’ve taken to doing the same for the sake of easier communication with my clients, even if what is really meant is attorney-in-fact.

What is a trustee?

Your Trustee is the person you name to be in charge of administering any trusts you create. A very brief and simple trust overview will probably be helpful here. A trust is, fundamentally, a relationship (of trust, hence the name) documented in writing where you, as the trust creator, appoint someone (the trustee) to hold and manage property for the benefit of yourself or someone else (the beneficiary of the trust). Trusts are normally created through a standalone document or, perhaps more commonly in Washington, as part of one’s Will. Not everyone will want or need a trust as part of their estate plan. For instance, if one’s children are all mature and responsible adults, then you probably don’t need to leave their inheritance to them in trust and instead can just give it to them outright. But if you have concerns about leaving property to someone outright (perhaps you have a disabled child who would not be able to manage his inheritance) then you may want or need a trust.

What are the responsibilities of a power of attorney?

Power of Attorney. The person you select as a Power of Attorney will be responsible for managing your assets, paying your bills, and managing your business dealings if you should become incapacitated. Basically, this person acts in your stead when it comes to your finances.

What is the role of a trustee?

A Trustee and or Executor will have the responsibility of, managing, and distributing your assets to your desired beneficiaries upon your passing. Similar to a Power of Attorney, a trustee has the duty to pay your bills, and properly manage all of your investments. A Power of Attorney, Trustee, and Executor have substantial powers, ...

Can a family member be sued for mismanagement of an estate?

If you appoint a family member who does not have the financial expertise required to administer your estate properly and instead mismanages your estate or account, they can be sued personally. In addition, they can be held criminally liable for fraud. I previously had a Client who chose to appoint a family member as Trustee of their estate based on the fact that the proposed Trustee was the oldest child. Although honorable, this was not the best thing for the Client. The Client passed, and the Trustee was sued for Breach of Fiduciary Duty for mismanaging their deceased parents’ assets. The Trustee was not a “bad” person, just inexperienced in handling such complex financial matters. If you know this person does not have the capacity and or willingness to handle complex financial transactions, you should not appoint them as they can be sued, and even jailed for mismanagement of your assets.

Who is responsible for estate assets?

Once appointed to serve and until the estate has been fully administered and distributed, the executor is responsible for estate assets. The executor must prepare an initial inventory of assets, then she must keep detailed records of additions to the estate and expenses or other distributions.

What are the duties of a probate attorney?

While specific responsibilities vary depending on the estate and the state's probate rules, duties commonly include the following: Locate and examine the will and trust documents, if applicable. Locate beneficiaries and heirs. Notify creditors and other interested parties. Pay valid debts and final expenses.

What are the duties of an executor?

Executors do more than divide assets among beneficiaries. Depending on the size and makeup of the probate estate, the executor may wear several hats. While specific responsibilities vary depending on the estate and the state's probate rules, duties commonly include the following: 1 Locate and examine the will and trust documents, if applicable 2 Locate beneficiaries and heirs 3 Notify creditors and other interested parties 4 Pay valid debts and final expenses 5 Collect, inventory, and safeguard property 6 Appraise and value assets and tangible personal property 7 Report and pay the deceased's final income taxes 8 Determine and handle state and federal estate tax obligations, as applicable 9 Sell or transfer title to real estate, vehicles, and other assets 10 Maintain detailed records of transactions handled 11 Prepare the final accounting 12 Distribute assets and account to the court, as necessary

What is estate administration?

Estate Administration Basics. Individual state laws dictate whether estates go through probate when people pass away. Probate involves proving and executing the deceased person's will if they left one. If there was no will, state intestacy laws govern estate administration.

What is the role of executor in probate?

The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries. In some states, the executor files the final accounting that includes all of this information with the court before finalizing probate.

What happens if there is no will?

If there was no will, state intestacy laws govern estate administration. A key part of any probate proceeding is appointing someone to wind down the deceased person's affairs. That executor or personal representative administers and distributes estate assets.

What is the difference between a power of attorney and an executor of a will?

The main difference between an agent with power of attorney and the executor of a will is that one represents a living person while they are alive, and the other represents a decedent’s estate while they are dead. The two do not intersect at any point. This effectively means that one person can fulfill both roles.

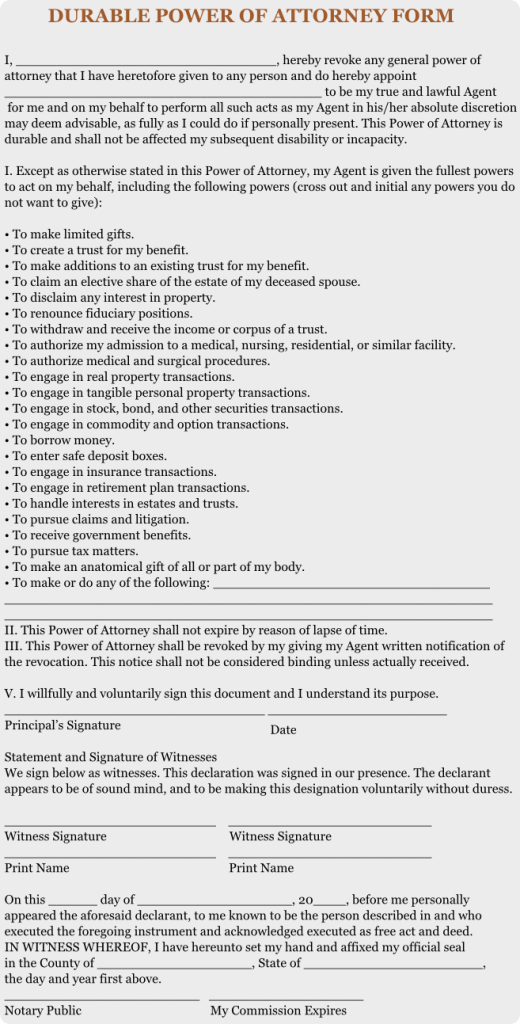

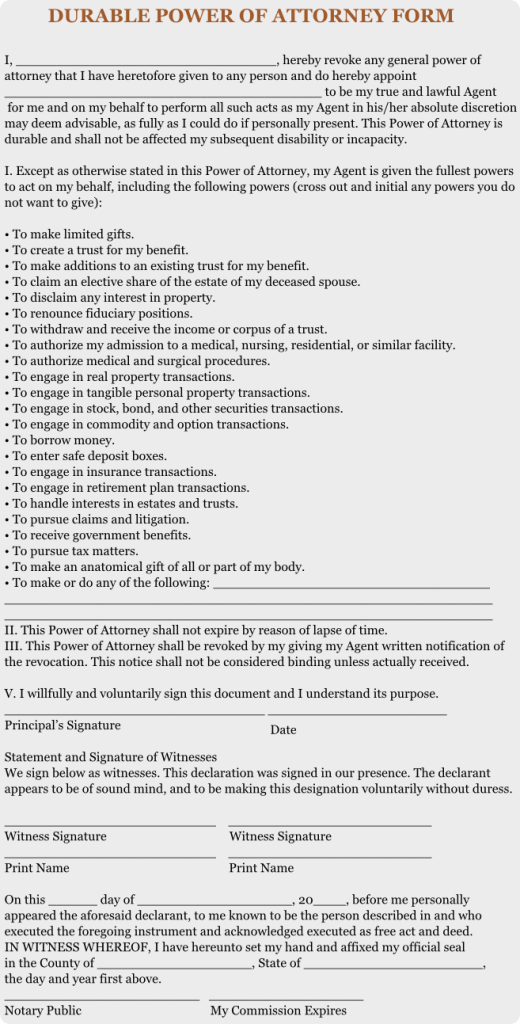

What is a durable power of attorney?

It simply gives them the ability to act on your behalf, just as you might. Even more limited is a limited power of attorney, which specifically gives someone the right to act on your behalf within very specific parameters, such as only being able to sign on your behalf for a specific cause, or for one day. A durable power of attorney gives your ...

What is an executor of a will?

An executor is someone who oversees and administrates the process of fulfilling a will or trust, making sure your will is properly carried out after your passing. An executor’s job begins after you’ve passed away. Someone with a power of attorney gets to work while you are still alive, yet unable to make choices for yourself.

When does a springing power of attorney go into effect?

A springing power of attorney only goes into effect once you have become incapacitated and does not give your agent any powers until you are otherwise indisposed. As with all things legal, the specifics and details are important – for example, in a springing power of attorney, it is critical to carefully and specifically outline what it means ...

What is a POA?

What Is a Power of Attorney (POA)? A power of attorney is a document that gives someone the ability to act on behalf of the document’s grantor or principle, usually within certain limits, and with different documents detailing different capabilities.

What is the fiduciary duty of an attorney?

Attorneys are bound by a fiduciary duty to act in the best interests of the estate. If an executor steals or fails to perform, it’s up to the estate’s beneficiaries to act quickly.

What is the role of executor in probate?

Generally, an executor is in charge of the decedent’s will, representing the estate in the probate process, and taking on the responsibility of executing the will, and fulfilling a series of duties during the probate process, including: Kick-starting the probate process by ...

Understanding the Power of Attorney

The power of attorney is a legal document that grants someone limited authority to act on your behalf (as your “agent”) within the scope of the document. A power of attorney can be built to certain specifications, limiting the agent’s power, or granting them sweeping authority to act in your name.

Executor of a Will

A last will and testament is a very different document from a power of attorney, and the testator (you) cannot grant anyone the power to execute it once you pass away.

Amending a Power of Attorney or a Will

As principal and testator, you can amend a power of attorney as well as a last will and testament. If you feel your agent is no longer fit to carry out their duties, or if you believe you have made a poor choice for your executor, then you can go about amending and/or revoking the old documents.

Popular Posts:

- 1. how to aquire a power of attorney form someone with dementia

- 2. why bob marley defense attorney

- 3. miss perez attorney how much wood decks

- 4. how independent is a city attorney?

- 5. what happens if you don't have a power of attorney for medical?

- 6. wisconsin divorce what info do i have to give ex's attorney

- 7. can my ex husband get me for attorney fees when i can not afford a lawyer in tn

- 8. when an attorney accepts the first prospects called to the jury box, this attorney has followed the

- 9. the court can appoint an attorney to represent an indigent parent under what circumstances:

- 10. how many episodes are in ace attorney 3