No — not without express authorization to do so. A person with power of attorney does not need to add their own name to the bank account. They already have the legal authority to withdraw money from your account to take care of your needs.

Can power of attorney withdraw money from deceased bank account?

May 23, 2014 · This is a complicated question to which additional facts are necessary to formulate an answer. The Power of Attorney likely contains the power to withdraw the funds. However, whether or not something "wrong" was done will depend heavily on what was done with the funds. You should contact an attorney to discuss this matter in more detail.

Can a power of attorney add a name to a bank account?

Jun 09, 2011 · If you are power of attorney of your parent and your name is not on his bank account can you withdraw the money? Yes, you can. Please bear in mind that there may be fiduciary issues in this ...

When does a power of Attorney come to an end?

Jan 09, 2017 · No, a person designated as power of attorney cannot "do anything they want" with regard to money or putting their charge in harm's way. The POA should be filed with your mother's county assessor's office or which ever state's office they in …

Can a person with power of attorney give money to themselves?

May 11, 2020 · As an agent, you step into the shoes of the principal so assuming that you have a general power of attorney, you should have authority to pay the debts of the principal. However, I do not recommend withdrawing cash to do so.

What does the POA mean on a bank account?

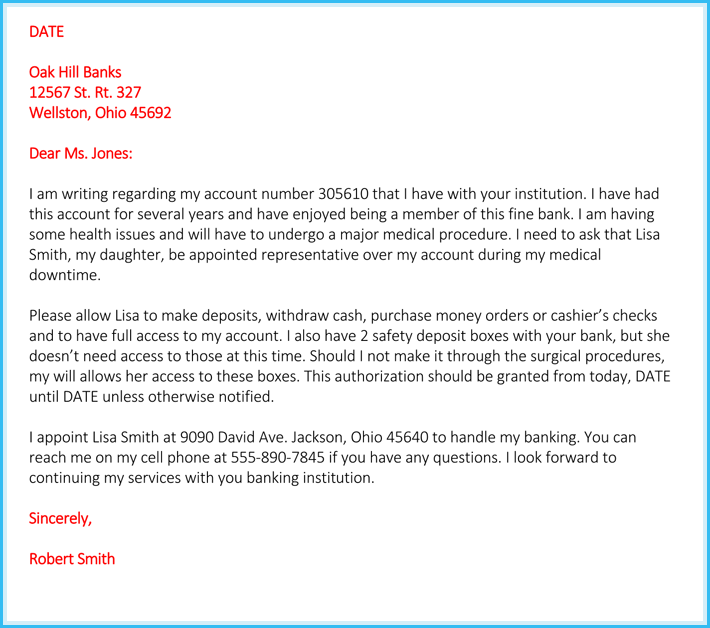

A power of attorney for banking transactions is a POA that allows a trusted agent to deal with your bank account(s) on your behalf. If you want to set up a power of attorney in a way that allows someone to make bank transactions in your stead, your POA has to specifically state that.

Can a power of attorney transfer money to themselves in Canada?

As a general rule, a power of attorney cannot transfer money, personal property, real estate or any other assets from the grantee to himself.Sep 21, 2021

Can a family member withdraw money from my account?

Generally, everyone whose name is on a joint account can write checks, withdraw money, and make transactions. Similarly, if one of the account holders owes money, the creditor can try to collect from money in the joint bank account.Aug 15, 2016

Can you withdraw from someone's bank account?

Withdrawing money from a bank account is easily accomplished--if you have the legal right to access the account. Withdrawals can be made in a variety of ways, including through in-person bank visits and electronic transactions. You can also legally withdraw money from someone else's account with a court order.

Can PoA spend money on themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

How do you withdraw money after someone dies?

The surviving account holder will have to submit a written application informing about the death of account holder to the bank along with the copy of death certificate and copy of ID proof of the deceased. The copy of ID proof of the deceased account holder will be self-attested by the surviving account holder.Jul 7, 2021

Who can withdraw money from my bank account?

So, no one else can withdraw money from your account unless you give a written consent authorising another person to withdraw cash on your behalf.Nov 3, 2020

How does a bank know when someone dies?

The main way a bank finds out that someone has died is when the family notifies the institution. Anyone can notify a bank about a person's death if they have the proper paperwork. But usually, this responsibility falls on the person's next of kin or estate representative.Jan 27, 2022

Can a bank deny a withdrawal?

Your bank is also allowed to ask you why you want the money. Refusal to explain the need for an unusually large cash withdrawal can result in a denial. If the withdrawal is large enough to require IRS reporting, your bank's report must include the reason for the withdrawal.Apr 5, 2019

Is banks liable for Unauthorised withdrawals?

If you notify your bank or credit union after two business days, you could be responsible for up to $500 in unauthorized transactions. Also, if your bank or credit union sends your statement that shows an unauthorized debit, you should notify them within 60 days.Aug 25, 2020

Can someone take money out of my bank account without my permission?

Generally, your checking account is safe from withdrawals by your bank without your permission. However, there is one significant exception. Under certain situations the bank can withdraw money from your checking account to pay a delinquent loan with the bank. The bank can take this action without notifying you.

Where to file a POA?

The POA should be filed with your mother's county assessor's office or which ever state's office they in which they live and those are public records. Get a copy of the POA, take it to an attorney and have him/her file a Writ asking a judge to look into the finances.

What happens if someone steals your money?

If theft really happened, then it would be up to someone in charge to pursue legal action against the person for restoration of the missing funds even if it means putting a lien on the person's assets including home, car, or even their bank account.

What does it mean when someone complains about money missing?

Just because someone complains about money missing from their account doesn't always mean there's been a theft , sometimes when someone is put onto an account, they have equal rights but there are probably rules in place for that privilege.

Can you be a joint owner of a bank account?

You can also be just a joint owner on a bank account and also be able to do just about anything. I was joint on but an account with my foster dad but not officially a POA, just a joint owner on the account. Jointly owned accounts by two or more parties allow equal rights and privileges.

Can a bank account be garnished if someone is judgment proof?

However, if the person happens to be judgment proof, that money is probably gone and will never be able to be recovered because they have nothing that can be liened and by law, their bank accounts can't even be garnished. Investigations are supposed to be very thorough to find out the truth either way.

John O. Knappmann

I agree with Ms. Fanning and Mr. Glick. There can always be problems when in agent makes a payment on behalf of the principal. If you suspect that there may be problems in your case, I recommend that you speak with a lawyer now. It is much cheaper to avoid a problem in the beginning then to pay a lawyer to clean up the mess...

Peter L. Conway

Both Ms. Fanning and Mr. Glick raise excellent points. When acting as a fiduciary under a power of attorney, it is generally a good idea to consult with an attorney to understand your authority, reporting requirements and documentation. I agree using cash is never a good idea because it provides no direct record of how the money was spent.

Sara Zivian Zwickl

The purpose of a financial power of attorney is to appoint an agent to handle financial affairs for another person, often times when that other person is incapacitated and unable to handle their own affairs.

Eric S. Glick

Good morning. As an agent, you step into the shoes of the principal so assuming that you have a general power of attorney, you should have authority to pay the debts of the principal. However, I do not recommend withdrawing cash to do so.

What is a power of attorney?

Powers of attorney are key estate planning documents. In the unfortunate event that you become unable to care for yourself, it is crucial that you grant a trusted party the authority to effectively make legal, financial, and medical decisions on your behalf. Through two key estate planning documents — the durable power of attorney and ...

Can you have multiple power of attorney?

Yes. You have the legal right to appoint multiple people as your power of attorney. You could even split your durable power of attorney and your medical power of attorney. The legal documents should state whether each agent has full, independent power or if they have to act jointly.

Can a doctor override a power of attorney?

Yes — but only in limited circumstances. If an advance medical directive is in place, the instructions in that document may override the decision of a power of attorney. Additionally, doctors may also refuse to honor a power of attorney’s decision if they believe that the agent is not acting in the best interest of the patient.

Do power of attorney have fiduciary duty?

Yes — but the agent always has a fiduciary duty to act in good faith. If your power of attorney is making such a change, it must be in your best interests. If they do not act in your interests, they are violating their duties.

Can a durable power of attorney make medical decisions?

Can a Durable Power of Attorney Make Medical Decisions? No. A durable power of attorney is generally for legal decision making and financial decision making. To allow a trusted person to make health care decisions, grant them medical power of attorney.

Can a power of attorney withdraw money from a bank account without authorization?

No — not without express authorization to do so. A person with power of attorney does not need to add their own name to the bank account. They already have the legal authority to withdraw money from your account to take care of your needs.

Can a person change their power of attorney?

Yes. A durable power of attorney is a flexible legal document. As long as a person is mentally competent, they can change — even revoke — power of attorney.

Popular Posts:

- 1. what is the normal hourly attorney fee

- 2. are there companies who carry out power of attorney documents

- 3. how long does a u.s. district attorney serve quizlet

- 4. how to protect former attorney lien from dismissal oklahoma

- 5. how old is attorney david gruber

- 6. how to file bankruptcy without an attorney in maryland

- 7. why is my attorney lying to me?

- 8. how to start an email to attorney

- 9. what does an attorney do at a home closing

- 10. who do i put as capacity in a power of attorney