Full Answer

How to find a lawyer to sue a debt collector?

If you need repayment for a debt and the debtor isn’t paying up, a debt collection attorney can help figure out your best course of action to get your money back. You may also want to consider a creditors rights attorney, who works solely for creditors to help them regain their money. How Much Does a Debt Collection Attorney Cost? Attorneys use different methods of billing, so …

How to respond to a debt collection attorney?

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

Do I need a debt collection attorney?

Mar 22, 2021 · Your client owes you at least $5,000. Some debt collection experts recommend hiring a debt collection attorney anytime a nonpaying client owes you $5,000 or more. In general, as long as a debt is ...

Is a debt collector a lawyer?

Dec 06, 2018 · Collection attorneys specialize in debt collections. In addition to calling debtors and sending letters, attorneys have the power to take legal action against debtors and file a debt collection lawsuit. They have a dedicated team at their firm to handle your case who are experts in their field. The Big Difference.

How do you defend against a debt collector?

7 Ways To Defend a Debt Collection LawsuitRespond to the Lawsuit or Debt Claim. ... Challenge the Company's Legal Right to Sue. ... Push Back on Burden of Proof. ... Point to the Statute of Limitations. ... Hire Your Own Attorney. ... File a Countersuit if the Creditor Overstepped Regulations. ... File a Petition of Bankruptcy.Jul 4, 2019

How Much Do Debt collectors usually settle for?

A debt collector may settle for around 50% of the bill, and Loftsgordon recommends starting negotiations low to allow the debt collector to counter. If you are offering a lump sum or any alternative repayment arrangements, make sure you can meet those new repayment parameters.Jun 30, 2020

How likely do debt collectors sue?

Roughly 15% of Americans who have been contacted by a debt collector about a debt have been sued, according to a 2017 report by the Consumer Financial Protection Bureau. Of those, only 26% attended their court hearing — again, a big no-no.Apr 27, 2021

What a debt collector Cannot do?

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

What should you not say to debt collectors?

3 Things You Should NEVER Say To A Debt CollectorNever Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. ... Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. ... Never Provide Bank Account Information.Sep 21, 2021

What happens if a debt collector won't negotiate?

If the collection agency refuses your settlement offer, consider contacting the original creditor of the debt. ... The creditor may accept your offer, negotiate a different settlement amount with you or refer you back to the collection agency to resolve the matter.

Can a debt collector take you to court after 7 years?

After the statute of limitations runs out, your unpaid debt is considered to be “time-barred.” If a debt is time-barred, a debt collector can no longer sue you to collect it. In fact, it's against the law for a debt collector to sue you for not paying a debt that's time-barred.

Can a debt collector threaten you?

Even if you do, debt collectors aren't allowed to threaten, harass, or publicly shame you. You can order them to stop contacting you.

Can a debt collector take you to court?

Debt collection agencies may take you to court on behalf of a creditor if they have been unable to contact you in their attempts to recover a debt. Before being threatened by court action, the debt collection agency must have first sent you a warning letter.May 1, 2019

Do debt collectors give up?

Do debt collection agencies ever give up? ... At the end of the day, it is their job to make sure the debt is paid, so they will do whatever they can to collect the balance. If you do not receive contact from a debt collector for a lengthy period of time, then the debt could become 'statute barred'.Mar 3, 2020

Should I answer debt collector calls?

The phone call from a debt collector never comes at a good time—but the best response is to confront the state of these affairs head-on. You may want to hide or ignore the situation and hope it goes away–but that can make things worse. Depending on your personal situation, there may be different steps to take.

What powers do debt collectors have?

Debt collection agencies don't have any special legal powers. They can't do anything different to the original creditor. Collection agencies will use letters and phone calls to contact you. They may contact by other means too, such as text or email.

What is debt collection attorney?

A debt collection attorney is a lawyer who can work with you to develop legal strategies for recovering debts from nonpaying clients. Their work often involves completing and filing paperwork for you, and if your case goes to trial, they typically represent you in court.

How much does a collection agency charge?

Some collection agencies will charge 25% of your debt to work for you; some may even charge 50%. A 25% fee is probably less than what a lawyer will cost, whereas 50% is more. However, in some cases, a court judgment in your favor will require your debtor to cover your attorney fees, so your fees might not ultimately matter.

Can a lawyer be busy?

Lawyers can be quite busy, but their hectic schedules shouldn't hamper their communication with you. Surely, you'll get a feel for your potential debt collection attorney's communication process as you search for lawyers, but this initial impression only tells you so much.

Can a lawyer represent you in court?

Additionally, only attorneys can represent you in court and bring about a binding ruling from a judge. How much you actually want to go to court. If you're not invested in taking your case to court, then hiring a lawyer may not be worth it. In this case, choose a collection agency, or just leave the debt be.

Who is Max Freedman?

Max Freedman is a content writer who has written hundreds of articles about small business strategy and operations, with a focus on finance and HR topics. He's also published articles on payroll, small business funding, and content marketing. In addition to covering these business fundamentals, Max also writes about improving company culture, optimizing business social media pages, and choosing appropriate organizational structures for small businesses.

How to sue a creditor for a debt?

When a creditor sues you to collect debt you haven't paid, you have three choices to deal with the lawsuit: 1 allow the creditor to obtain a judgment against you (called a "default judgment") 2 defend the lawsuit yourself, or 3 hire an attorney to represent you in the lawsuit.

What is a defense in a lawsuit?

A defense is a reason why you aren't liable for the debt or a reason why the creditor shouldn't be allowed to collect the debt. Here are some common defenses to creditor suits: the statute of limitations (the time period in which the creditor must bring the lawsuit) has run.

Can you keep your retirement account in bankruptcy?

If bankruptcy might be inevitable, think twice before using retirement funds to pay bills. Most people can keep their retirement account in bankruptcy.

What is a counterclaim?

A counterclaim is a claim that you have against the creditor. In most states, the counterclaim must relate to the transaction at issue in the creditor's lawsuit. For example, say the creditor sues you for nonpayment of a credit card debt.

Can a creditor get a judgment against you?

allow the creditor to obtain a judgment against you (called a "default judgment") defend the lawsuit yourself, or. hire an attorney to represent you in the lawsuit. Which option is best for you will depend on a number of factors.

How to get help with debt collection?

Where Can I Get Help? 1 Free or reduced-fee legal help, if you have a low income. To find a legal aid organization near you, use the Legal Service Corporation’s search tool. Or search for a pro bono (free legal help) program using the American Bar Association’s pro bono directory. 2 Free online answers to debt collection questions from an attorney in your state, which you may be able to get at org. 3 Hiring an attorney, if you can afford it. Find a lawyer in your state using the American Bar Association’s Directory. Be sure to ask if they have experience with consumer law, debt collection defense, or the Fair Debt Collection Practices Act.

What happens if a debt collector files a lawsuit against you?

If a debt collector files a lawsuit against you to collect a debt, it’s important to respond — either yourself or through an attorney. And remember, you have rights when it comes to dealing with debt collectors. Here are answers to some common question you might have about the process.

Can a debt collector take money from your bank account?

If the court rules against you and orders you to pay the debt, the debt collector may be able to garnish — or take money from — your wages or bank account, or put a lien on property, like your home. The debt collector can also ask the court to award them additional money for collection costs, interest, and even attorney’s fees.

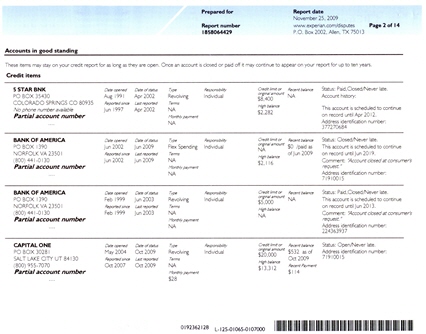

Can a judgment show up on your credit report?

The debt collector can also ask the court to award them additional money for collection costs, interest, and even attorney’s fees. A judgment will likely show up on your credit report and might make it harder to get credit in the future. That can affect whether you get a job, insurance, a phone, or a home.

What is the FDCPA?

The federal Fair Debt Collection Practices Act (FDCPA) (15 U.S.C. §§ 1692 and following) limits what collectors can and can't do. For instance, this law prohibits debt collectors from using obscene language or threatening you with violence if you don't pay.

How do debt collectors communicate with you?

The Consumer Financial Protection Bureau issued a final rule amending Regulation F, which implements the FDCPA, to clarify how collectors may use texts, emails, and use other forms of digital communication, like social media, to contact you.

Can debt collectors violate the law?

But debt collectors often violate the law while trying to get money out of people. If you know your rights, you'll be able to tell when the debt collector is crossing a line into illegal territory, and you won't be intimidated by unlawful tactics. You might even be able to use the debt collector's violations of the law to your benefit.

What happens if you get sued?

If you get sued, you'll have to raise the statute of limitations as a defense. If you don't, the creditor or collector might be able to get a judgment against you on an otherwise unenforceable debt. Also, a statute of limitations doesn't eliminate the debt—it just limits the collector's ability to sue you for it.

Can you give a debt collector your personal information?

Don't give a collector any personal financial information, make a "good faith" payment, make promises to pay, or admit the debt is valid. You don't want to make it easier for the collector to get access to your money, or do anything that might revive the statute of limitations.

What to do if a debt collector contacts you?

If a debt collector contacts you, consider ignoring the calls or not responding to other communication methods —at least until you learn about your rights, find out if the debt is truly yours, and learn whether the statute of limitations has expired. You don't want to provide the collector with useful collection information inadvertently, or worse, say something that reaffirms the debt.

Can a collector stop trying to collect?

A collector doesn't have to stop trying to collect just because you can't pay. But telling collectors that you can't pay, and giving them a short explanation of your financial difficulties, might lead them to move on to other consumers. It might also prevent your file from being referred to litigation.

What is the FDCPA?

The federal Fair Debt Collection Practices Act (FDCPA) was enacted to curb these annoying and abusive behaviors, but some debt collectors flout the law. Here are five tactics that debt collectors are specifically forbidden from using. Knowing what they are can help you stand up for yourself with confidence.

How long does it take for a debt collector to contact you?

Within five days of first contacting you, a debt collector must send you a written notice stating how much you owe, to whom, and how to make your payment.

Who is Amy Fontinelle?

Amy Fontinelle has more than 15 years of experience covering personal finance—insurance, home ownership, retirement planning, financial aid, budgeting, and credit cards—as well corporate finance and accounting, economics, and investing. In addition to Investopedia, she has written for Forbes Advisor, The Motley Fool, Credible, ...

Can debt collectors contact you?

Debt collectors are not permitted to try to publicly shame you into paying money that you may or may not owe. In fact, they're not even allowed to contact you by postcard. They cannot publish the names of people who owe money. They can't even discuss the matter with anyone other than you, your spouse, or your attorney.

What to do if you don't owe debt?

If you really don't owe the debt, there are steps you can take. Even if you do, debt collectors aren't allowed to threaten, harass, or publicly shame you. You can order them to stop contacting you. A 2014 incident in Georgia shows exactly what debt collectors are not supposed to do.

Who is Erika Rasure?

She is a graduate of Washington University in St. Louis. Erika Rasure, Ph.D., is an Assistant Professor of Business and Finance at Maryville University.

Is a debt collector subject to the FDCPA?

There’s an important exception to the FDCPA: In-house debt collectors aren’t subject to it. For example, if you are delinquent on your Macy's credit card bill and Macy's calls you directly, it doesn’t have to follow the rules described in the FDCPA.

Popular Posts:

- 1. how to find out if attorney has complaints ny

- 2. how can attorney client privilege be compromised by raid on trump's attorney

- 3. who is the prosecuting attorney for oakland county

- 4. when a new power of attorney is signed

- 5. what did ny attorney general do to trump foundation

- 6. how do i get power of attorney for my husband?trackid=sp-006

- 7. how to inform client new attorney on case

- 8. what is the designation to use in a letter when addressing an attorney

- 9. what is district attorney office

- 10. how to call a female attorney