Can a lawyer find out where my bank account is?

Mar 21, 2010 · Posted on Mar 22, 2010. Whether the attorney, who I assume is acting as a debt collector on the judgment or is representing the judgment creditor, can lawfully access your consumer reports depends on the status of the judgment. If the judgment was never paid and the judgment creditor took the necessary steps to keep the judgment alive, which does require …

How do I find out if a lawyer is good for credit?

In addition, access to your credit report is strictly prohibited in court matters, such as divorce, immigration, civil investigation, and child custody proceedings (without a court order). If you believe that a lender or business illegally gained access to your credit report, we can help.

How do investigators obtain bank records or account information?

Feb 15, 2017 · Under the Fair Credit Reporting Act, anyone who has a "permissible purpose" (for example, a creditor when you apply for a line of credit, or after a court order/subpoena) can access your credit report. Other than that, only you and those who have your written consent can check your credit report.

What is a credit Lawyer called?

May 29, 2019 · Credit repair is the process of correcting the information that the major credit bureaus have in your credit files—the information used to create your credit reports. You can do credit repair yourself, with the help of a credit repair company or with the services of a credit lawyer. A credit lawyer—also called a credit repair lawyer—is an attorney that’s qualified to …

Do Lawyers use databases?

LexisNexis and Westlaw LexisNexis (Reed Elsevier) and Westlaw (Thomson Reuters), the primary legal databases for conducting professional legal research, are largely out-of-reach for academics unaffiliated with a law school.

Is LexisNexis a public database?

Leverage one of the largest databases of public and proprietary information available on the market today. LexisNexis ® Public Records features over 84 billion public records from over 10,000 diverse sources, comprising public, private, regulated, emerging and derived data.

Is Westlaw a consumer reporting agency?

THOMSON REUTERS IS NOT A CONSUMER REPORTING AGENCY AND NONE OF THE INFORMATION PROVIDED THROUGH ANY OF ITS SERVICES CONSTITUTES A "CONSUMER REPORT" AS SUCH TERM IS DEFINED IN THE FEDERAL FAIR CREDIT REPORTING ACT (15 U.S.C.A.Mar 3, 2021

What information does LexisNexis report?

The report includes items such as real estate transaction and ownership data, lien, judgment, and bankruptcy records, professional license information, and historical addresses.

Who can access LexisNexis?

Q. Who are your customers? Examples of LexisNexis customers include law enforcement agencies, federal homeland security departments, banking and financial services companies and insurance carriers, legal professionals, and state and local governments.

Which Businesses and Lenders Are Allowed to Access Your Credit Report?

Many laws, including the Fair Credit Reporting Act (FCRA) and state credit reporting statutes, restrict who is allowed to use and access your credit information. Under current federal law, the following people may legally request a copy of your credit report:

Who Does Not Have a Right to Access My Credit Information?

Generally speaking, only the entities above may request your credit information—and most of these face restrictions, such as when you must be notified and how the information may be used.

WalletHub, Financial Company

This answer was first published on 02/15/17. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Dmitriy Fomichenko, President, Sense Financial

This answer was first published on 02/11/17 and it was last updated on 04/28/20. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Ross Garner, WalletHub Community Manager

This answer was first published on 12/17/12. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Slimgarfield, Member

This answer was first published on 11/24/14. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Carron Cook, Member

This answer was first published on 01/04/13. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

How to get rid of negative items on credit report?

Work with the credit bureaus to remove errors from your credit report. Work with the credit bureaus to remove negative items from your report sooner than they might fall off naturally. Possibly settle with debt collection companies for a fraction of your original debt or a workable payment plan of some type.

What is credit repair?

Credit repair is the process of correcting the information that the major credit bureaus have in your credit files—the information used to create your credit reports. You can do credit repair yourself, with the help of a credit repair company or with the services of a credit lawyer. A credit lawyer—also called a credit repair lawyer—is an attorney ...

What happens if you default on a credit card?

Those hits can accumulate and lead to damage that can take months or years to fix. And the credit bureaus and credit card companies and other lenders don’t care about your circumstances.

Is a comment on an article commissioned by a bank advertiser?

Comments on articles and responses to those comments are not provided or commissioned by a bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by a bank advertiser. It is not a bank advertiser's responsibility to ensure all posts and/or questions are answered.

1 attorney answer

Yes. Attorneys get information from their clients all the time. if the store knows where you bank, they can easily turn this information over to the attorney and it is the attorney's job to get all the information necessary to collect the debt for his or her client.

Carl H Starrett II

Yes. Attorneys get information from their clients all the time. if the store knows where you bank, they can easily turn this information over to the attorney and it is the attorney's job to get all the information necessary to collect the debt for his or her client.

Word of Caution

After reading this, you may be thinking, “if I hire an investigator to get banking records, it’s the investigators problem, not mine.” Consider this though – if you are ever asked to testify as to how the information was obtained, not only will the evidence be thrown out, but there may be legal implications against you and the investigator.

Are there legal ways to get bank information?

There are legal ways to identify bank accounts such as this case study where we identified bank accounts in a divorce filing.

Final Thought

Information obtained from “inside” sources can be extremely valuable for any investigator, but when the information obtained is by unlawful means, there can be serious legal implications.

Enjoyed What You Read?

Join 2,000+ others to get insider tips and tricks delivered to your inbox from what has been voted the best blog in the investigative industry!

Connect

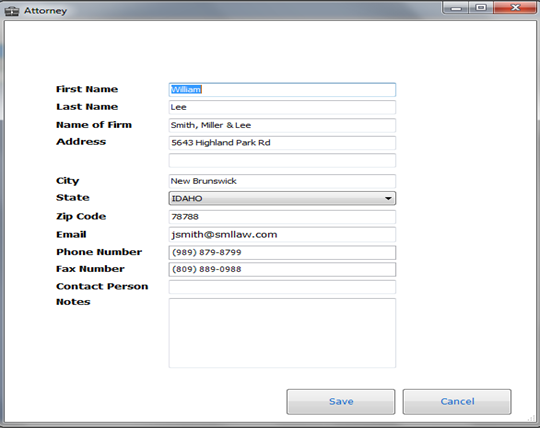

Find attorneys and stay in touch using the largest database of legal professionals.

Stay Informed

Learn about legal developments through thousands of articles from fellow attorneys.

Get Rated

Be recognized by the most trusted rating system for legal ability and ethical standards.

Grow Your Practice

Stand out for prospects with Profiles, Websites, Lead Generation and Live Chat.

What does a power of attorney do?

This agent, also known as an attorney-in-fact, can do whatever it is you allow him to do under the terms of the power of attorney (POA) document. For example, you can give your agent the ability to prepare your yearly tax return or rent an apartment on your behalf while you are out of the country.

Can an agent act while a POA is in effect?

Your agent can only act while the power of attorney is effective, and you can decide when this happens. For example, you can grant your agent the right to open credit on your behalf immediately upon signing the power of attorney document. You can also make the agent's powers contingent on certain conditions, such as granting the right to open credit if you ever become incapacitated or ill. Furthermore, a principal has the right to terminate an agent's power at any time, or include provisions in the POA that terminate the power automatically.

Can an agent open credit in your name?

The only limit on the kinds of things your agent is allowed to do is up to you and the laws of your state. If you want to allow your agent to be able to open credit in your name, you can. Talk to a lawyer for legal advice about using powers of attorney and what powers to grant your agent.

How Does A “Rogue” Investigator Get Bank Records?

Word of Caution

- After reading this, you may be thinking, “if I hire an investigator to get banking records, it’s the investigators problem, not mine.” Consider this though – if you are ever asked to testify as to how the information was obtained, not only will the evidence be thrown out, but there may be legal implications against you and the investigator. There are several instances investigators conduct…

Are There Legal Ways to Get Bank Information?

- There are legal ways to identify bank accounts such as this case study where we identified bank accounts in a divorce filing. But what you really need to figure out is what you are trying to do? Are you really trying to conduct an asset investigation, find assets or locate hidden assets?

Final Thought

- Information obtained from “inside” sources can be extremely valuable for any investigator, but when the information obtained is by unlawful means, there can be serious legal implications.

Popular Posts:

- 1. who pays attorney fees if class action fails

- 2. how much does a first year attorney make chicago

- 3. what happens when a joint power of attorney dies

- 4. how to get power of attorney over a spouse who has dementia

- 5. how do i obtain a power of attorney for a child

- 6. attorney who specializes in medicare issues

- 7. what happens when someone dies and you have power of attorney

- 8. when would plaintiff attorney ask for insurance policy limits

- 9. what does the legal term "attorney-in-fact" mean?

- 10. attorney who handles medicaid nc