Can I use a power of attorney instead of form 2848?

If you do not want to revoke any existing power(s) of attorney, check the box on line 6 and attach a copy of the power(s) of attorney. Filing Form 2848 will not revoke any Form 8821 that is …

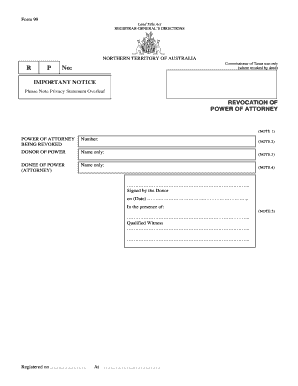

How do I revoke a power of attorney?

If you need to revoke an IRS power of attorney agreement or withdraw a representative, you must first write “REVOKE” across the top of the first page and include a signature and date below the annotation. Then, you will need to mail or fax a copy of the document to the IRS. If you need to file a Form 2848 with the IRS, Community Tax has the tools and resources to assist you. You …

What happens if the representative's address changes after filing Form 2848?

Apr 22, 2021 · To revoke a previously executed power of attorney without naming a new representative, the taxpayer must write “REVOKE” across the top of the first page of the Form 2848, along with a current signature and date immediately below the annotation. A copy of the revoked power of attorney is then mailed or faxed to the IRS.

How do I get a power of attorney for the IRS?

before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS. Form 2848, Part II, Declaration of Representative, lists eligible designations in items (a ...

How do I withdraw from power of attorney?

Revoke Your Current Power of Attorney To change or cancel your current power of attorney, you should complete a formal, written revocation. Your revocation should state that you're withdrawing your current power of attorney. Additionally, you should sign and notarize your cancellation.

Where do you file and withdraw form 2848?

Submit your Form 2848 securely at IRS.gov/Submit2848. Fax. Fax your Form 2848 to the IRS fax number in the Where To File Chart.Sep 3, 2021

Does Form 2848 expire?

Automatic Expiration: Form 2848 requires a manual cancelation but Form 8821 automatically expires. This makes it particularly useful for basic tasks like requesting your client's tax information that doesn't require full representation.Mar 23, 2021

How many years can a Form 2848 cover?

Under “Years or Periods,” be specific. Do not write “all years.” Instead, list the current tax year for which you are filing a return or you can list a series of years to cover past and future filings. However, you can only list up to three future years from the year you file the power of attorney form.Nov 8, 2021

How do you complete 2848?

0:352:24Learn How to Fill the Form 2848 Power of Attorney and ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe name and address followed by the CAF. Number telephone number and fax number the form 2848.MoreThe name and address followed by the CAF. Number telephone number and fax number the form 2848. Allows the taxpayer to elect the scope of the power of attorney granted.

Should I use Form 2848 or 8821?

Use: Form 2848, Power of Attorney and Declaration of Representative PDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information Authorization PDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.Aug 26, 2021

Who can use form 2848?

IRS Form 2848 authorizes individuals or organizations to represent a taxpayer when appearing before the IRS. Authorized representatives, include attorneys, CPAs, and enrolled agents. Signing Form 2848 and authorizing someone to represent you does not relieve a taxpayer of any tax liability.

Can IRS form 2848 be signed electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.Nov 15, 2021

Can I fax a POA to the IRS?

You must then mail or fax a copy of the power of attorney with the revocation annotation to the IRS, using the Where To File Chart, or if the power of attorney is for a specific matter, to the IRS office handling the matter.Sep 2, 2021

How long is a power of attorney valid for?

It must be signed by the grantor and 2 witnesses and will remain valid until such time as it is revoked, when the mandate is completed or where the agent or grantor passed away, is sequestrated or becomes mentally unfit.Aug 28, 2019

What is the purpose of form 2848?

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.Mar 8, 2021

How long does it take to create an account on a mobile phone?

Individuals who can verify their identity with a U.S.-based mobile phone can complete the process in a single session, which takes about 15 minutes to complete.

How to get a TDS?

Before You Get Started 1 If you are an e-Services user (e.g, TDS, TIN Matching) and logged in, you will need to log out of e-Services and return here to log in. 2 Ensure you have authenticated the identity of your client. 3 Make sure the form is signed by all parties either electronically or with an ink signature. Refer to the Frequently Asked Questions below for more information on electronic signatures. 4 Have your Secure Access credential ready, along with the device used to receive the security code. If you don’t have a Secure Access account, you can sign up when you click the Log in to Submit button.

What is a 2848 Power of Attorney?

For financial and tax-related purposes, an IRS Power of Attorney Form 2848 may be drafted so that an agent may make tax-related decisions on someone else’s behalf with the IRS.

What is Form 2848?

IRS Form 2848 is a document provided by the IRS that authorizes an individual to appear before them on your behalf. Due to federal laws, the IRS is required to keep your taxpayer information confidential, so Form 2848 must be filed and approved before anyone else may inquire about your taxes or receive them.

Who can represent a client before the IRS?

However, it’s a good idea to select a credentialed tax professional such as an attorney, CPA, or Enrolled Agent who can represent a client before any department of the IRS.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative(s) to inspect and/or receive confidential tax information and to perform all acts (that is , sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not includethepower to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreementto Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

What is Form 2848?

We ask for the information on this form to carry out the Internal Revenue laws. Form 2848 is provided by the IRS for your convenience and its use is voluntary. If you choose to designate a representative to act on your behalf, you must provide the requested information. Section 6109 requires you to provide your identifying number; section 7803 authorizes us to collect the other information. We use this information to properly identify you and your designated representative and determine the extent of the representative's authority. Failure to provide the information requested may delay or prevent honoring your power of attorney designation; providing false or fraudulent information may subject you to penalties.

What is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the return.Limited representation rights. Unenrolled return preparers may only represent taxpayers before revenue agents, customer service representatives, or similar officers and employees of the Internal Revenue Service (including the Taxpayer Advocate Service) during an examination of the tax period covered by the tax return they prepared and signed (or prepared if there is no signature space on the form). Unenrolled return preparers cannot represent taxpayers, regardless of the circumstances requiring representation, before appeals officers, revenue officers, attorneys from the Office of Chief Counsel, or similar officers or employees of the Internal Revenue Service or the Department of the Treasury. Unenrolled return preparers cannot execute closing agreements, extend the statutory period for tax assessments or collection of tax, execute waivers, execute claims for refund, or sign any document on behalf of a taxpayer.Representation requirements. Unenrolled return preparers must possess a valid and active Preparer Tax Identification Number (PTIN) to represent a taxpayer before the IRS, and must have been eligible to sign the return or claim for refund under examination.

What is a CAF power of attorney?

Generally, the IRS records powers of attorney on the CAF system. The CAF system is a computer file system containing information regarding the authority of individuals appointed under powers of attorney. The system gives IRS personnel quicker access to authorization information without requesting the original document from the taxpayer or representative. However, a specific-use power of attorney is a one-time or specific-issue grant of authority to a representative or is a power of attorney that does not relate to a specific tax period (except for civil penalties) that the IRS does not record on the CAF. Examples of specific uses not recorded include but are not limited to:

Does the IRS require a new 2848?

If the representative's address has changed, the IRS does not require a new Form 2848. The representative can send a written notification that includes the new information and the representative's signature to the location where you filed the Form 2848.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative(s) to request and inspect confidential tax information and to perform all acts (that is, sign agreements, consents, waivers or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, or the power to execute a request for disclosure of tax returns or return information to a third party. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

What is Form 2848?

We ask for the information on this form to carry out the Internal Revenue laws. Form 2848 is provided by the IRS for your convenience and its use is voluntary. If you choose to designate a representative to act on your behalf, you must provide the requested information. Section 6109 requires you to provide your identifying number; section 7803 authorizes us to collect the other information. We use this information to properly identify you and your designated representative and determine the extent of the representative's authority. Failure to provide the information requested may delay or prevent honoring your Power of Attorney designation.

Who can a registered tax preparer represent?

Registered tax return preparers and unenrolled return preparers may only represent taxpayers before revenue agents, customer service representatives, or similar officers and employees of the Internal Revenue Service (including the Taxpayer Advocate Service) during an examination of the taxable period covered by the tax return they prepared and signed. Registered tax return preparers and unenrolled return preparers cannot represent taxpayers, regardless of the circumstances requiring representation, before appeals officers, revenue officers, attorneys from the Office of Chief Counsel, or similar officers or employees of the Internal Revenue Service or the Department of Treasury. Registered tax return preparers and unenrolled return preparers cannot execute closing agreements, extend the statutory period for tax assessments or collection of tax, execute waivers, execute claims for refund, or sign any document on behalf of a taxpayer.

What is a PTIN for a tax return?

A PTIN is required for representatives that are registered tax return preparers and unenrolled return preparers.

Can I revoke a power of attorney on the CAF?

If the IRS records this power of attorney on the CAF system, it generally will revoke any earlier power of attorney previously recorded on the system for the same matter. If this power of attorney is for a specific use or is not recorded on the CAF, this power of attorney will only revoke an earlier power of attorney that is on file with the same office and for the same matters.

What is a TIPpersonnel of the IRS?

TIPpersonnel of the IRS when such representation occurs outside the United States. Individuals acting as representatives must sign and date the declaration; leave the “Licensing jurisdiction (state) or other licensing authority” column blank. See section 10.7(c)(1)(vii) of Circular 230.

Does the IRS require a new 2848?

If the representative's address has changed, the IRS does not require a new Form 2848. The representative can send a written notification that includes the new information and the representative's signature to the location where you filed the Form 2848.

What is the form for a power of attorney?

Most practitioners regularly use a power of attorney (Form 2848, Power of Attorney and Declaration of Representative) to represent their clients. However, other types of IRS authorizations have practical uses. And, at times, it may make sense to obtain more than one type of authorization.

What is a third party designee on a 1040?

A CPA can complete the "Third Party Designee" section on a client's Form 1040, U.S. Individual Income Tax Return (often referred to as "checkbox authority"). This allows the CPA to discuss the processing of the client's tax return, including the status of tax refunds.

What is a 8821?

Form 8821. Form 8821, Tax Information Authorization, is used to obtain taxpayer information. It does not hold the same weight as Form 2848 (i.e., Form 8821 does not allow a practitioner to represent a client in any way).

What is a CAF number?

A CAF number is a unique nine - digit identification number assigned to a practitioner the first time he or she files an authorization form with the IRS. A CAF number is different from a Social Security number, employer identification number, or PTIN.

Do CPAs need a power of attorney?

Most practitioners regularly use a power of attorney (Form 2848, Power of Attorney and Declaration of Representative) to represent their clients. However, other types of IRS authorizations have practical uses. And, at times, it may make sense to obtain more than one type of authorization.

Popular Posts:

- 1. ip attorney who is bar eligibility

- 2. what happens if you cant afford an attorney for a hearing

- 3. what is the pin for the office of attorney general

- 4. how to determine who has power of attorney over an estate in arkansas

- 5. how to fire your attorney letter sample

- 6. who is william barr attorney general

- 7. why did mia say red white blue ace attorney

- 8. how long has rosenstein been in the attorney general's office

- 9. how to define attorney document review on resume

- 10. what kind of attorney for liquor licensing sarasota