How does a lawyer resolve a tax dispute?

Aug 03, 2020 · Tax attorneys can help you with major dealings with the IRS, including tax fraud charges and audits. You should hire a tax attorney if you have unfiled taxes or if you are accused of failing to submit payroll taxes. A tax attorney can try to get hefty tax debts reduced. Contact Ayar Law to get free, no-obligation legal advice at 800.571.7175.

Can a tax attorney settle my tax problems for pennies on the dollar?

Jul 14, 2021 · Resolve Tax Disputes. Get help resolving your tax disputes with the IRS and understanding your rights and responsibilities as a taxpayer: Taxpayer Advocate Service (TAS) - This free service helps you resolve tax problems. Get help with delayed or undelivered refunds, assistance if you're unable to pay your taxes, and more.

Can the Taxpayer Advocate Service (TAS) help you?

If you are having tax problems and have not been able to resolve them with the IRS, the Taxpayer Advocate Service (TAS) may be able to help you. Please answer just a few brief questions to determine if TAS can help you with your tax issue. Generally, we help taxpayers whose tax issues fall into one of these main categories.

How do I resolve a tax issue with the IRS?

Attorney Patrick J. Best has been named a “Top 10 Best Bankruptcy Lawyer in Pennsylvania for Customer Service” by the American Institute of Bankruptcy Attorneys. He’s also been named a Super Lawyer Rising Star by Philadelphia Magazine. So if you’re looking for one of the best tax attorneys, you’ve found him.

Will the IRS settle with me?

Yes – If Your Circumstances Fit. The IRS does have the authority to write off all or some of your tax debt and settle with you for less than you owe. This is called an offer in compromise, or OIC.

Who can help with IRS issues?

You can call your advocate, whose number is in your local directory, in Pub. 1546, Taxpayer Advocate Service -- Your Voice at the IRS, and on our website at irs.gov/advocate. You can also call us toll-free at 877-777-4778.

What does a tax lawyer do?

Tax lawyers advise clients regarding the settlement of disputes, including the appropriateness or otherwise of alternative dispute resolution and litigation. Experienced tax lawyers will comment on draft fiscal legislation and make representations to the authorities regarding changes to tax law.

Do tax relief companies really work?

Unfortunately, the industry is rife with scams and poor business practices. Disreputable companies lure customers with false promises while charging high fees. Still, legitimate tax settlement firms do exist.

How can tax problems be resolved?

The most common options to resolve your tax problems are:Full Payment: paying the amount on the tax notice and avoiding the confrontation with the taxing authority. ... Pay The Correct Tax Only: paying the actual amount of taxes if you can afford it is usually a good solution to your tax problem.More items...

What is considered a hardship for a tax advocate?

Reason 1 - 4. Financial Hardship issues are those involving a financial difficulty to a taxpayer, or an IRS action or inaction has caused or will cause negative financial consequences, or have a long-term adverse impact on a taxpayer.

How much will the IRS usually settle for?

Each year, the Internal Revenue Service (IRS) approves countless Offers in Compromise with taxpayers regarding their past-due tax payments. Basically, the IRS decreases the tax obligation debt owed by a taxpayer in exchange for a lump-sum settlement. The average Offer in Compromise the IRS approved in 2020 was $16,176.Dec 6, 2021

What is LLB taxation?

B. Com LLB with Specialisation in Taxation Laws is a 5-year undergraduate program. It's a course that combines law and commerce while focusing on taxation laws. If you have an interest in commerce, tax and law – BCom LLB syllabus will prove to be highly valuable and informative during the journey.Apr 18, 2019

What type of lawyer makes the most?

Types Of Lawyers That Make The Most MoneyMedical Lawyers – Average $138,431. Medical lawyers make one of the highest median wages in the legal field. ... Intellectual Property Attorneys – Average $128,913. ... Trial Attorneys – Average $97,158. ... Tax Attorneys – Average $101,204. ... Corporate Lawyers – $116,361.Dec 18, 2020

Does IRS forgive tax debt after 10 years?

Yes, indeed, the length of time the IRS is allowed to collect a tax debt is generally limited to ten years, according to the statute of limitations on IRS collections. When the ten years are up, the IRS is required to write the debt off as a bad debt, essentially forgiving it.Nov 18, 2021

Is there a one time tax forgiveness?

What is One-Time Forgiveness? IRS first-time penalty abatement, otherwise known as one-time forgiveness, is a long-standing IRS program. It offers amnesty to taxpayers who, although otherwise textbook taxpayers, have made an error in their tax filing or payment and are now subject to significant penalties or fines.Dec 1, 2021

How do I resolve IRS back taxes?

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability, or doing so creates a financial hardship....Apply With the New Form 656Ability to pay;Income;Expenses; and.Asset equity.Dec 13, 2021

What is TAs in tax?

TAS will help ensure that you receive fair and equitable treatment and that your rights as a taxpayer are protected. Some issues will be determined by the National Taxpayer Advocate and will generally be based on a unique set of circumstances warranting assistance to certain taxpayers.

What is financial hardship?

Financial Hardship issues are those involving a financial difficulty to a taxpayer, or an IRS action or inaction has caused or will cause negative financial consequences, or have a long-term adverse impact on a taxpayer.

Is the tax resolution process daunting?

The tax resolution process can be daunting. To help our clients along the way, we provide a number of free resources to answer your questions and walk you through the process.

Can the IRS speak to you?

When you hire a tax attorney, the IRS is no longer permitted to speak with you. They are required by law to communicate directly with your attorney. No more calls. No more letters. Just relief. We have experience helping taxpayers like you eliminate hundreds of thousands of dollars in tax debt.

What are Back Taxes?

Simply put, back taxes are taxes that were not paid in the year that they were due. These are taxes owed to the federal government, the state government, or even local municipalities.

Consulting With a Tax Professional

As part of the negotiation process, we can help you secure an extension on the repayment of your back taxes. This can provide you with valuable time to gather the necessary funds and get control of your financial situation, without all the debilitating fees and interest.

Why Should I Hire a Tax Attorney?

There are two reasons why you should hire a tax attorney to represent your interests against either the IRS or the FTB. First, all communication between you and your tax attorney is privileged information.

When Should I Hire a Tax Attorney?

The short answer to this question is that you need a tax attorney when you are initially contacted by the IRS or FTB regarding a potential problem with your return or tax payment. Ideally, however, it is wise to have a tax attorney giving you advice before trouble raises its ugly head.

Is emotional distress a physical injury?

In many cases a tax-savvy settlement agreement could have improved the plaintiff’s tax chances. 4. Symptoms of Emotional Distress Are Not “Physical”. Tax law draws a distinction between money you receive for physical symptoms of emotional distress (like headaches and stomachaches) and physical injuries or sickness.

What are the rules for settlements?

Here are 10 rules lawyers and clients should know about the taxation of settlements. 1. Settlements and Judgments Are Taxed the Same. The same tax rules apply whether you are paid to settle a case (even if your dispute only reached the letter-writing phase) or win a judgment.

How are settlements taxed?

2. Taxes Depend on the “Origin of the Claim”. Settlements and judgments are taxed according to the matter for which the plaintiff was seeking recovery (the origin of the claim). If you are suing a competing business for lost profits, a settlement or judgment will be considered lost profits taxed as ordinary income.

Is a slip and fall a compensatory damages?

If you sue for personal physical injuries resulting from, for example, a slip and fall or car accident, your compensatory damages should be tax-free. That may seem odd if, because if you could not work after your injuries, you are seeking lost wages. However, a specific section of the tax code—section 104—shields damages for personal physical injuries and physical sickness.

What is the tax rate for long term capital gains?

Long-term capital gain is taxed at a lower rate (15 percent or 20 percent , plus the 3.8% Obamacare tax, not 39.6 percent) and is therefore much better than ordinary income. Apart from the tax-rate preference, your tax basis may be relevant as well.

Is personal injury tax free?

Before 1996, “ personal” injury damages included emotional distress, defamation, and many other legal injuries and were tax-free. Since 1996, however, your injury also must be “physical” to give rise to tax-free money. Unfortunately, neither the IRS nor Congress has made clear what that means.

Is medical expense tax free?

At that point, you will not have a choice about reporting the payments on your tax return. 5. Medical Expenses Are Tax-Free. Even if your injuries are purely emotional, payments for medical expenses are tax-free, and what constitutes “medical expenses” is surprisingly liberal.

What to do when you get in over your head with taxes?

When individuals and small business owners get in over their heads with their taxes, they often contact a tax resolution attorney to help them square their problems with the IRS or their state government — and with good reason!

Can a tax attorney testify against you?

Once you retain a tax attorney to represent you, they cannot testify against you, and all your communications with them become confidential. Everything you say to your attorney is bound by attorney-client privilege and cannot be used to incriminate you (although certain exceptions do apply). The same cannot be said for CPAs or licensed enrolled agents.

What is tax resolution in Maryland?

Tax resolution lawyers are here to protect your rights, act as a buffer between you and the IRS or State of Maryland, and deliver quality legal resolutions for your particular tax situation. This might include things like negotiating an offer in compromise or proving doubt as to liability. Your attorney will work hard for you, but they will also expect you to remain in regular communication with their office, provide accurate and timely documentation and information, and follow their counsel throughout the legal process.

Can a tax lawyer help me?

Not only will your tax lawyer help resolve your past and current tax problems , but they can also advise you about how to avoid these issues in the future . However, it’s not always as simple as filling out your forms correctly or putting a check in the mail on time, especially if you are self-employed or operate your own business.

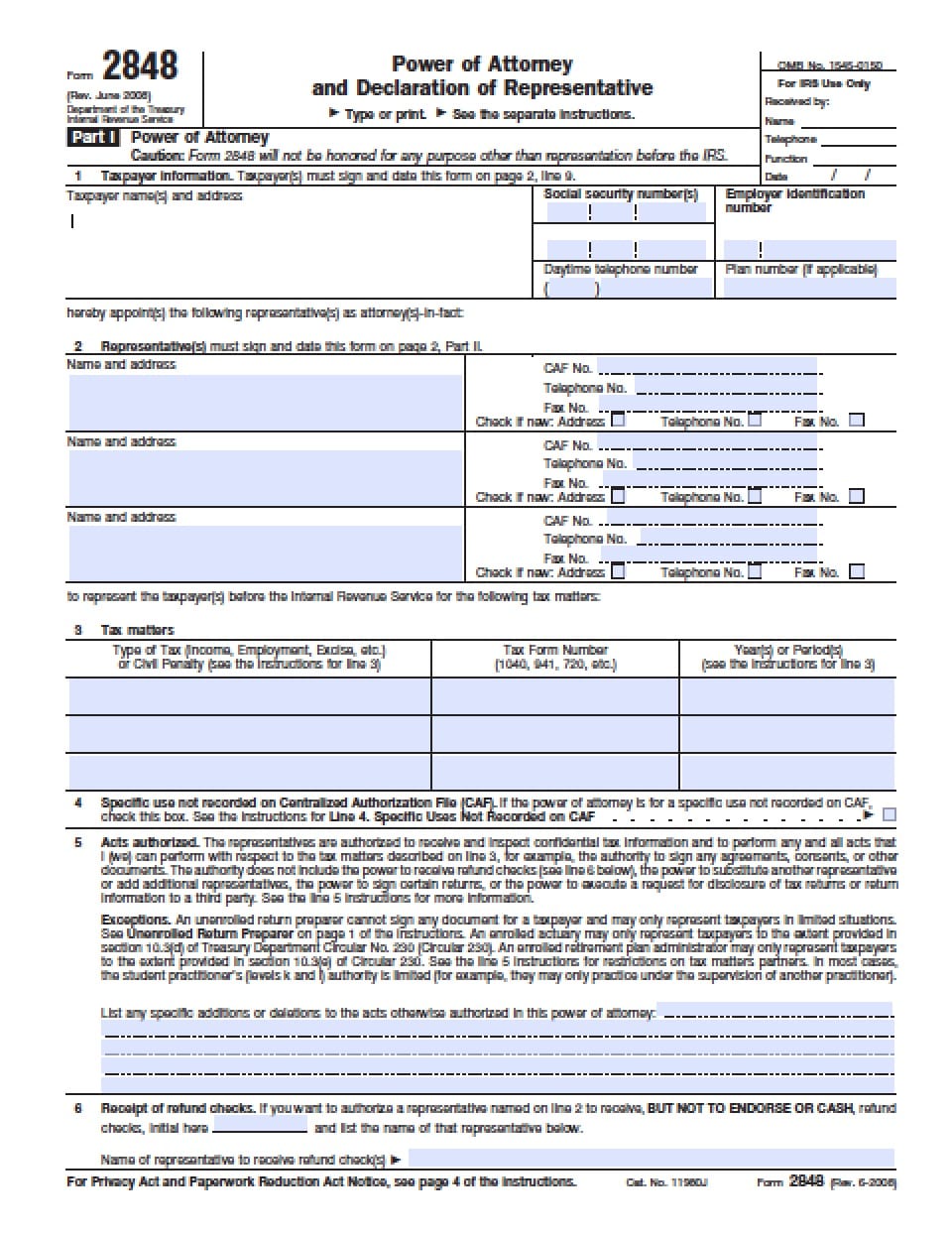

What does MD 548 mean?

By completing MD 548, you grant your lawyer power of attorney, which means they can handle all interactions with the IRS or State of Maryland on your behalf. For instance, if you are being audited, the auditing agency may want to meet with someone in person. If your lawyer has power of attorney stating they are an audit representative, they may handle all these meetings, which will cut down on the time you have to spend on this complex process.

Popular Posts:

- 1. who is the black attorney who is always on greta?

- 2. white woman attorney assistant who slept with charles anthony cosby

- 3. why cant my attorney help me get my things from my home

- 4. what do i need power of attorney for when my spouse deploys

- 5. when did ace attorney sword of justice come out

- 6. how can i find out who is my public attorney

- 7. how to contact the laguna beach city attorney

- 8. how do you attorney in arabic

- 9. document b letter to us attorney general what type of jobs did the author have

- 10. whatquestionsdo i ask when hiring a dui attorney