What happened in the State Farm lawsuit case?

Sep 11, 2021 · Harry’s son, Nelson Rockefeller Jr., sued the company for wrongful death, and another man, Thomas Edison, claimed that the lawsuit was nothing but a personal vendetta. The class action lawsuit against State Farm was eventually dropped, but not before thousands of dollars in premiums and damages were lost. The suit was, in fact, a sham.

Why did Harry Bennett Sue State Farm?

State Farm had a valid anti-stacking clause in the policy and prevented the policyholder from doing so. The policyholder was not informed by State Farm orally or in writing that the anti-stacking clause applies. State Farm $250 Million Class Action Lawsuit. In 2019, State Farm Auto Insurance was sued by 4.7 million customers in a class-action ...

Did Nelson Rockefeller threaten a class action lawsuit against State Farm?

Louisiana attorney general sues State Farm, accusing insurer of unsafe auto repair practices Attorney General Buddy Caldwell filed a lawsuit Tuesday …

Can you sue state farm for breach of contract?

Mar 06, 2019 · Those performing at the most profitable levels are rewarded by State Farm with lavish trips, and fancy titles like the “Millionaire Club” or “Life Traveler,” the lawsuit states. “These agents have all these back door, you know, unethical incentive to make sure that these claims aren’t paid out,” Aguiar said.

What is State Farm lawsuit?

State Farm Insurance is a large multinational group of insurance and financial services firms that was founded in 1922 in the US. It is one of the biggest insurance companies in the US that ensures cars and homes more than any other provider. The parent company is State Farm Mutual Automobile Insurance ...

When was State Farm Mutual sued?

In 1995 , State Farm Mutual Automobile Insurance Company was sued by policyholders in an Ohio class-action lawsuit. The litigation lasted 11 years and involved 35 depositions and the presentation of more than 10,000 pages of documentation to resolve.

How many violations does State Farm have?

To date, State Farm has 58 violations with a total penalty paid of $648,266,572 since 2000. The lawsuits filed against them involve insurance violations, consumer protection violations, banking violations, and many others. In this article, we will bring to light some of the most notable State Farm lawsuits and the dollar amount ...

How many customers were sued by State Farm?

In 2019, State Farm Auto Insurance was sued by 4.7 million customers in a class-action lawsuit. The plaintiffs alleged the defendant cheated its customers by issuing them with substandard motor vehicle replacement parts. Here are some specifics of the class action lawsuit:

Is State Farm suing?

However, State Farm allegedly denied businesses of their loss of business income claims. Here are some of the specifics of the class-action lawsuit that ensued:

Did State Farm deny business income?

However, State Farm allegedly denied businesses of their loss of business income claims . Here are some of the specifics of the class-action lawsuit that ensued: The plaintiff submitted claims to State Farm seeking reimbursement for lost income under the provisions of the policy they purchased.

Do I need a lawyer to file a small claim?

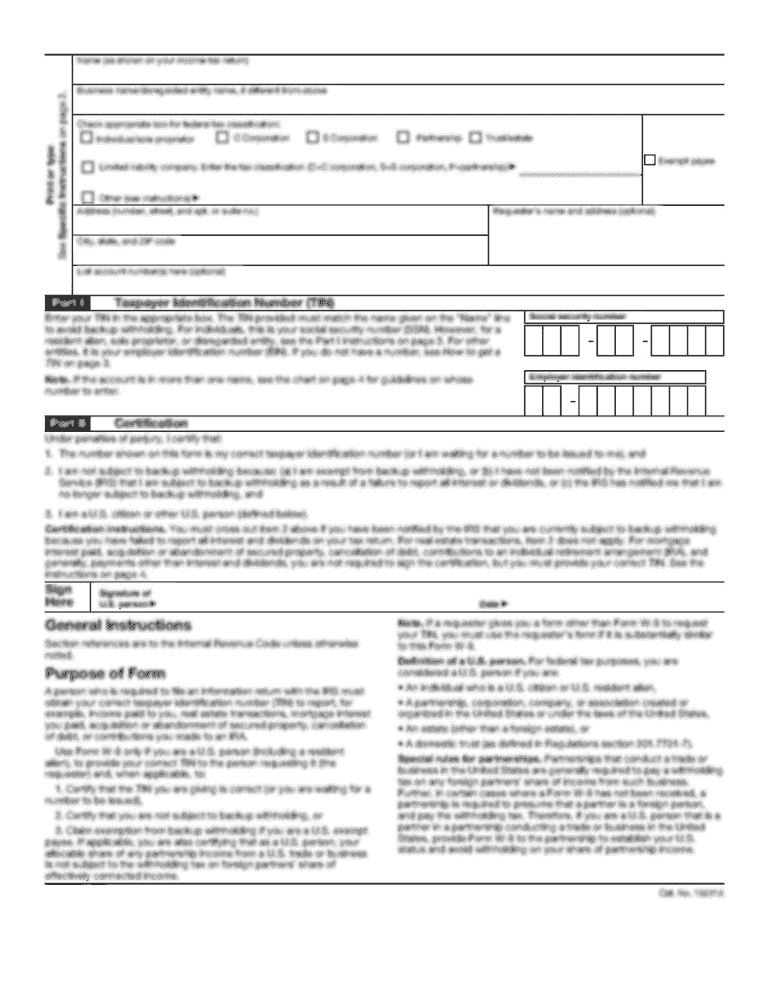

Although filing small claims does not require the services of a lawyer, it still involves going through bureaucracies and filing technically challenging forms and demand letters. With DoNotPay, all you need to do is: Log in to DoNotPay and select the Sue Now product. Enter the dollar amount you are owed.

Important Information

Attorneys working with ClassAction.org are no longer investigating this matter. The information here is for reference only. A list of open investigations and lawsuits can be viewed here.

Case Update

Thank you to everyone who contacted us in regard to the State Farm Bank investigation. At this time, attorneys working with ClassAction.org have decided not to pursue this matter. To view our open list of investigations, please visit this page.

How Do I Know If This Happened to Me?

Your best bet is to look at your credit report. It may show a hard inquiry, loan or credit card from State Farm Bank – and you may not notice this unless you go looking for it. Attorneys working with ClassAction.org are also willing to take a look at your credit report to determine whether you were affected by State Farm’s illegal activity.

How Can a Class Action Lawsuit Help?

While you may have heard that State Farm Bank settled the claims against it, keep in mind that this settlement pertains only to the CFPB investigation – and not to any class action lawsuit.

Who is the state farm accident lawyer?

If you were injured and you want fair treatment when making a State Farm car accident claim, call the offices of the nationally recognized personal injury legal team of Stewart J. Guss, Injury Accident Lawyers.

How does State Farm work?

State Farm accomplishes this by making unreasonably broad medical record requests and going through your files with a fine-toothed comb, even if they are decades old. They’re looking for anything that could qualify as a pre-existing condition, which they will use to invalidate your pain and suffering.

How can an experienced lawyer help you get compensation?

Here are some of the specific ways an experienced lawyer can help you get the compensation you deserve — from State Farm and other insurance companies: Protect your rights during the claims process – If you suffered an injury in an accident, the insurance company’s adjusters will not hesitate to take advantage of you.

What does it mean when State Farm assigns an adjuster?

If State Farm assigns your claim to a “team” of adjusters, it means the company considers it a lower value / lower risk claim and it is going to lowball you every step of the way. A “team” adjuster assignment means State Farm considers yours a “minor” accident versus a major injury claim. While all of the adjusters have ...

What is the fourth secret of handling a car insurance claim?

The fourth secret of handling a car insurance claim involves recognizing another one of State Farm’s sneaky tactics. State Farm and other insurance companies are well aware of the financial pressures that accident victims face. For this reason, they often take their sweet time when it comes to processing a claim.

Is State Farm a fraud?

State Farm (and other insurance companies) argued that they needed to use such “hardball” tactics to fight insurance fraud, but the fact is that only a very tiny percentage of auto accident claims are fraudulent. Because of State Farm’s tactics, many innocent victims end up in financial ruin.

Does State Farm reassign claims?

Typically speaking, if you end up having to file a lawsuit, State Farm will reassign your claim to a dedicated individual adjuster higher up on the ladder. While this is no guarantee of an increase in the settlement offer, typically State Farm will up its offer once you file a lawsuit.

What’s Going on?

How Do I Know If This Happened to Me?

- Your best bet is to look at your credit report. It may show a hard inquiry, loan or credit card from State Farm Bank – and you may not notice this unless you go looking for it. Attorneys working with ClassAction.org are also willing to take a look at your credit report to determine whether you were affected by State Farm’s illegal activity.

How Can A Class Action Lawsuit Help?

- While you may have heard that State Farm Bank settled the claims against it, keep in mind that this settlement pertains only to the CFPB investigation – and not to any class action lawsuit.The CFPB settlement offers no compensation or remedy for people who had their credit scores impacted or who were otherwise affected by State Farm Bank’s practices. This recourse will nee…

Popular Posts:

- 1. how to get attorney jobs as a freelancer

- 2. women attorney from fox news who made a statement against the nfl

- 3. how to write a legally binding will without an attorney

- 4. what happened to attorney in breaking bad

- 5. attorney who deals with kids assasulated at school

- 6. how to choose a good dui attorney

- 7. what happened to the prosecuting attorney for the oj simpson trial

- 8. what can my attorney do if he overpaid me

- 9. how to find a traffic court attorney in atlanta ga

- 10. when health care power of attorney is needed